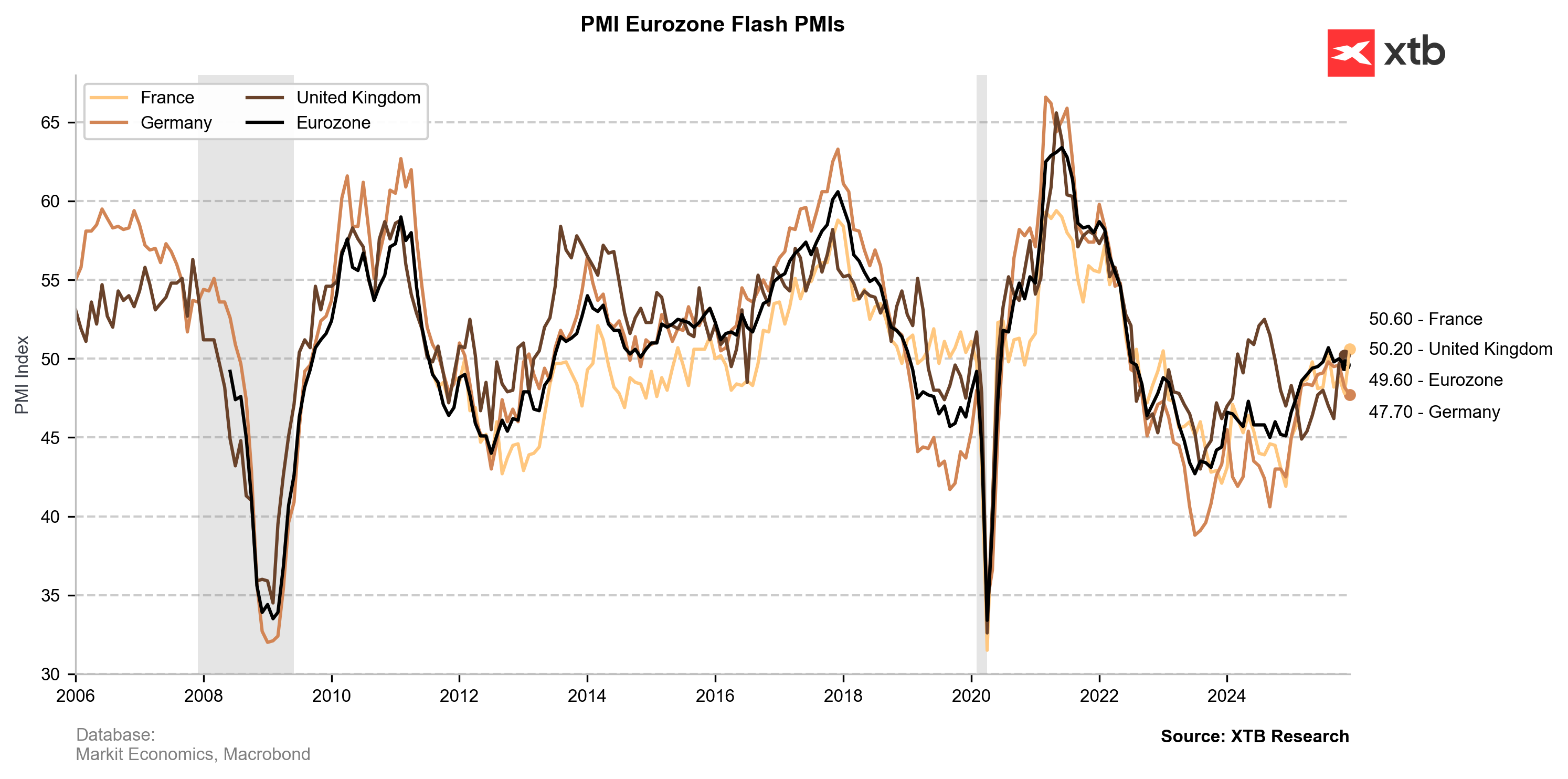

The Euro is trading lower following the release of the final preliminary Purchasing Managers’ Index (PMI) data for December, which highlighted fatal weakness in Germany’s manufacturing sector and a mixed activity profile for France.

Germany: Preliminary December PMI Readings

-

Manufacturing PMI: 47.7 (Expected 48.5; Prior 48.2). Significantly worse than anticipated. Signals further distress for the industrial sector, which has struggled to gain traction throughout the year.

-

Services PMI: 52.6 (Expected 53.0; Prior 53.1). Marginally below expectations. The sector remains in expansion territory but is losing momentum.

-

Composite PMI: 51.5 (Expected 52.4; Prior 52.4). Worse than expected. Indicates a slowdown in the overall rate of economic growth.

France: Preliminary December PMI Readings

-

Manufacturing PMI: 50.6 (Expected 48.1; Prior 47.8). Significantly better than anticipated. A surprise return to the expansion zone (above 50.0).

-

Services PMI: 50.2 (Expected 51.1; Prior 51.4). Worse than expected. A slowdown in the rate of growth, bordering on stagnation.

-

Composite PMI: 50.1 (Expected 50.3; Prior 50.4). Marginally worse than expected. The economy is effectively stagnating at year-end.

Market Reaction and ECB Implications

Despite an initial flicker of optimism sparked by the unexpected improvement in French manufacturing, the overwhelmingly negative tenor of the German data has dominated market sentiment. The Euro is distinctly weaker following the releases, with a similar reaction observed in German bond yields.

The current readings suggest that the European Central Bank (ECB) may lack the mandate to shift its rhetoric to a more aggressively hawkish stance in upcoming meetings.

Key Takeaways

-

German Industry Under Pressure: The primary disappointment lies with the German Manufacturing PMI (47.7). This sharp decline, falling well short of forecasts, signals a deepening contraction in the bloc's key industrial engine. Production is falling for the first time in 10 months, confirming substantial sector weakness. It raises questions over whether the anticipated economic recovery for 2026 will materialize.

-

France’s Faltering Stability: France presents a mixed picture: industrial stabilization is positive, but the services sector is rapidly losing steam. The French Composite activity (50.1) signals a precarious balance between expansion and stagnation. Despite domestic political headwinds, the expansionary nature of the manufacturing print is a welcome development.

-

Wider Eurozone Outlook: The acute weakness in Germany, the Eurozone's largest economy, outweighs the relative strength seen in French manufacturing. The German Composite PMI’s drop to 51.5 (vs 52.4 expected) implies a further deceleration in the region’s growth momentum.

-

ECB Policy Stance: The ECB is expected to maintain a neutral position in its forward guidance. The data is broadly consistent with the trend observed throughout 2025. Crucially, there appears to be little prospect for introducing a more hawkish tone for 2026. This dynamic may serve to neutralize any residual positive impact on the euro stemming from recent hawkish comments by policymakers like Isabel Schnabel.

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.