Monetary policy decision from the European Central Bank is a key market event of the day. Rate announcement is scheduled for 1:15 pm BST, with ECB President Lagarde set to hold post-meeting press conference half an hour later at 1:45 pm BST. Let's take a quick look at what markets expect from the meeting and how markets may react!

ECB expected to cut rates today!

European Central Bank is widely expected to deliver a 25 basis point rate cut today, with deposit facility rate seen dropping from 4.00% to 3.75%. This will make ECB the second G7 central bank to launch an easing cycle after Bank of Canada decided to cut rates yesterday. This will be the first time ECB lowers interest rate since 2019.

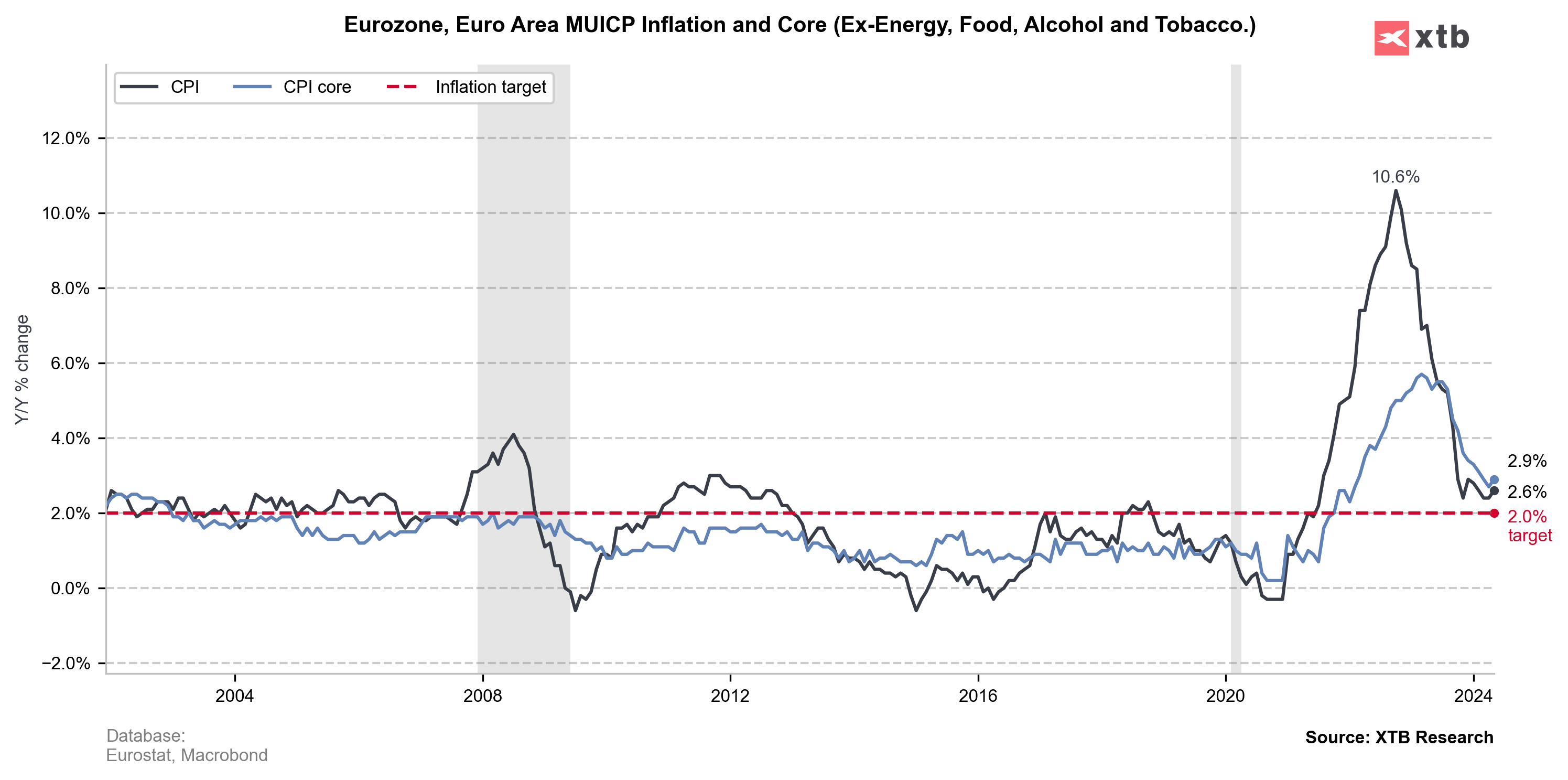

Macro setup for lowering rates is there - PMIs hint at European manufacturing sector being in recession, industrial production continues to decline year-over-year, GDP growth has been sluggish and inflation has decelerated significantly towards the 2% target. Also, ECB members have been clear in communicating that June is an appropriate timing for the first rate cut given how macro data has developed recently.

Inflation in euro area has decelerated significantly from post-Covid peaks and is approaching 2% inflation target set by ECB. Source: Macrobond, XTB Research

Economists are almost unanimous

We have said that ECB is widely expected to cut rates, but it may be an understatement - almost everyone thinks that a rate cut is coming! 60 out of 62 economists polled by Bloomberg expect a 25 basis point rate cut today, while one expects an even bigger move of 50 basis points. Just a single economist in the survey expects ECB to keep rates unchanged. Money markets are certain that ECB will decide on a rate cut today - swap market prices in a 100% chance of a 25 basis point cut today! However, what comes next is not as clear.

Source: Bloomberg Finance LP, XTB Research

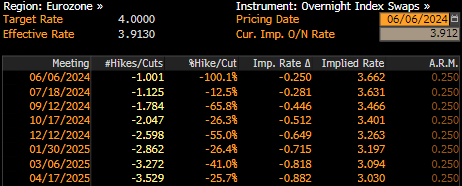

Expectations became less dovish since the beginning of 2024

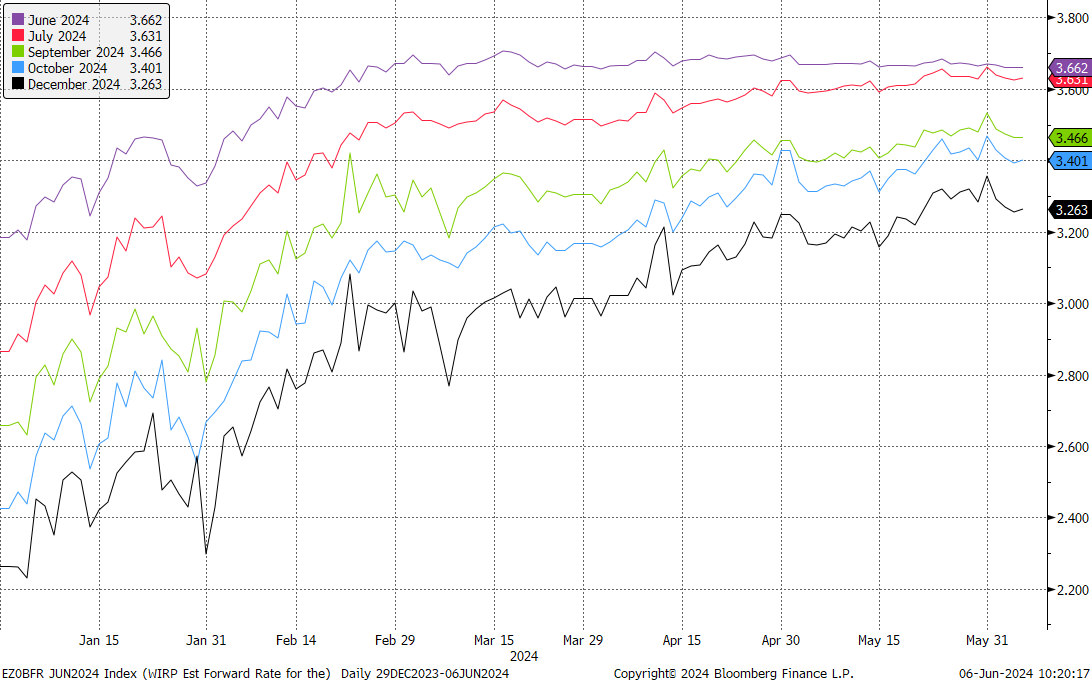

Markets are pricing in 3 rate cuts this year (June, September and December). Currently, markets see around 80% chance of 25 bp cut in September and around 80% of another 25 bp move in December, which will put deposit facility rate at 3.25% at year's end. While 3 rate cuts may sound dovish, it should be said that money markets saw 4 rate cuts this year as recently as in April and 7 cuts for 2024 at the beginning of the year.

Market expectations have got less and less dovish since the beginning of the year. Source: Bloomberg Finance LP, XTB Research

Market expectations have got less and less dovish since the beginning of the year. Source: Bloomberg Finance LP, XTB Research

How can markets react?

As usual, this is a tricky question. Given that the 25 basis point rate cut is expected and fully priced-in, rate announcement is unlikely to have any impact on the markets, unless ECB decides to keep rates unchanged or go with a 50 basis point rate cut. However, any surprise with regard to level of rates is highly unlike. Having said that, guidance for the future meeting as well as a new set of macroeconomic projections may be the driver of market reaction.

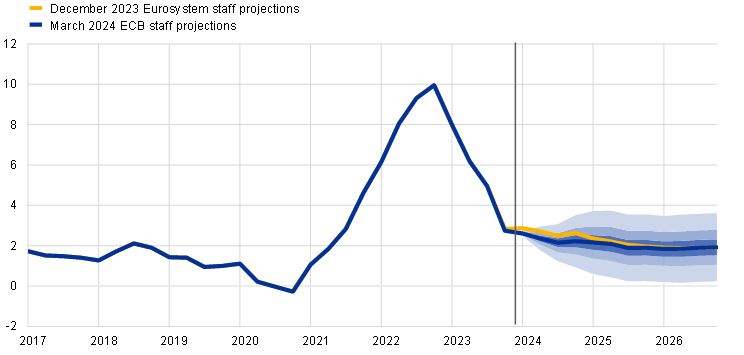

ECB is unlikely to provide clear guidance on rate and instead repeat that decision will be taken on a meeting-by-meeting basis and with regard to incoming economic data. Also, recent comments from some ECB members strongly suggested that back-to-back rates cuts are unlikely now. However, should new economic forecast include significantly lower inflation projections, it could reinvigorate markets expectations for a more dovish ECB in the second half of the year (3 or more cuts). This would be EUR-negative. On the other hand, keeping inflation projections little changed may see EUR strengthen.

ECB staff projections will be closely watched. Another downward revision may put pressure on EUR and boosts market odds for more rate cuts in the second half of 2024. Source: ECB

EURUSD gains ahead of ECB decision

EUR is one of the best performing G10 currencies today. Taking a look at EURUSD chart at D1 interval, we can see that the pair trades slightly higher on the day after erasing a big part of previous gains. Overall, the pair attempted to break above the 1.09 resistance zone recently but bulls failed to push it above this hurdle, at least for now. Lack of big downward revisions to inflation and GDP projections as well as highlighting that decisions will be made on a meeting-by-meeting basis may provide support for EUR and lead to another attempt of breaking above 1.09 area. On the other hand, should ECB issue lower inflation and GDP forecasts, and ECB Lagarde stresses at the post-meeting press conference that economic activity has moderated, this may trigger EUR weakening.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.