- Bankers saw only limited progress in the decline in core inflation after excluding housing inflation

- Bankers noted that further policy tightening would be appropriate if data indicated insufficient progress toward the inflation target

- Gold continues declines after the release of the minutes, the dollar gains slightly, stock indices do not react to the report

As can be seen from the minutes of the latest FOMC meeting released at 20:00, bankers unanimously agreed that keeping interest rates unchanged is advisable at this stage of the cycle. On the other hand, all bankers said that rates should be kept at higher levels for a longer period of time and that further decisions need to be taken carefully. Keeping rates at the current level will help bankers gain time to learn new macro data, which will play a key role in further decisions. If the inflation-fighting process is not satisfactory, bankers have declared their willingness to raise interest rates further (especially in the context of bringing down core inflation without the housing inflation).

"Risks to the inflation outlook were seen as tilted upwards, given the possibility that inflation could prove more persistent than expected or that there could be further adverse shocks to supply conditions." - the Minutes added. It is worth mentioning that at the time of the decision, the CPI inflation reading for October, which came in well below expectations, was unknown.

Following the publication of the Minutes, the money market valuation of the further path of interest rates remained unchanged. The first full cut is priced for May 2024.

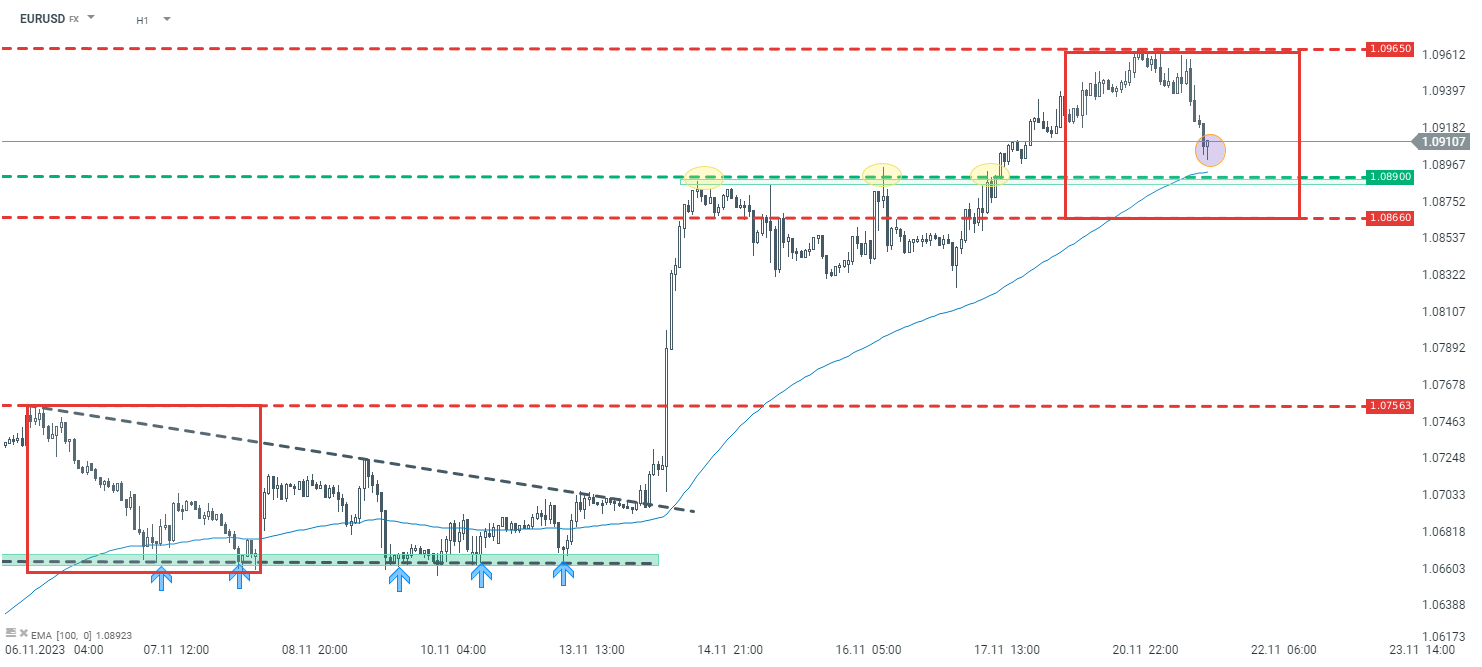

Looking technically on the EURUSD, quotes, are in retreat today. Nevertheless, just after 7:00 pm GMT no major movement is seen. Shortly after the publication, the price moved downwards, but losses were quickly erased. Nevertheless, if the downward sentiment seen since the morning is maintained, a test of support at 1.0890 or 1.0866 is not excluded.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.