The Eurodollar is recording declines, and futures contracts on US interest rates indicate less than a 60% chance of a Fed interest rate cut in March, compared to over 70% priced in before Christopher Waller's Fed speech.

Fed Waller

- According to Fed projections, Waller assumes three 25 basis point cuts in 2024. This is more than half less than the market expects.

- A Fed member signaled that the Federal Reserve will not have to rush the pace of cuts if it decides on them.

- Waller advocates a cautious approach to premature cuts, emphasizing methodical and data-driven decisions.

- At the same time, in Waller's assessment, the Fed is closer today to achieving a sustainably lower, 2% inflation, although the timing and scale of cuts will depend on data.

- The current condition of the US economy gives the Federal Reserve the opportunity to not react and balance the risk of excessive tightening of policy, which should be avoided.

- There are still risks of a rebound in price pressure, but a slowdown in consumer activity is visible, which will be further illuminated by tomorrow's US retail sales readings (1:30 PM GMT).

The overall tone of Waller's remarks is not very hawkish but definitely does not support the 'dovish' expectations for 2024, which have solidified in recent months on Wall Street. Waller suggests rather methodical cuts, with which the Fed will not be overly rushed. As a result, we see the dollar appreciating and downward pressure on EURUSD, which records a decline of almost over 0.5%.

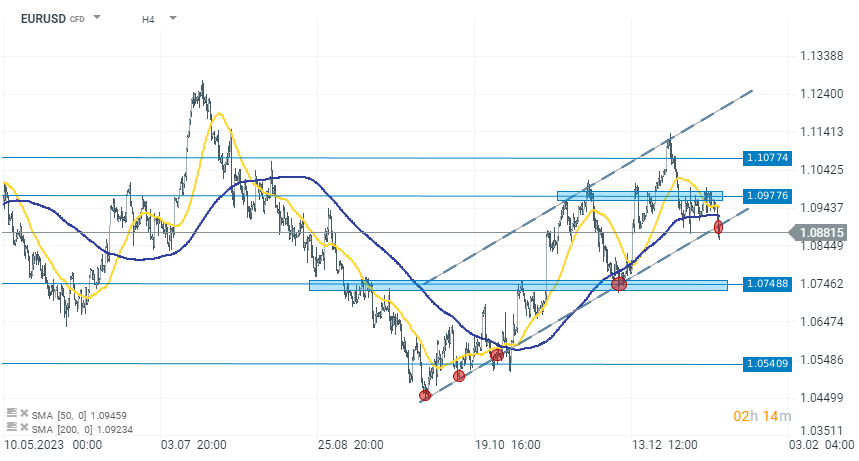

EURUSD (H4, D1 Interval)

H4 Interval: strong dollar in the last two weeks is exerting downward pressure on the EURUSD pair. On the chart, we see an attempt to break through the lower limit of the upward channel around the 1.08800 level. If the pressure is maintained, the next range will be levels in the 1.07500 zone, otherwise, for bulls, it will be crucial to defend the upward channel and return above the lower line.

Source: xStation 5

D1 Interval: looking at the EURUSD on the D1 chart, we see that the pair has reached a significant support point, which is the 23.6% Fibonacci retracement of the upward wave from autumn 2022. If the 1.087 level is maintained, a continuation of the upward trend is possible. On the other hand, a fall below 1.087 could indicate a test of the SMA200 (red line) and levels around 1.06, in case the support from the nearest Fibonacci retracement and the 200-week simple moving average prove too weak to withstand selling pressure. The key zone in the medium term appears to be around the 1.05 levels (horizontal, red line), below which a breakout could even suggest a retest of parity on EURUSD.

Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.