EURUSD continues pullback triggered by yesterday's higher-than-expected US CPI reading for March. The pair is down 0.3% on the day and trades at the lowest level in almost 2 months. The main currency pair is now testing the support zone ranging around 1.0700 mark.

- Current plunge on EURUSD reflects growing concerns about the scale of Fed policy easing in 2024. Comments from the Fed's Barkin suggest that the fourth, higher-than-forecast CPI reading is increasing central bankers' uncertainty.

- Looking at today's PPI data, we see that while the headline reading turned out slightly lower than expected, the core PPI turned out higher than suggested by forecasts and significantly higher than in February. Also, initial jobless claims came in lower than expected

- RBC Capital expects only one 25 basis point Fed rate cut this year, in December. Previous forecast called for 75 basis points of easing

- OPEC raised its forecast for US GDP growth to 2.1% in 2024 today, from the previous 1.9%

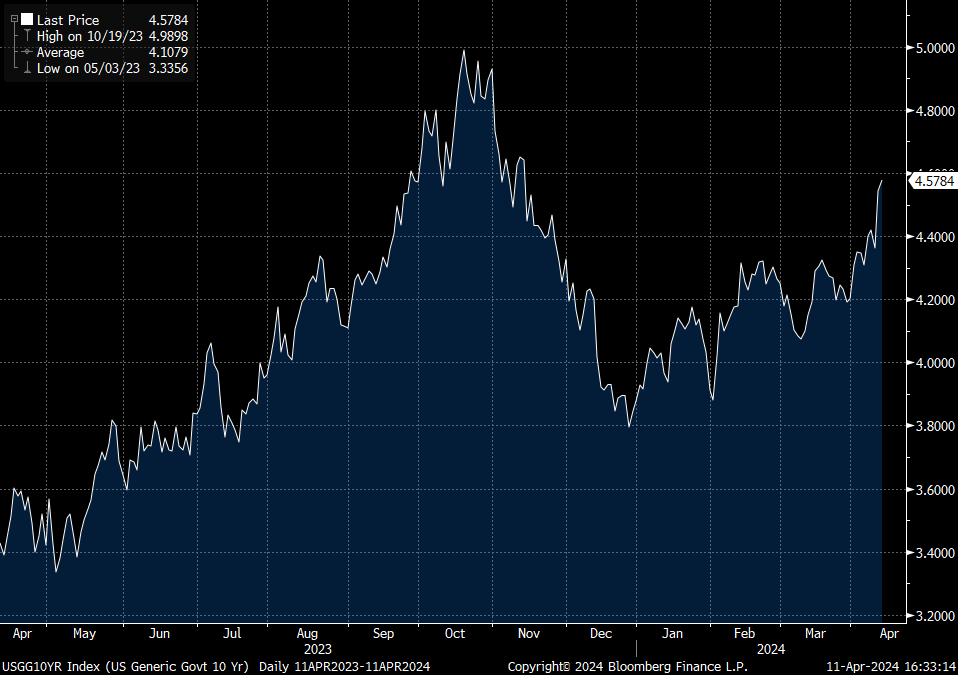

- Yields on 10-year US Treasury bonds have risen to levels not seen since the turn of October and November 2023, when the EURUSD was trading around 1.062

10-year US yield climbed to the highest level since mid-Novemebr 2023. Source: Bloomberg Finance LP

10-year US yield climbed to the highest level since mid-Novemebr 2023. Source: Bloomberg Finance LP

Hawkish comments from Fed Barking

- After rather hawkish remarks from Williams, even more hawkish comments came from Thomas Barkin from Richmond Fed. He conveyed that the inflation data "Raise questions about whether we are seeing a change in the right direction." Barkin emphasized that "We are not where we should be" although he expressed confidence that the Fed is acting appropriately so far. In his view, however, time is needed to assess the current trajectory of price pressures

- According to Barkin, the latest data looks similar to the one from end of 2023, with falling goods prices, while housing is effectively moving sideways, and services are increasing. The recent readings did not increase the belief that deflation is spreading in the economy. IMF Managing Director Georgieva highlighted the strength of the US economy and pointed out that a persistently strong dollar could become a global financial problem. If higher interest rates in the US persist for a longer period, this could become a cause for concern

EURUSD (D1 interval)

EURUSD is deepening the ongoing slide and drops further below 200-session moving average. Local lows from mid-February 2024 in the 1.0700 area are being tested at press time.

Source: xStation5

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

Chart of the Day: EURUSD after data from Europe and weaker US labor market

Daily summary: Red dominates on both sides of Atlantic

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.