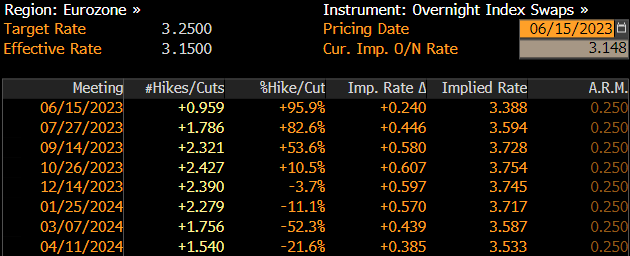

Euro is one of the best performing G10 currencies today. The ECB is scheduled to announce its next monetary policy decision today at 1:15 pm BST and markets expect that it will deliver the second 25 basis point rate hike in a row, pushing the deposit rate to 3.50% - the highest level since mid-2001. However, ECB is not expected to stop there with money markets pricing in one more 25 basis point rate hike later this year, most likely at the July or September meeting. A hint that rate hike is more likely to come in July than September could be seen as hawkish.

Money markets see two more ECB rate hikes by the end of the year. Source:Bloomberg

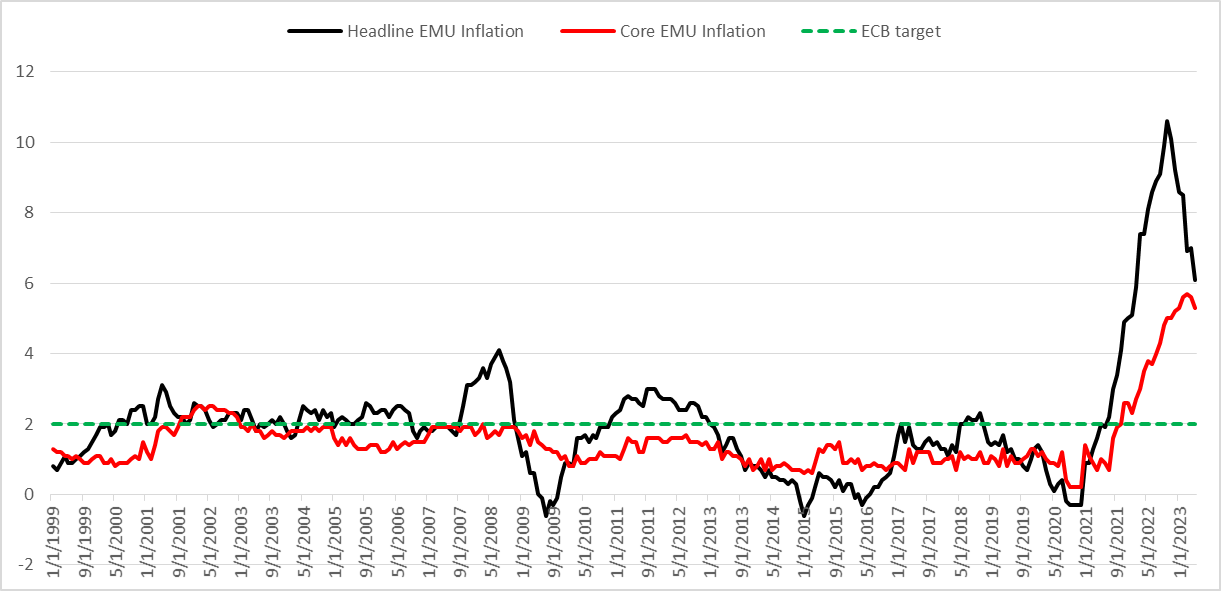

ECB has reasons to continue to tighten policy - while headline inflation has been decelerating for some time and core gauge also moved lower recently, both measures continue to run significantly above Bank's target. A point to note is that the ECB will also release a new set of economic projections today, including inflation forecasts. Forecasts will be released 30 minutes after the decision (1:45 pm BST), when ECB President Lagarde starts a press conference.

As scope for a surprise on rate decision looks very small, with all 45 economists polled by Bloomberg expecting a 25 bp rate increase, economic forecasts may be a key driver for European assets. ECB projections from March suggested that inflation is not expected to reach 2% target until 2025. An upward revision to those would likely see EUR gain while a downward revision, signaling that target may be reached earlier, could have a negative impact on common currency.

Inflation in the European Monetary Union started to decelerate but remains significantly above the ECB target. Source: Bloomberg, XTB Research

Inflation in the European Monetary Union started to decelerate but remains significantly above the ECB target. Source: Bloomberg, XTB Research

A look at EURUSD chart

EURUSD attempted to break above the 50-session moving average yesterday (green line) but failed as USD regained some ground following the FOMC decision. However, failure to break above the aforementioned moving average did not change the technical landscape - uptrend sequence is still present on the chart and a recent rebound off the mid-term trendline confirmed bullish momentum. A hawkish surprise, in terms of higher inflation forecast or more hawkish forward guidance, could provide support for the pair and a fuel for another test of the 50-session moving average. On the other hand, should ECB sent a dovish message, the near-term support to watch is an area ranging between 1.0750 mark and the 23.6% retracement of upward impulse launched in September 2022.

EURUSD at D1 interval. Source: xStation5

EURUSD at D1 interval. Source: xStation5

Economic calendar: US CPI in the spotlight (13.02.2026)

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.