The euro is gaining against most currencies, with the EURUSD pair increasing by 0.30% following information that the European Central Bank (ECB) is allegedly preparing to introduce a strategy to manage the excess liquidity in banks, which currently stands at about 3.5 trillion euros. The above strategy is expected to be the main point of the next ECB meeting regarding interest rate decisions, which will take place on October 26 in Athens.

According to several insiders closely associated with the ECB, to whom Reuters reached out, a potential strategy could involve raising the mandatory reserves of banks from the existing 1% of customer deposits to a range of 3-4%. This adjustment aims to help curb inflation, which, despite ten previous rate hikes, consistently exceeds the 2% target, and also to reduce the interest expenses of central and national banks on deposits, which are a loss-inducing factor.

Technical outlook

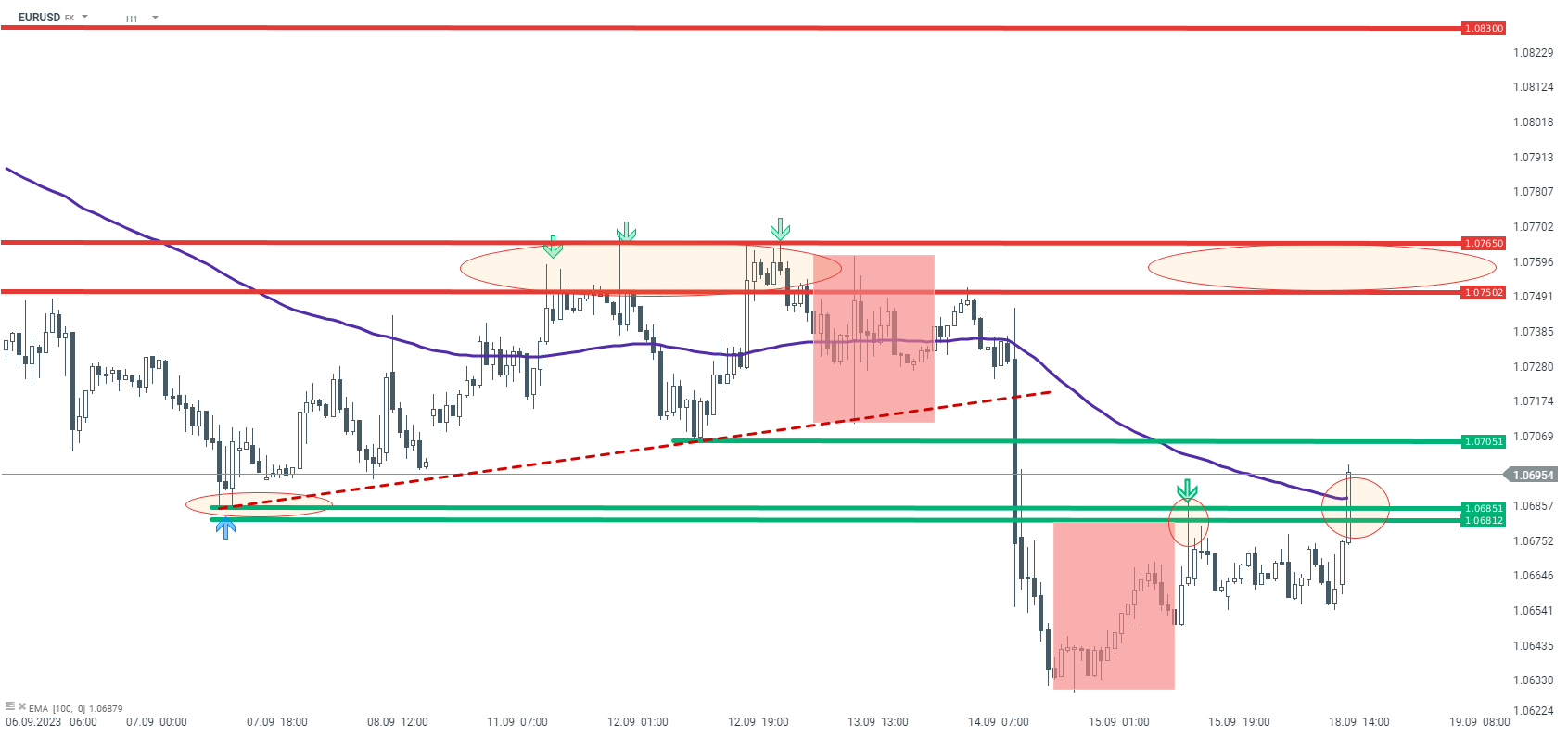

From the perspective of the D1 interval, the sentiment on EURUSD remains bearish. Recently, the rate broke below the key support level at 1.0750, which should now be treated as resistance. This point arises from the breached 1:1 geometry and the trend line. In the event of a continuation of the movement to lower levels, the 1.0630 and 1.0530 levels should be treated as support.

Source: xStation5

As for the H1 interval, we observe an attempt to break the key short-term resistance at 1.0860, resulting from the minimum of September 7 and the 1:1 geometry (red rectangles). In case the upward movement continues, attention should be paid to the resistance at 1.0705, and then the zone 1.0750-1.0760.

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

Morning Wrap - Oil price is still elevated (07.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.