Monetary policy decision from the European Central Bank (1:15 pm BST) is a key event of the day. Bank is expected to deliver a 75 basis point rate hike, following a 50 basis point rate move in July. This would put the deposit rate at 0.75% - the highest level since October 2011. Inflation in the euro area exceeded 9% according to flash estimates for August, increasing pressure on the ECB to tighten policy quicker.

Such a big rate move from a usually dovish ECB may send an important message to the markets, even if it is almost 100% priced-in. EURUSD has been struggling as of late on the back of two reasons. Firstly, the common currency is underperforming amid a spike in energy costs that is threatening to push the euro area economy into recession. Secondly, pick-up in US yields is providing support for the US dollar. Having said that, a continuation of the ongoing drop in prices of energy commodities and potential drop in US yields, for example in case Fed slows tightening process, may be a chance for EUR.

Apart from that decision, press conference of ECB President Lagarde at 1:45 pm BST will also be in focus. Traders will look for hints on future rate moves and balance sheet reduction. EURUSD traders should also keep in mind that the pair may be more volatile at 2:00 pm BST during a speech from Fed Chair Powell.

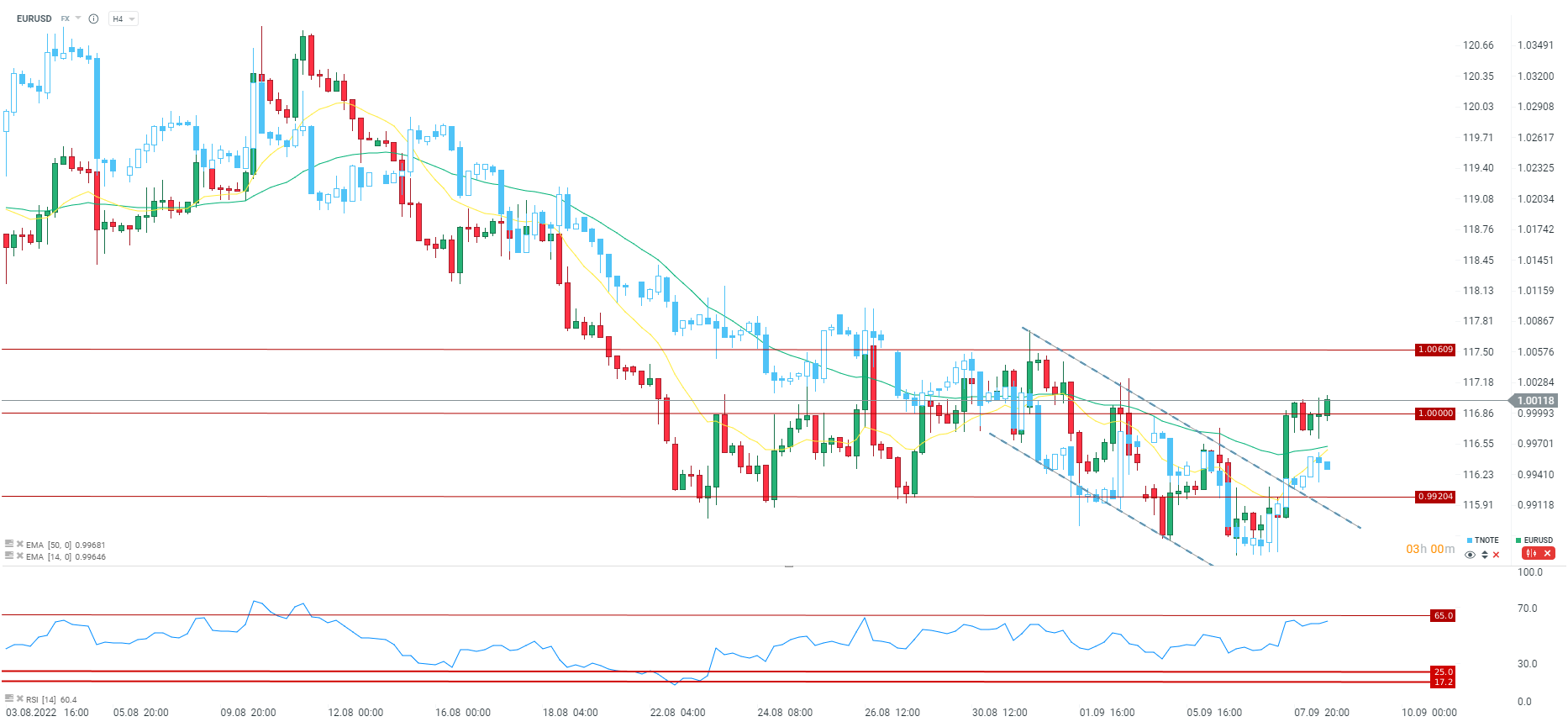

EURUSD is hovering around 1.00 handle today. The pair could benefit from a hawkish ECB guidance but the bank warned that it will make decision on meeting-by-meeting basis therefore any clear forward guidance may not be offered. If ECB fails to sound hawkish (or hikes by 50 bp) may see the pair resume recent slide. Source: xStation5

EURUSD is hovering around 1.00 handle today. The pair could benefit from a hawkish ECB guidance but the bank warned that it will make decision on meeting-by-meeting basis therefore any clear forward guidance may not be offered. If ECB fails to sound hawkish (or hikes by 50 bp) may see the pair resume recent slide. Source: xStation5

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily Summary - Powerful NFP report could delay Fed rate cuts

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.