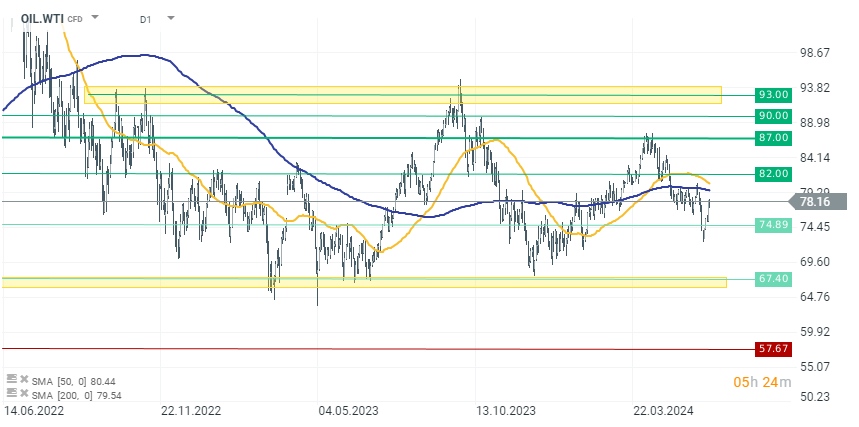

The June 2024 Short-Term Energy Outlook by the U.S. Energy Information Administration (EIA) presents several forecasts for energy prices and production through 2025. Notably, Brent crude oil prices are predicted to increase slightly reflecting adjustments due to OPEC+ production cuts extending through the third quarter of 2024. U.S. crude oil production is expected to rise.

OPEC+ is expected to start relaxing its voluntary production cuts in the fourth quarter of 2024, which is later than previously anticipated. This adjustment is expected to sustain a decline in global oil inventories through the first quarter of 2025. Despite these cuts and an anticipated rise in oil prices, the EIA has revised its Brent crude price forecast downward by 4% to $84 per barrel for 2024, based on lower-than-expected prices in May.

-

EIA now expects Brent Crude prices to average $84.15 a barrel this year, 4% lower than the previous forecast of $87.79.

-

US crude oil output to rise by 310,000 bpd in 2024, vs the previous forecast for 270,000 bpd increase, and is to grow by 470,000 bpd in 2025, vs the previous forecast of 530,000 bpd

-

EIA raises forecast for 2024 world oil demand growth by 180,000 bpd, now sees 1.10 mln bpd year-on-year increase

-

Current year crude oil production forecast 13.24 mln bpd vs. 13.2 mln bpd previously. Year-ahead crude oil production forecast 13.71 mln bpd vs. 13.73 mln bpd previously

-

EIA forecasts US retail gasoline prices to average $3.42 a gallon this year, 3% lower than previous forecast

US natural gas production is forecast to decrease by 1% in 2024 due to lower prices, with significant declines expected in the Haynesville and Appalachia regions. Conversely, production in the Permian region is projected to grow, associated with oil production increases. Additionally, US electricity consumption is set to increase slightly, influenced by warmer temperatures and growing power demand from data centers, particularly in the South Atlantic and West South Central regions.

Daily Summary - Wall Street is waiting for Nvidia (25.02.2026)

BREAKING: Massive Crude Build Shatters Expectations. WTI is down by 1%

BREAKING: German GfK consumer sentiments worsen, GDP in line with expectations

Daily summary: Technology Drives Wall Street as Tehran Seeks Truce

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.