It is expected that US CPI inflation report for November (1:30 pm GMT) will show a deceleration in headline price growth from 7.7 to 7.3% YoY while core gauge is seen dropping from 6.3 to 6.1% YoY. Both measures are seen at 0.3% MoM. Markets are somewhat positioning for a slightly hotter-than-expected CPI reading, given strong labor market data for November and a higher-than-expected PPI reading. On the other hand, CPI inflation includes a number of items that are less dependent on changes in producers' inflation therefore there is a chance for a downside surprise in today's US inflation data.

Used car prices drop significantly

Manheim index shows that prices of used cars continue to drop significantly. Source: Bloomberg

Manheim index shows that prices of used cars continue to drop significantly. Source: Bloomberg

Food prices no longer increase

UN food price index dropped recently, a development that is yet to be seen in US inflation data. Source: Bloomberg

UN food price index dropped recently, a development that is yet to be seen in US inflation data. Source: Bloomberg

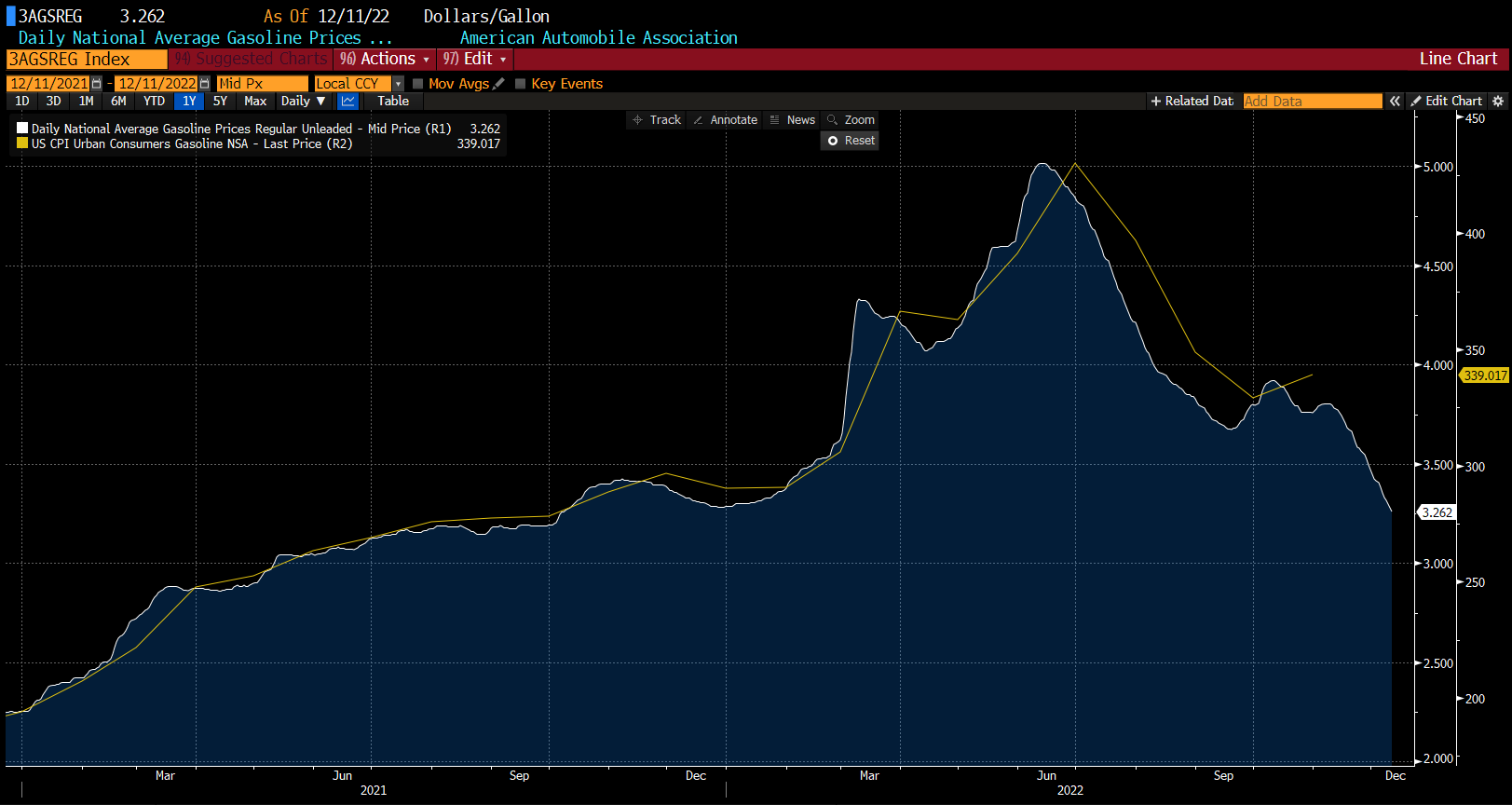

Cheaper fuel!

US gasoline prices continue to drop towards $3 per gallon. Prices dropped around 7.5% in November alone and are now trading at the lowest level in a year. Source: Bloomberg

US gasoline prices continue to drop towards $3 per gallon. Prices dropped around 7.5% in November alone and are now trading at the lowest level in a year. Source: Bloomberg

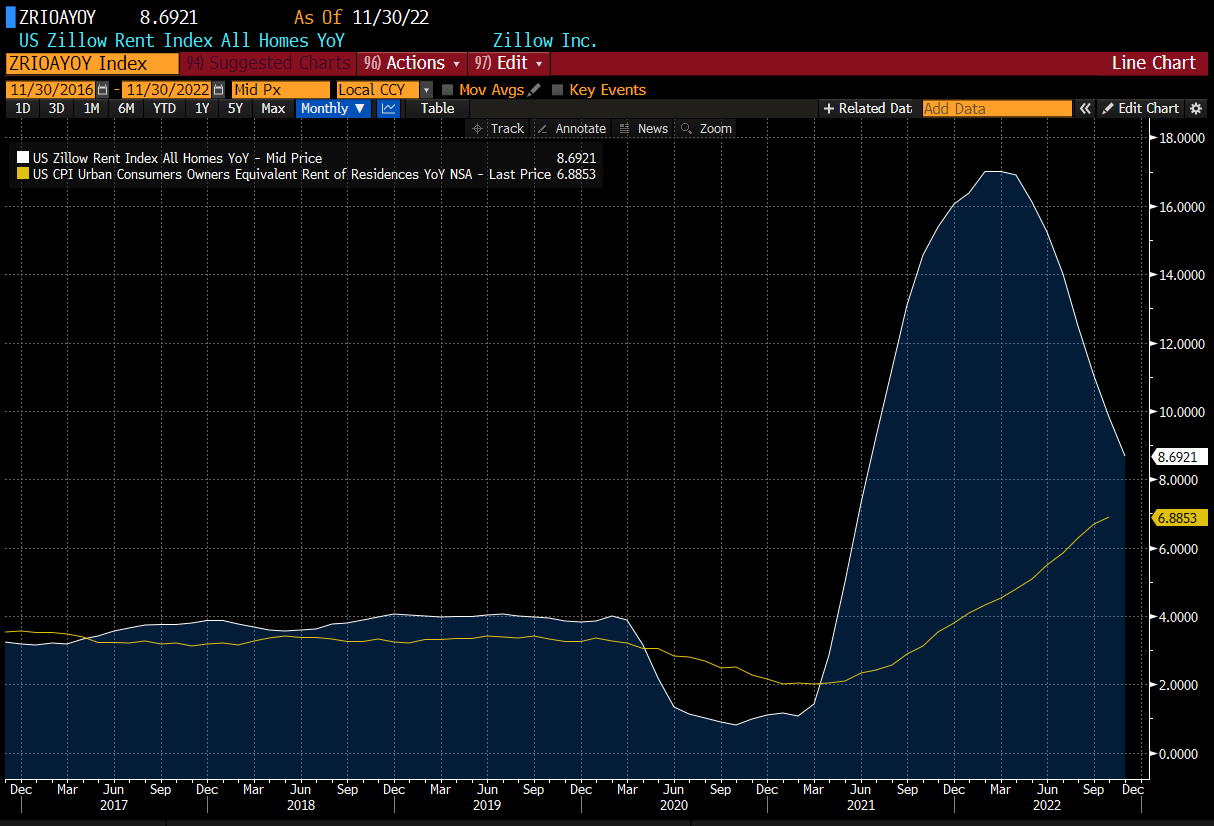

Rental price increases start to ease as well

According to Zillow Research, increases in rental prices start to decelerated and it should be noted that rents have a big impact on CPI readings. As such, there is a chance for rents to start to negatively contribute to inflation. Source: Bloomberg

According to Zillow Research, increases in rental prices start to decelerated and it should be noted that rents have a big impact on CPI readings. As such, there is a chance for rents to start to negatively contribute to inflation. Source: Bloomberg

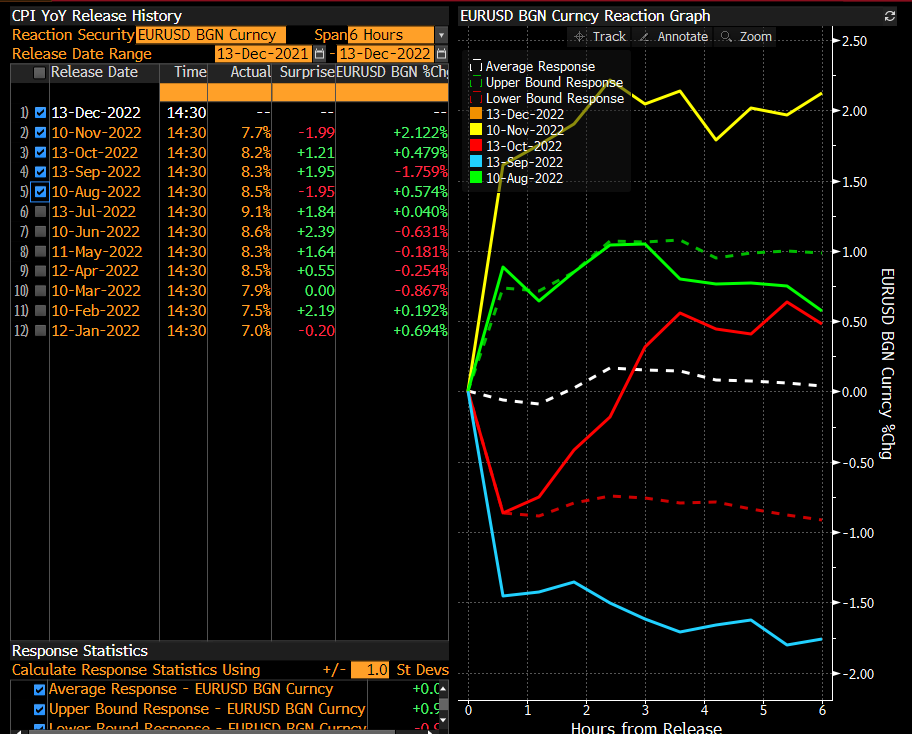

How will markets react?

It should be noted that US CPI showed negative surprises in November (data for October) and in August (data for July). EURUSD gained quite significantly following those readings. As such, a downside surprise in US CPI data today could see USD weaken and EURUSD gain. Also, indices from Wall Street should benefit in such a scenario. On the other hand, should we see a higher-than-expected reading, volatility may remain elevated ahead of FOMC meeting as uncertainty would increase as well.

EURUSD reactions to latest US CPI data releases. Source: Bloomberg

EURUSD reactions to latest US CPI data releases. Source: Bloomberg

EURUSD continues to trade below 38.2% retracement of the latest major downward impulse. Should bulls manage to break above this level and stay there in the aftermath of Fed decision, it would be a strong signal that trend on the main currency pair is about to reverse. Source: xStation5

EURUSD continues to trade below 38.2% retracement of the latest major downward impulse. Should bulls manage to break above this level and stay there in the aftermath of Fed decision, it would be a strong signal that trend on the main currency pair is about to reverse. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

BREAKING: Pound frozen after lower-than-expected GDP data from UK 🇬🇧 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.