Christine Lagarde, the head of the ECB, presented the mixed state of the economy, while talking about the actions taken by the bank in connection with the ongoing coronavirus pandemic. Below we present some key takeaways from the ECB Lagarde press conference.

- ECB expects that the economy will shrink in Q4 as services sectors has been severely hit and inflation remains on very low levels. Also incoming data suggest more pronounced near-term impact of pandemic

- Increase in PEPP program reflects fallout from pandemic in economic activity and it can be recalibrated if warranted.

- Policymakers approved more long-term loans on cheap terms for another year until June 2022, and announced four additional pandemic emergency longer-term refinancing operations to be offered in 2021.

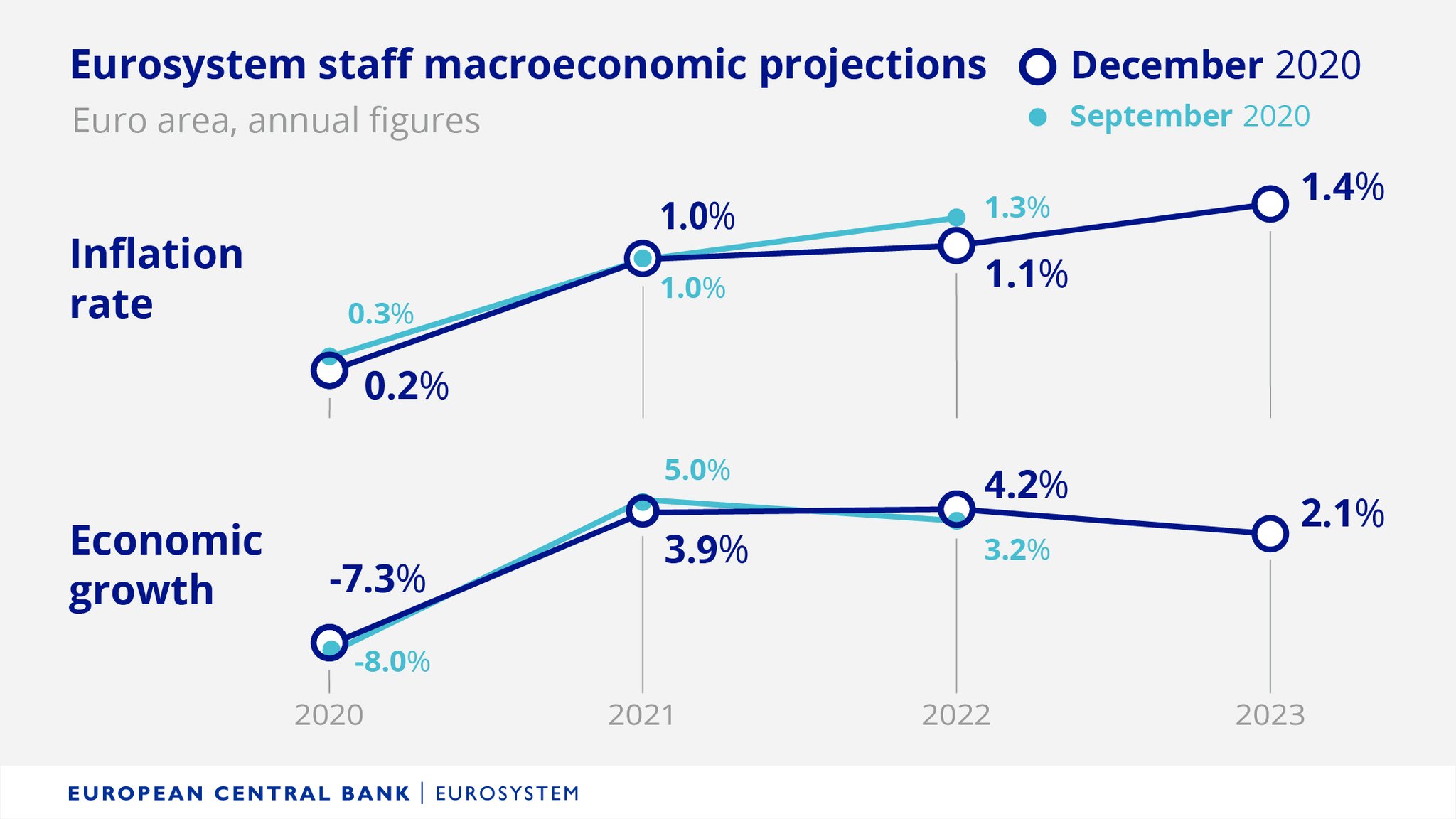

- The outlook for economic activity has been revised down in the short term, with GDP seen expanding by just 3.9 % in 2021 compared to 5 % predicted in September. Inflation projections for 2020 and 2022 were also revised down to 0.2 and 1.1 % from 0.3 and 1.3 %, respectively.

- Lagarde also said, that the fiscal message should be targeted and risks of delayed recovery warrants fiscal support.

Macroeconomic forecasts:

Source: ECB

Source: ECB

- During the Q&A session Lagarde said, that there are good reasons to believe immunity could be reached by the end of 2021.

- The service sector should not be impaired by the end of 2021

- Lagarde expects that 4Q GDP will shrink around -2.2% as the duration of 2nd wave is stronger than seen

- PEPP volume intended to preserve favorable financing conditions. The 9 month PEPP extension was a compromise. The ECB did not discuss bank dividends.

- ECB is planning to adjust purchases on basis of what is needed to maintain favorable financing conditions and will tailor purchases to keep financial conditions loose. The compass will be "favorable financial conditions".

- Lagarde admitted that inflation is "disappointingly low". Inflation has to do with low price of energy and German VAT, lower wages, and exchange-rate appreciation.

- ECB expects that inflation will rise to 1% in 2021 from 0.2% in 2020.

The trend on EURUSD remains upward. Source: xStation5

The trend on EURUSD remains upward. Source: xStation5

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.