Summary:

- Equities have rebounded noticeably on the back of trade optimism

- China said it wanted to focus on removing new tariffs in order to prevent a further escalation of the trade battle

- A mixed set of data from Japan, better industrial output from South Korea

Renewed optimism

Thursday turned out to be a remarkably good day for US investors as major indices closed higher on the back of renewing optimism with regard to the US-China trade war. Upbeat sentiment has also been seen across Asian markets where the Korean KOSPI is leading the gains (+1.8% at the time of writing), while other major indices are also adding more than 1%, except the Shanghai Composite being up just 0.3%. Where did optimism come from? On Thursday, China said that it would not retaliate immediately against the latest US tariff increase and it wanted to focus on removing new tariffs so as to prevent a further escalation of the trade spat. In addition to that, several hours later Donald Trump informed that the US and China were scheduled to have a conversation about trade, however, we have yet to get any information from these talks. Let us notice that US GDP for the second quarter grew less than expected, according to the data released yesterday, which could be also a factor prompting Donald Trump to reconsider his trade strategy (put it simply, he could realize that any trade restrictions are harmful not only to China but for the US as well.

The US30 is looking to break above its latest consolidation. Should it happen, the US index might take a stab at heading toward 27300 points. Source: xStation5

The US30 is looking to break above its latest consolidation. Should it happen, the US index might take a stab at heading toward 27300 points. Source: xStation5

Avalanche of data

Looking at the Asian macroeconomic calendar we may notice a lot of prints released overnight. First of all, let’s begin with Japan from where we got many ambiguous numbers. First, industrial production rose 1.3% MoM in July, above the consensus pointing to a 0.3% MoM increase, while retail sales (for the same month) decelerated 2.3% MoM, that was worse than the consensus had indicated at. Second, inflation in Tokyo for August slowed to 0.6% YoY from 0.9% YoY, matching the median Bloomberg estimate, while core price growth also did decelerate irrespective of what a gauge we look at (either ex-fresh food or ex-fresh food and energy). Third, the data from the labour market showed the jobless rate decreasing to 2.2% from 2.3% (the consensus had not assumed any decline), while the job-to-applicant ratio fell to 1.59 from 1.61, missing the median estimate assuming no change. Looking beyond Japan, it is worth mentioning a solid 2.6% MoM increase in South Korean industrial production, well above the consensus suggesting a 0.5% MoM jump. Taking into account that some macroeconomic releases from South Korea tend to lead those from other economies, it could be considered as a somewhat reassuring sign for investors. This solid release is also helping the KOSPI rise today. Last but not least, building permits for July from New Zealand fell 1.3% MoM, while permits from Australia (also for July) plunged as much as 9.7% MoM. However, keep in mind that these are very volatile series, hence looking at a single reading, in attempting to draw constructive conclusions, seems to be pointless.

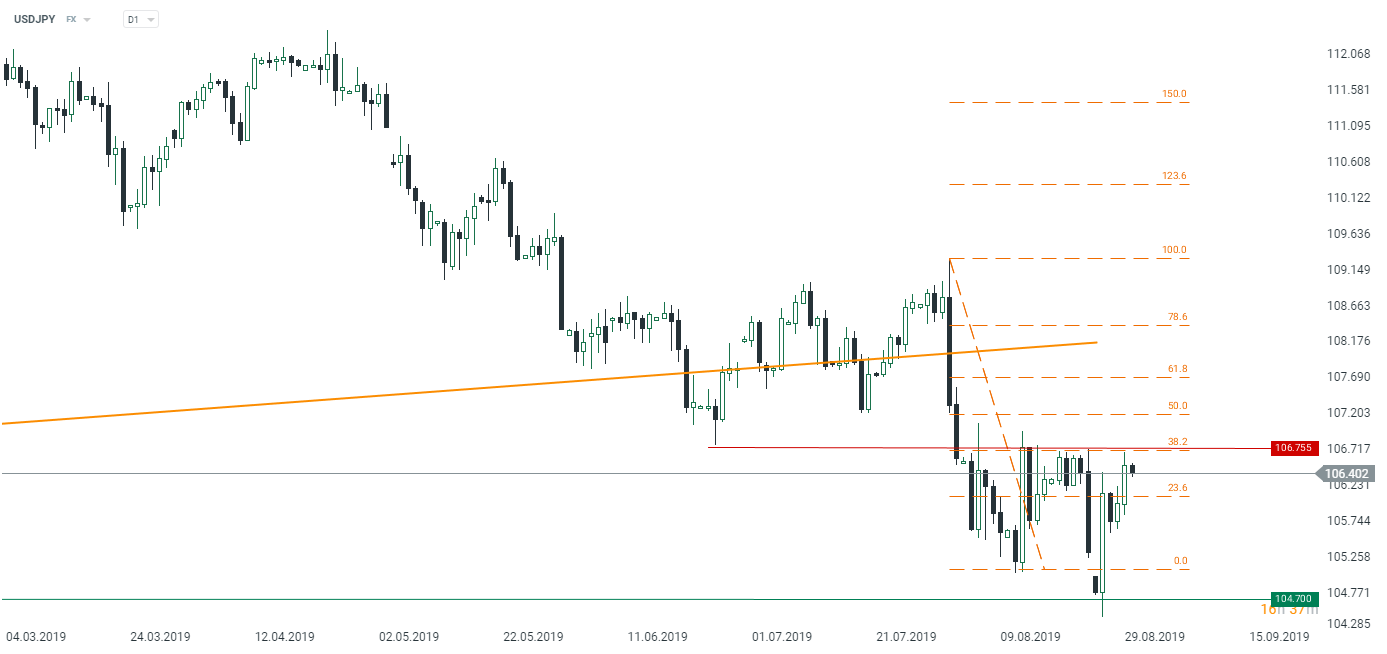

The USDJPY is hovering right below its important technical resistance. Source: xStation5

The USDJPY is hovering right below its important technical resistance. Source: xStation5

In the other news:

-

S&P cut Argentina to SD from B- after the country said it would delay payments on $101 billion of debt; the new rating means that the country should be able to make other payments in a timely manner

US Open: Wall Street in Blood

DE40 dips 3% and falls to 2026 lows 🚨📉

Morning wrap (03.03.2026)

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.