Majority of stock markets in Europe are shut today in observance of the Good Friday holiday. There will be no cash trading session on Wall Street today either. However, FX markets are operating normally and US index futures will trade until 2:15 pm BST today.

Limited liquidity means that markets that are running may see some outsized, volatile moves in response to US jobs market data for March, scheduled for release at 1:30 pm BST. A recent streak of downbeat data from US labour market suggests that we may be in for a weak NFP reading today:

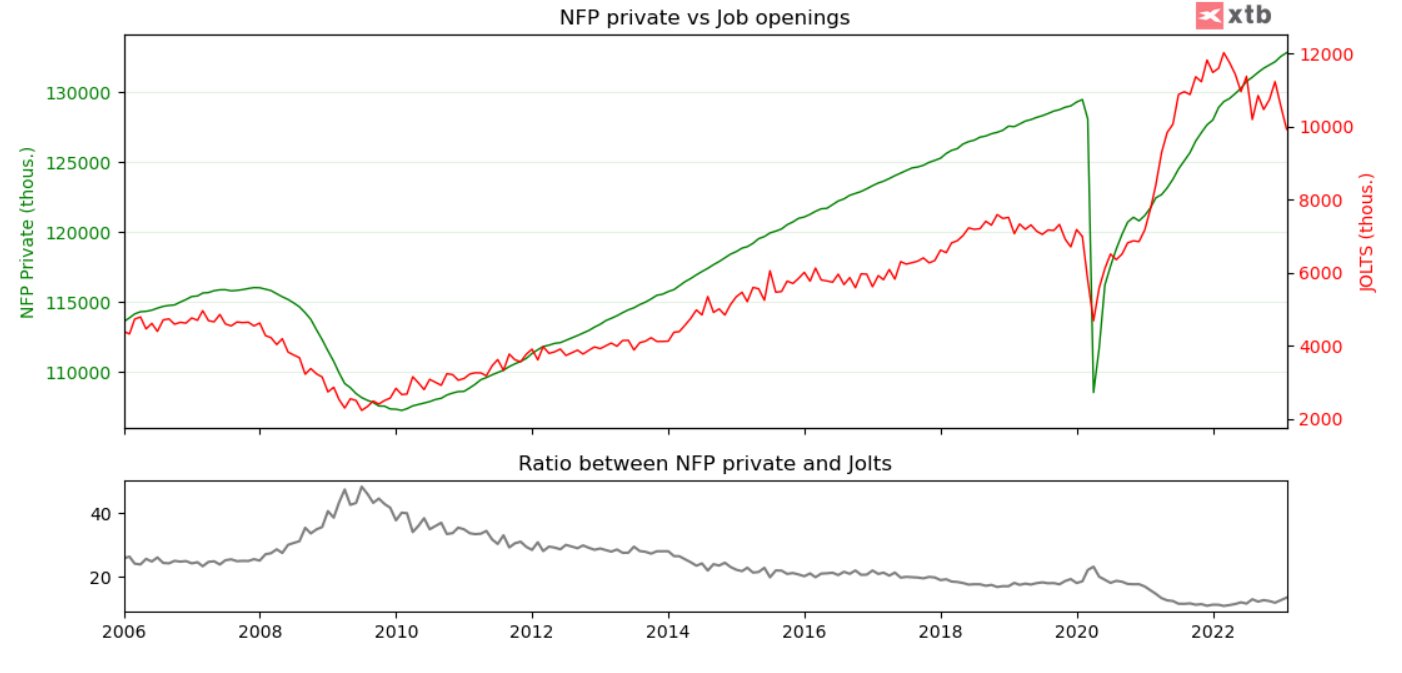

- JOLTS, or new job openings, dropped below 10 million for the first time in almost 2 years. This was also one of the biggest monthly drops in recent years

- Declines in ISM employment subindices. Manufacturing gauge dropped from 49.1 to 46.9 while services gauge moved from 54.0 to 51.3

- Higher-than-expected planned lay-offs according to Challenger report - almost 320% YoY increase!

- ADP data at 145k in March - below 200k expected and also below 3-, 6- and 12-month average

- Weekly jobless claims at 228k. Previous reading revised higher from 198k to 246k

New job openings drop, the number of newly unemployed increases and companies are more reluctant to hire. Is the US jobs market in trouble? Source: Bloomberg, XTB

New job openings drop, the number of newly unemployed increases and companies are more reluctant to hire. Is the US jobs market in trouble? Source: Bloomberg, XTB

However, it should be noted that NFP data has a good track record of beating both - expectations and ADP readings - in recent months. NFP data beat expectations for 11 months in a row! This shows that analysts' overestimate the impact of tightening on the labor market. Moreover, household surveys showed an employment drop on a few occasions in recent months, even as employer surveys (NFP) continued to show relatively high employment gains. What does the market expect from today's report?

- Non-farm payrolls. Expected: 240k. Previous: 311k

- Unemployment rate. Expected: 3.6%. Previous: 3.6%

- Average earnings growth. Expected: 4.3% YoY. Previous: 4.6% YoY

EURUSD

USD is trading slightly higher today but EURUSD remains above 1.09 mark and maintains the uptrend. The latest drop in US yields shows that USD still has room to drop. If NFP data shows sub-200k jobs gain, it would be a strong sign of the labour market cooling down. However, it will not be a sign of a crisis yet. Nevertheless, readings that are significantly below 200k would likely encourage the Fed to pause the rate hike cycle and not raise rates at the May meeting. On the other hand, should we once again see strong job gains and strong earnings growth, rate hike at the May meeting may be still in play.

EURUSD is trading slightly lower today but the uptrend is maintained. Source: xStation5

EURUSD is trading slightly lower today but the uptrend is maintained. Source: xStation5

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.