-

Tech companies dominate earnings calendar this week

-

Tesla (TSLA.US) reported promising Q3 delivery figures

-

Biotechs Abbott (ABT.US) and Biogen expected to report lower revenue

-

Coca-Cola (KO.US) forecasted to report another sales drop

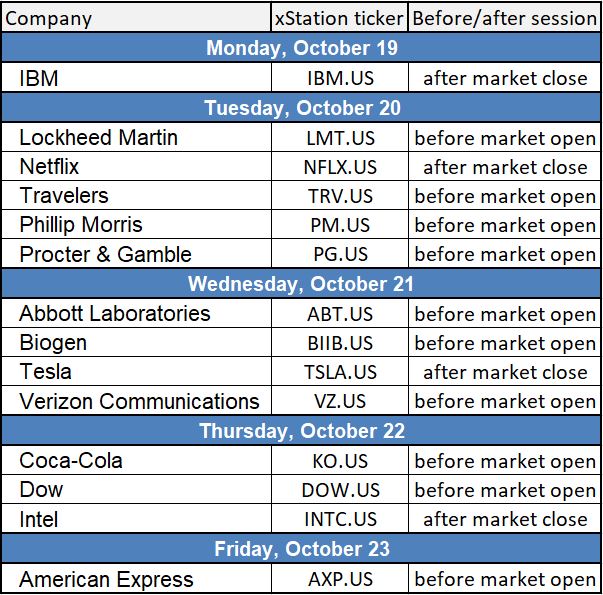

US banks dominated the earnings calendar last week. Earnings flow will be more diverse this week but tech companies will be the most closely watched ones, including reports from Tesla (TSLA.US) and Netflix (NFLX.US). Abbott Laboratories (ABT.US), developer of rapid Covid-19 tests, will also report as well as two big consumer goods companies - Coca-Cola (KO.US) and Protect & Gamble (PG.US).

Tesla (TSLA.US) halted recovery at $460, the level of the previous local peak. Stock still trades below pre-split valuations but Q3 deliveries data was promising. Solid earnings report could provide fuel for bulls to look towards all-time highs at $500. Source: xStation5

Tesla (TSLA.US) halted recovery at $460, the level of the previous local peak. Stock still trades below pre-split valuations but Q3 deliveries data was promising. Solid earnings report could provide fuel for bulls to look towards all-time highs at $500. Source: xStation5

Tech stocks

This week will be abundant in earnings releases from tech companies, including some big names. Tesla will publish Q3 results on Wednesday after the market closes. US electric vehicle manufacturers delivered better than expected Q3 delivery results and investors are eager to see if higher profits accompanied. IBM (Monday, after session) and Intel (Thursday, after session) are expected to report small revenue declines compared to a year ago and lower profits. Meanwhile, Netflix (Tuesday, after session) is expected to report record revenue. However, the question is whether strong subscriber growth remained after lockdowns were lifted.

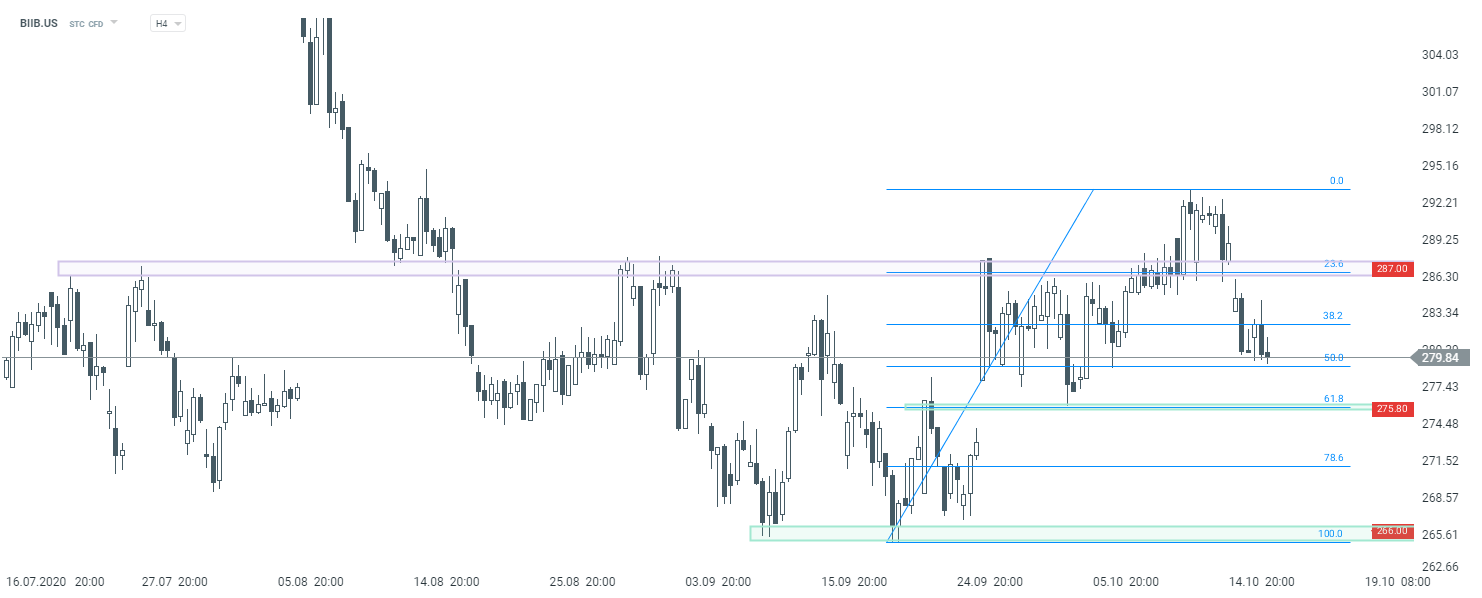

Biogen (BIIB.US) halted decline at 50% retracement of recent upward impulse last week. Poor expectations for the upcoming report create some downside risks but on the other hand, Biogen has a solid track record of delivering positive surprises. Source: xStation5

Biogen (BIIB.US) halted decline at 50% retracement of recent upward impulse last week. Poor expectations for the upcoming report create some downside risks but on the other hand, Biogen has a solid track record of delivering positive surprises. Source: xStation5

Biotechs

In spite of lifting lockdowns, the coronavirus pandemic is far from over. Case numbers remained high throughout summer and started to spike at the turn of Q3 and Q4. Abbott Laboratories (Wednesday, before session) designed a rapid Covid-19 test that is widely used in the United States. The company is expected to report revenue decline and higher profits. Other US biotech Biogen (Wednesday, before session) is seen delivering lower earnings and revenue as the company was not involved in development of any noteworthy Covid vaccines or treatments.

Coca-Cola (KO.US) started to recover from recent decline but began to struggle near 23.6% retracement of July-August upward move. Two key near-term zone to watch amid upcoming earnings release on Thursday are $51.40 (resistance) and $49 (support, 38.2% retracement). Source: xStation5

Coca-Cola (KO.US) started to recover from recent decline but began to struggle near 23.6% retracement of July-August upward move. Two key near-term zone to watch amid upcoming earnings release on Thursday are $51.40 (resistance) and $49 (support, 38.2% retracement). Source: xStation5

Consumer goods

Apart from technological and biotechnological companies, investors will be served reports from some big consumer goods companies. Those reports may show whether spending habits have changed due to Covid-19. Coca-Cola (Thursday, before session) is expected to report lower revenue and operating profit than a year ago as people around the world are less likely to dine out and drink beverages. On the other hand, Procter & Gamble (Tuesday, before open) is expected to post low single-digit growth of EPS and sales.

Key US earnings releases this week. Source: Bloomberg, XTB

Key US earnings releases this week. Source: Bloomberg, XTB

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.