- Consensus: ~50k jobs in November (no forecast for October); unemployment rate up to 4.5%; wages +0.3% m/m.

- Data distortion risks: The release covers two months (Oct–Nov) after the shutdown → higher volatility, lower overlap in the household survey sample, and no October unemployment rate.

- Leading indicators mixed: ISM Services employment improved but remains <50; ISM Manufacturing weaker; ADP negative; jobless claims slightly better; NFIB hiring plans also slightly higher.

- Implications for the Fed: The market prices only a 28% chance of a January cut; a positive NFP may support the USD but won’t change policy unless the report shows a clear trend.

- Consensus: ~50k jobs in November (no forecast for October); unemployment rate up to 4.5%; wages +0.3% m/m.

- Data distortion risks: The release covers two months (Oct–Nov) after the shutdown → higher volatility, lower overlap in the household survey sample, and no October unemployment rate.

- Leading indicators mixed: ISM Services employment improved but remains <50; ISM Manufacturing weaker; ADP negative; jobless claims slightly better; NFIB hiring plans also slightly higher.

- Implications for the Fed: The market prices only a 28% chance of a January cut; a positive NFP may support the USD but won’t change policy unless the report shows a clear trend.

We are moments away from the delayed U.S. labor-market release. The NFP report will cover two months and comes at a moment of exceptionally high uncertainty around interpreting the condition of the U.S. labor market. The consensus expects around +50k jobs in November, but private forecasts cover a wide range from +20k to +100k due to unusual distortions caused by the shutdown. October’s payrolls will likely show a small decline, but they will not include an unemployment-rate reading from the household survey. For November, markets expect unemployment to rise to 4.5%, reflecting both weaker employment and statistical noise following the closure of statistical agencies.

What do macroeconomic indicators suggest?

Leading macro indicators suggest a labor market that is stabilizing. They do not indicate a major downturn, although several signals are mixed.

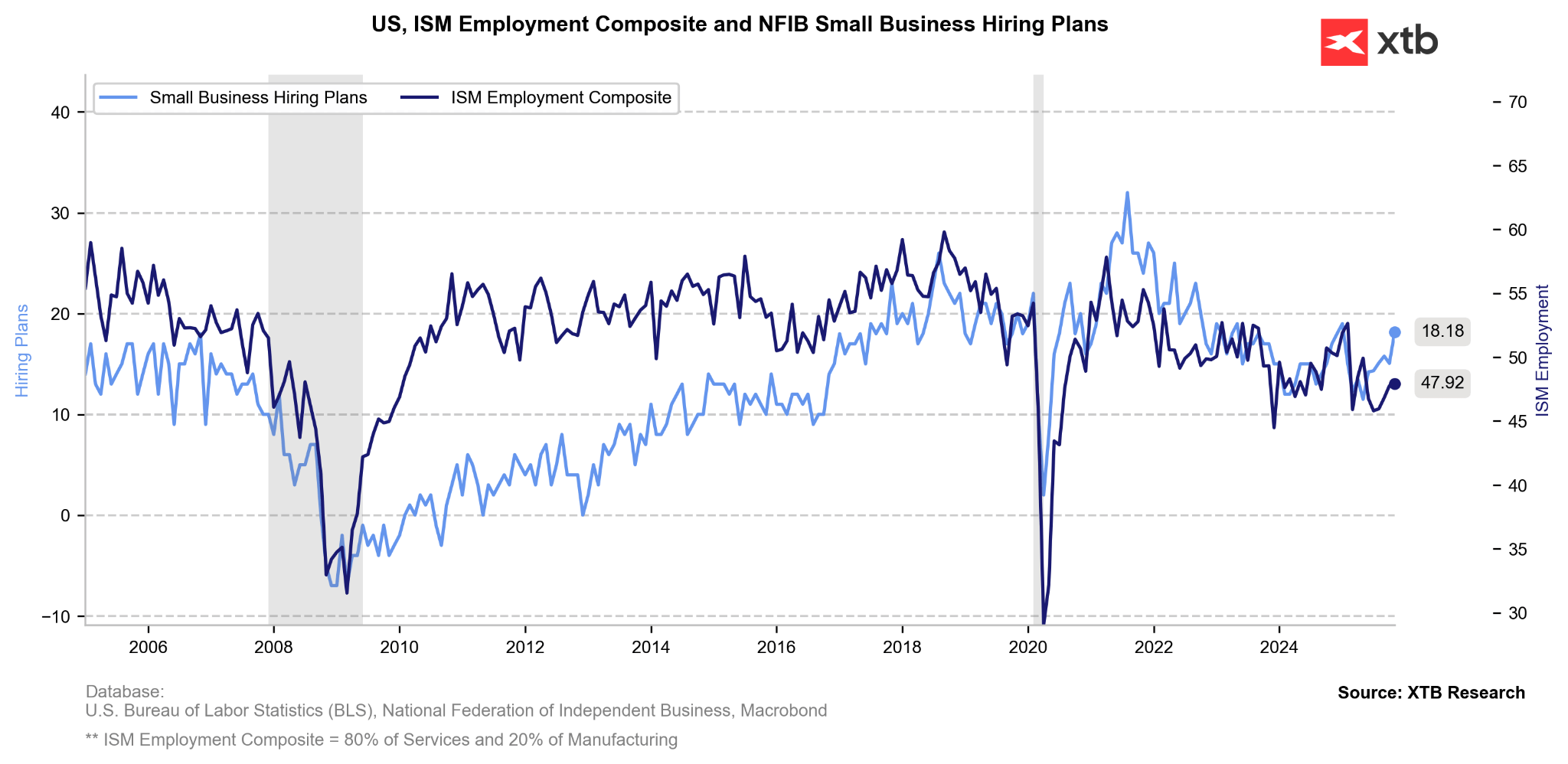

The ISM composite employment index — consisting of ISM Services (80% weight) and ISM Manufacturing (20% weight) — points to a moderate improvement while still remaining in contraction territory. It is important to note the much stronger situation in the services sector, which due to its larger weight pulls the composite index slightly upward. A similar, more decisive trend is also indicated by small-business hiring plans.

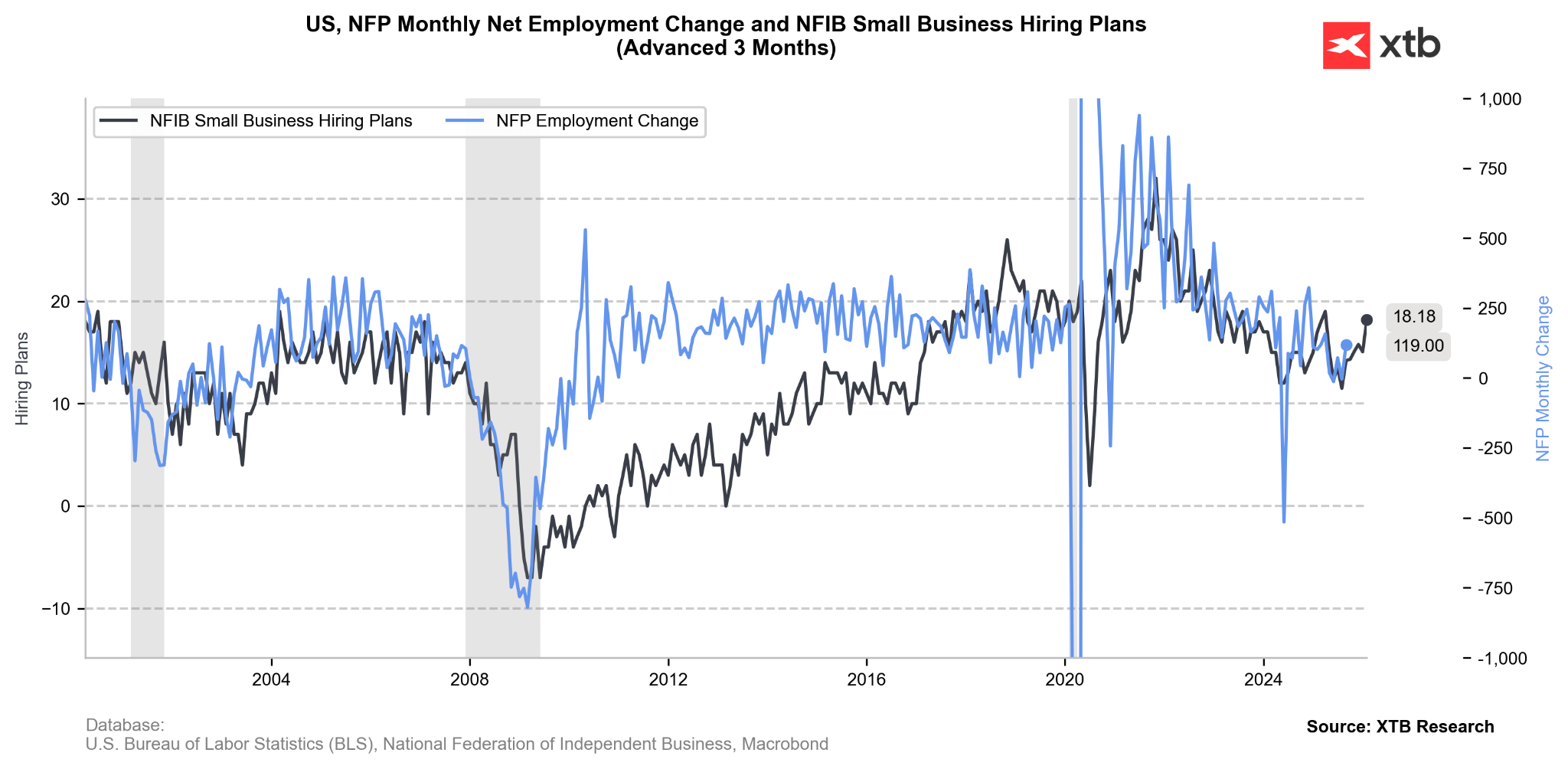

As we can see in the chart below, NFIB hiring plans correlate closely with changes in U.S. employment. The data therefore suggest potentially good numbers.

The 4-week average of new jobless claims has also improved slightly.

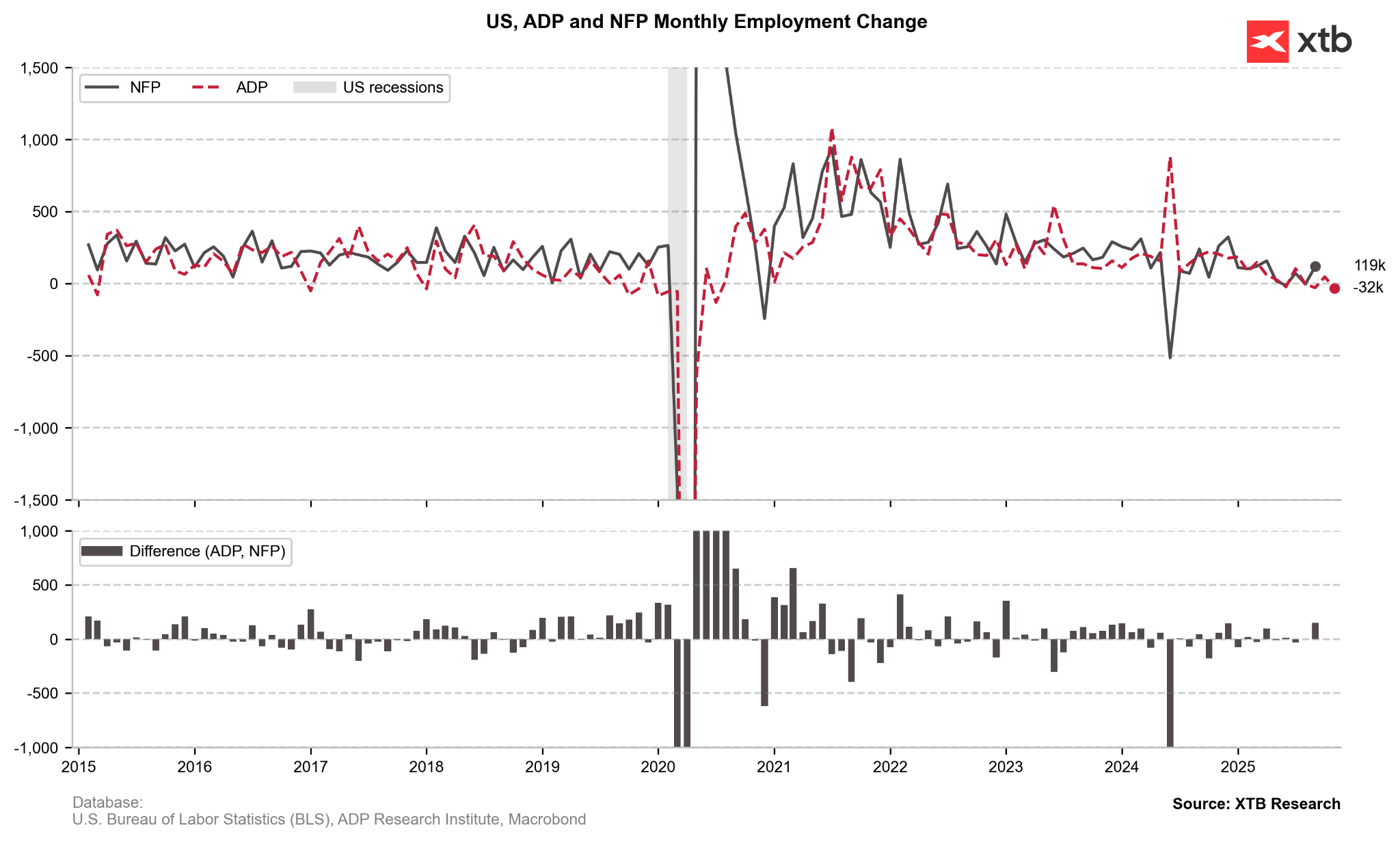

However, weak ADP readings in recent months (including for October and November) point in the opposite direction. It should be remembered that ADP covers only the private sector, while NFP also includes the significant government sector. ADP, being a private analytics provider, was able to publish data during the government shutdown.

Wages and labor force participation

Beyond the headline figure, wage growth and labor-force metrics will be key. Wages are expected to rise 0.3% m/m, consistent with easing wage pressures but still above levels typical for the Fed’s 2% inflation target. Additionally, due to the shutdown’s impact — smaller survey sample and shortened November data-collection window — the unemployment-rate reading will carry a significantly higher standard error, making interpretation more difficult.

Fed expectations

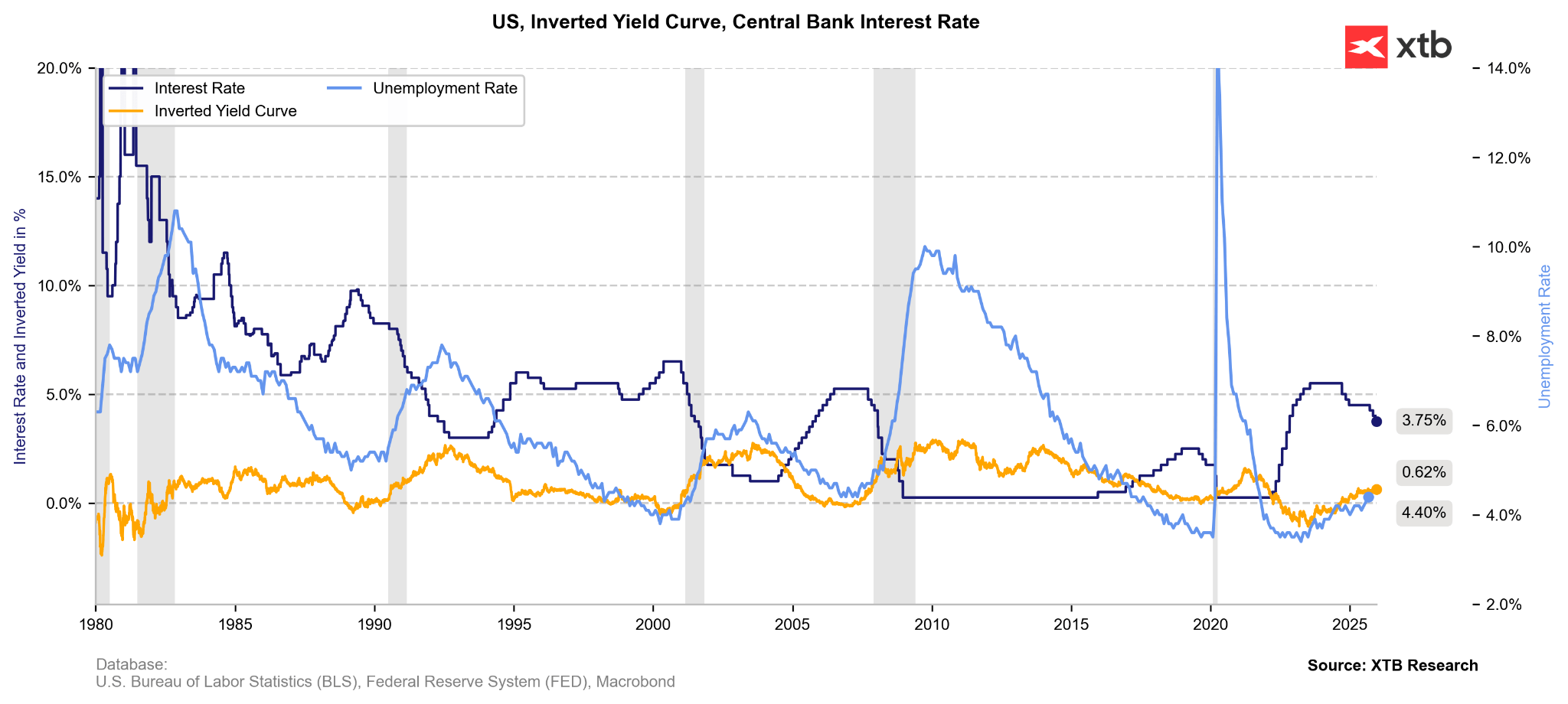

For markets and the Fed, today’s report may generate more uncertainty than clear signals. The Fed has already acknowledged that previous payroll reports may have been overstated by ~60k per month, implying caution when interpreting incoming data.

Before the January 27–28 FOMC meeting, we will still get full CPI and employment reports. The market currently prices a 28% probability of a January rate cut, and today’s data would need to show either a clear acceleration or a major deterioration to meaningfully shift those expectations. Over the past few days, expectations of a January cut have been gradually increasing.

EURUSD

EURUSD continues to climb ahead of the key NFP release. The pair is testing its highest levels since September, having firmly broken above the 61.8 retracement level yesterday. Interestingly, the rally has extended despite the negative tone of the European PMI data. Investors will focus today on the November print. If it comes in around 50k, volatility should remain limited. However, a strong reading could even trigger an attempt to test 1.17. A weaker-than-expected number would open the door for a move toward 1.18.

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.