- The market is expecting a very dovish message from the ECB

- Communication over the past months has indicated a desire to keep interest rates high for an extended period. Lagarde may want to dampen expectations for strong cuts

- The market expects interest rates to be held today and as many as 6 cuts next year

- Eurozone inflation is very close to the inflation target

- Inflation projections will be key to the EURUSD's further fortunes in today's session

Will the ECB change its communication like the Fed?

A lack of interest rate hikes in the eurozone seems more than certain. The key question, however, is whether the ECB will change its communication regarding interest rates next year. For many months, ECB bankers suggested that interest rates could be maintained at the same level throughout the next year, but at the same time, a significant drop in inflation and the risk of a recession may force the ECB to cut rates earlier than the Fed. Moreover, the Fed's pivot allows for a similar move by the ECB.

The market expects the first interest rate cuts in the eurozone to appear as early as spring. However, this is too early, considering the latest communication from European bankers. Source: Bloomberg Finance LP, XTB

Lagarde has repeatedly emphasized during recent meetings that we should not expect interest rate cuts in the coming quarters. However, the situation is changing dynamically. Inflation for November fell to 2.4%! In July, it was more than twice as high. With a deposit rate at 4.0% and current inflation, real interest rates seem extremely high.

What to expect from ECB projections and Lagarde?

Certainly, Lagarde should indicate that further interest rate hikes should no longer occur, although this will be said more gently. With such a statement, there is a chance for the euro to weaken. Additionally, Lagarde should note the recent drop in inflation but emphasize the risk of its rebound next year. Nevertheless, the inflation projection for 2024 should be lowered. It currently stands at 3.2%. At the moment, projections indicate a target of 2% by mid-2025. Today's results may give a chance to achieve this goal earlier.

Moreover, there is also a chance for "tightening" communication regarding the PEPP program and balance sheet reduction. Given the mitigation of risks related to yield increases in countries like Italy, there is a chance to accelerate balance sheet reduction and quicker cessation of PEPP program reinvestments. If such communication occurs, there would be a chance for the continuation of the euro's strengthening. Of course, the ECB will still keep in mind the significant risk of a potential recession.

A possible EURUSD reaction?

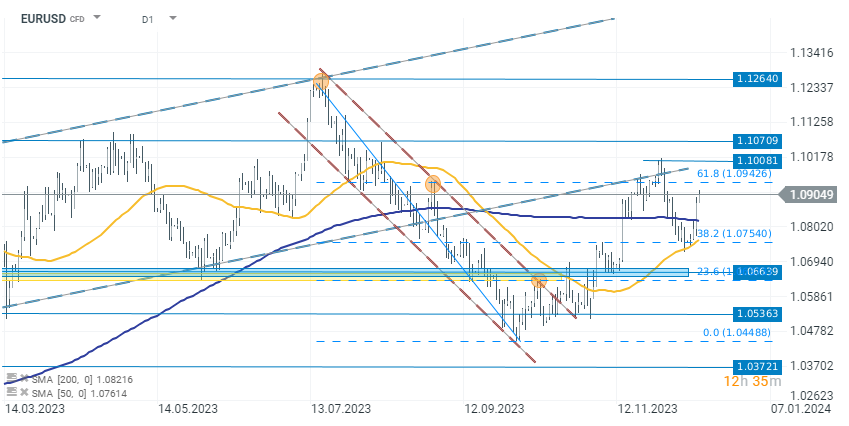

The euro remains one of the weaker currencies in the market, as expectations point to a dovish message from the ECB. At the same time, the dollar is even weaker, allowing for a 0.3% gain on the EURUSD pair and a move above the 1.09 level. Investors are reacting to a more pronounced central bank pivot, with speculation in the markets now centered around the prospect of the first interest rate cuts. Just as importantly, EURUSD has already gained nearly 1.40% in 3 sessions, approaching the key 1.100 level again.

Although Lagarde is unlikely to be as dovish as the market sees it, inflation projections may give an indication of faster interest rate cuts. For further strong EURUSD appreciation, Lagarde would have to assure that rates would remain unchanged for the next few quarters, and the ECB itself would have to change its communication on the balance sheet and PEPP. If inflation projections go sharply down, a correction on EURUSD cannot be ruled out.

Source: xStation 5

Source: xStation 5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Market Wrap: Capital Flees Europe 🇪🇺 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.