- How high are the fines of American tech companies in Europe?

- Do these fines actually harm these companies?

- What is their role in the intensifying competition between Europe and the USA?

- Is the USA's position as strong as many believe?

- How high are the fines of American tech companies in Europe?

- Do these fines actually harm these companies?

- What is their role in the intensifying competition between Europe and the USA?

- Is the USA's position as strong as many believe?

At regular intervals, media reports surface about proceedings and fines imposed on American tech giants by the European Commission or related bodies. The amounts mentioned quickly become hard to imagine.

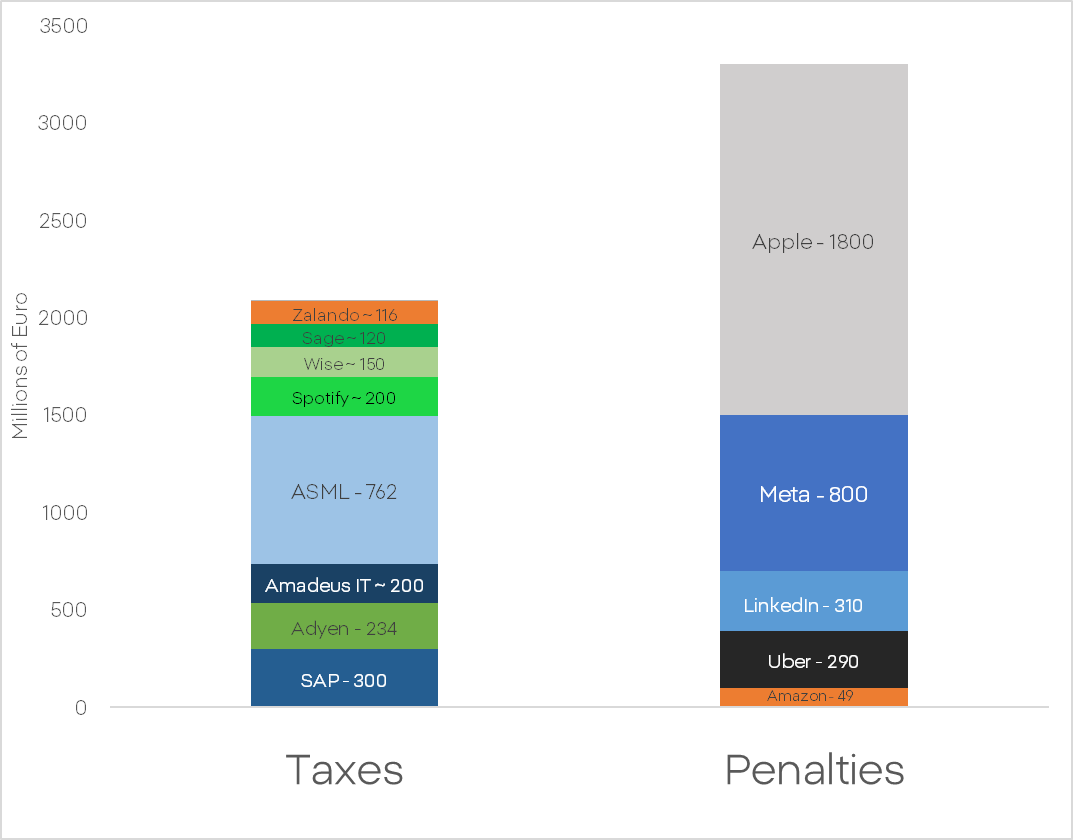

In 2024, the EU received more revenue from fines against the largest American tech companies than European tech companies paid in taxes. Apple alone paid over 1.8 billion euros, while Meta and LinkedIn together have to pay as much as 1.1 billion. And these are just fines from the year 2024. In 2025, Meta is set to pay another 200 million, Platform X 120 million, and Apple will owe another 500 million. Google received a record fine, having to pay nearly 3 billion euros. What is the reason for this, and what could be the consequences?

Firstly, it's important to dispel the myth that EU fines are harmless. Fines imposed by the European Commission are calculated based on the parent company's global revenues, not profits or specific segments of its operations. The ability to optimize the amount of these fines through company accounting policies is minimal.

If these fines are indeed so severe, why is it difficult to see their impact on valuations? Primarily, European Commission proceedings last, at best, many months. The process of discounting risk and the potential fine amount is spread over a long period. Losing a few percent of annual revenue is painful for any company, but not enough to provoke a deep devaluation or change in trend for the largest entities.

The question arises, what are the causes and potential ramifications of these fines? Why are they so regular, and do they reflect the relations between Europe and the USA?

The reason for the regularity of fines is quite simple. The business model of US tech giants has several assumptions crucial for maintaining their growth rate and profitability:

- Collecting and aggregating vast amounts of sensitive user data without their consent

- The ability to consolidate the market to a degree resembling a monopoly

These businesses need absolute dominance over customers and employees while lacking oversight or competition in their sector. This model operates in absolute contradiction to the fundamental regulatory assumptions of the European Union. American businesses cannot adapt to a system that protects competition principles and ensures basic consumer protection.

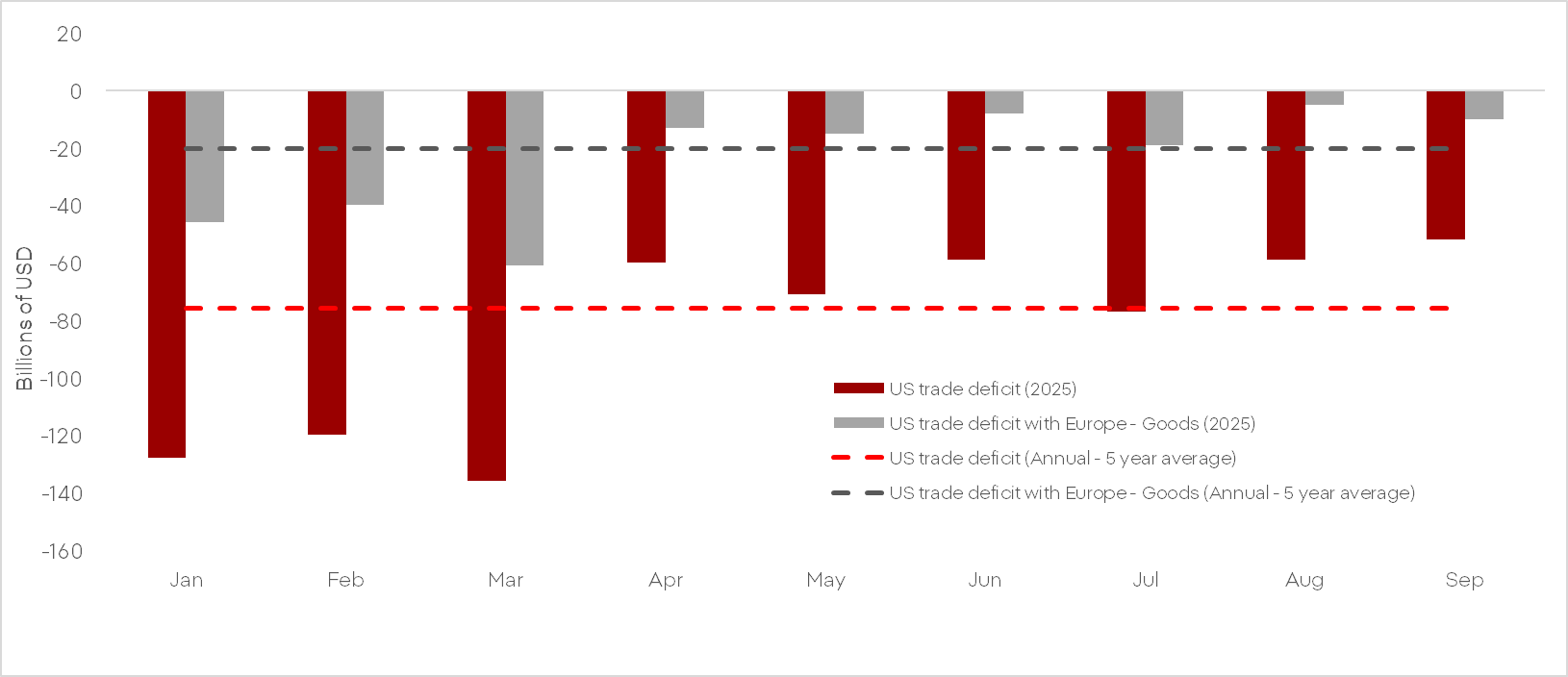

The US government has actively involved itself in the matter, where the stakes are not only ideological but also economic. Analyzing the US trade balance reveals a huge trade deficit with Europe, which contradicts the rhetoric of the USA as an economic powerhouse and Europe as a relic. In this balance, the position that allows the USA to recover at least part of the losses is IT services.

This is why the US administration fiercely defends the open law-breaking by American corporations.

However, the effectiveness of America's pressure instruments remains limited. Europe's military dependence on the USA has proven to be a fiction. Ukraine has been defending itself for a year without US support, and Rheinmetall alone produces several times more ammunition today than the entire USA. The American arms industry is losing key clients in the Middle East to Europe, whose equipment is equally good and not dependent on Israel's immediate interests.

Tariffs and narratives that Donald Trump uses to combat European products do not work. A slight decrease in the deficit can be observed, but not its elimination. However, even this results from a huge increase in imports at the beginning of the year to stockpile products before tariffs take effect. To draw more accurate conclusions, more current data is needed, which has not been published due to the government shutdown.

Additionally, the quality gap between European and American products is not a moat but an ocean. A billionaire going to buy a new car will not buy a Ford truck. He will buy a Lamborghini. Intel and Nvidia do not use Vecco machines to produce their chips but Dutch ASML, Americans use Danish Ozempic (or its knock-offs) for obesity, and during the COVID pandemic, Americans received vaccines of German and British production.

Examples can be multiplied further. The monumental economic advantage of the USA over Europe exists mainly in the minds of commentators and politicians who try to project their views onto markets and the economy.

EU regulations and structures, which are regularly criticized by economic elites, constitute a structural barrier for American companies. The policy and goals of the current US administration need a Europe that is relatively weak and divided. The European Union is too strong an opponent for open trade war in the face of resolute China and increasingly poor economic conditions in the USA.

Next year, we can expect intensified diplomatic pressure attempts and anti-European political agitation from US-controlled social platforms. We can also observe increased investments in European alternatives in data processing and AI areas.

Morning wrap (05.03.2026)

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.