The October CPI reading will be the first inflation reading in the USA following the presidential elections. From a market behavior perspective, there's strong positioning by investors anticipating inflation rebounds during Trump's presidency, consequently expecting the Fed to maintain higher interest rates for longer, thus somewhat restraining the rate cut cycle that the Federal Reserve initiated in September.

Prior to the CPI reading, we're observing near-historical maximums on American stock indices. The S&P500 has slightly dropped below the 6000-point threshold, while futures contracts on the index continue to oscillate around this psychological barrier. The EURUSD pair is falling to its lowest values since April this year, signaling dollar strength, while the 10-year bond yield oscillates around 4.43%, increasing by 82 basis points relative to the lows after the Fed's first rate cut. All these signals indicate market expectations for inflation growth both in October and potential price increase strengthening in the United States under Republican governance.

The structure of October's price increases is particularly significant. While headline CPI is likely to rise to 2.6% y/y, key components show varied dynamics. The decline in energy prices (-1.3% for gasoline) was offset by increases in other categories, particularly in the used car segment, where a significant increase of 1.5% m/m is predicted. However, there remains room for potential deepening of current movements if inflation rises higher than predictions, given the still high probability the market assigns to another interest rate cut at the Fed's December meeting.

What to Expect from Today's CPI Reading:

- Expected US CPI increase: 2.6% y/y versus 2.4% in the previous month

- Expected core CPI: 3.3% y/y versus 3.3% in the previous month. Such a reading would mean core inflation remaining unchanged for the third consecutive month.

Autumn months traditionally feature specific pricing patterns, particularly in the automotive sector. However, this year we're observing stronger-than-usual seasonal factor impacts on used car prices, which might complicate the continuation of the disinflation process in coming months. It's worth noting that significant monthly price decreases in this category would be necessary to maintain the disinflation pace.

Market Expectations for the December Fed Meeting

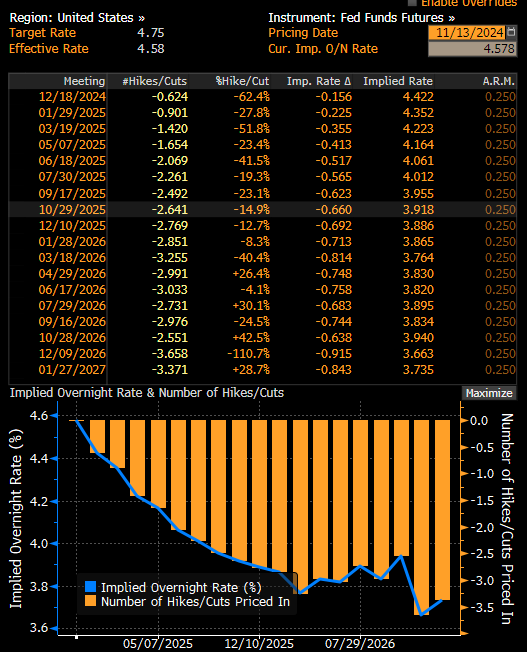

Today's CPI inflation reading may shed more light on current market sentiment, which is pricing in a December 25bp interest rate cut with decreasing probability. While last week the futures market priced such a decision with 72% probability, before the CPI reading this probability dropped to 62%. Maintaining core inflation at 3.3% for the third consecutive month may incline the Fed toward a more hawkish stance, particularly considering the potential impact of new administration policies on price dynamics.

Estimated path of policy rate changes. Source: Bloomberg Finance L.P.

Analyzing long-term inflation perspectives, special attention should be paid to structural changes in the American economy. The projected rent inflation level at the end of 2024 (5.1%) significantly exceeds pre-pandemic levels (3%), suggesting permanent changes in real estate market pricing mechanisms. Potential changes in trade and immigration policies may introduce additional inflationary pressure in the medium and long term, possibly requiring more decisive future Fed response.

EURUSD (Daily Interval)

The EURUSD pair is approaching this year's lowest levels. With further strengthening of the US dollar, testing of early 2023 or September 2023 minimums (1.05434 and 1.05079 respectively) is probable. The RSI indicator is approaching oversold territory, which historically often preceded trend changes. The MACD indicator also signals overselling, reaching values similar to September 2023. Currently, the rate is testing April's minimum of this year. Source: xStation

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Market Wrap: Capital Flees Europe 🇪🇺 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.