EURJPY is a pair that has seen some movements today. The pair has dipped below the 200-hour moving average during the Asian trading as yen gained on media reports saying that Japanese government may revive BoJ's mandate and inflation target in early-2023. However, the pair slowly recovered since and got a lift at the beginning of the European trading after ECB member De Guindos said that European central bank will stick to 50 basis point rate increases and that he does not know when rate hikes will stop, reinforcing hawkish message sent by President Lagarde at a post-meeting press conference. German IFO indices at 9:00 am GMT also supported EUR as they came in above expectations. Current conditions index jumped from 93.1 to 94.4 (exp. 93.5) while expectations index moved from 80.0 to 83.2 (exp. 82.0).

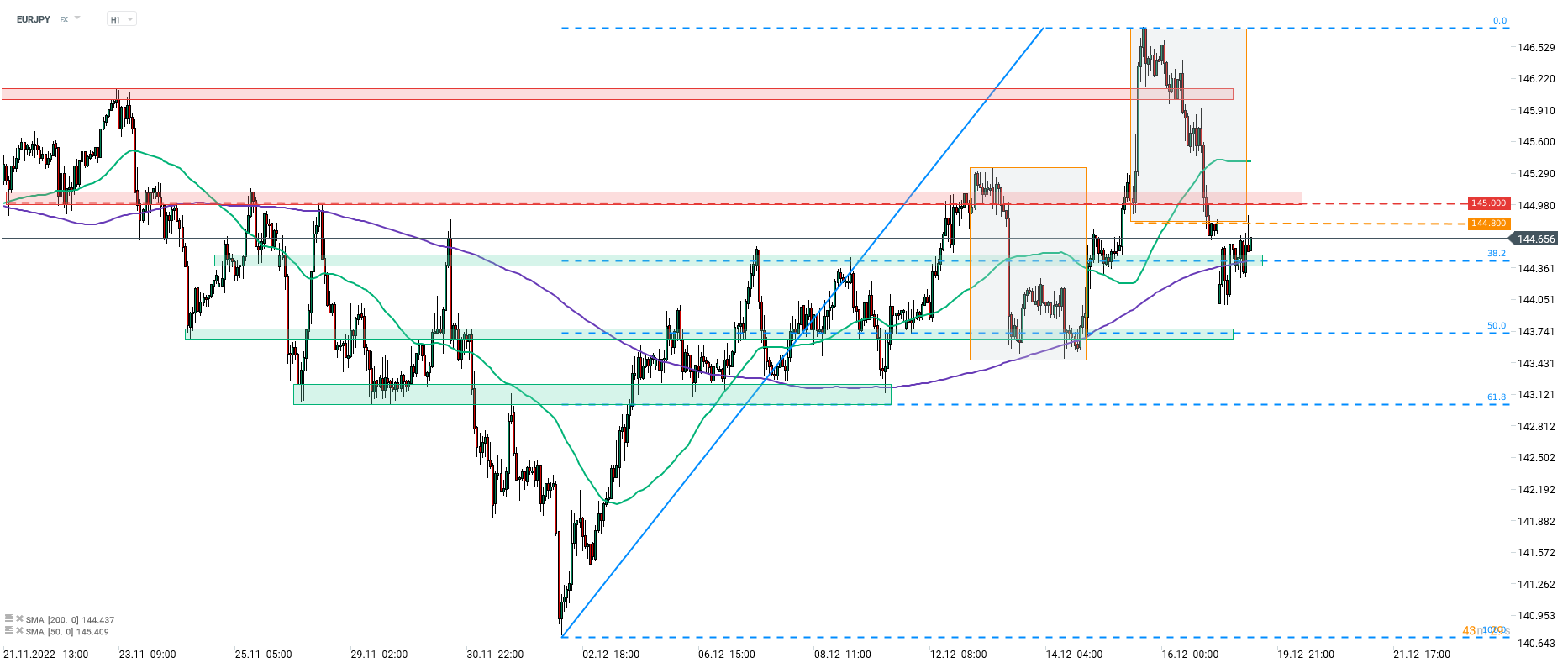

Taking a look at the pair at H1 interval, we can see that the pair recovered from a dip below the 200-hour moving average (purple line) and climbed back above a price zone marked with 38.2% retracement.. While this is a positive from a technical point of view, it should be noted that the pair has made the largest correction to date in the current upward impulse. This means that according to the Overbalance methodology, short-term trend has reversed to bearish. The nearest major resistance zone to watch can be found ranging above 145.00 mark.

Source: xStation5

Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.