Slightly higher inflation, strong rebound in claims

As expected, CPI inflation for August rose to 2.9% y/y from 2.7% y/y. Core inflation remained elevated at 3.1% y/y. The only surprise was a slightly higher monthly CPI, which rose 0.4% m/m versus expectations of 0.3% m/m. It is worth noting, however, that the m/m dynamic was twice as high as in July.

Core monthly inflation came in at 0.3% m/m, in line with expectations. On the other hand, we are seeing a very strong increase in jobless claims. This shows a growing divergence between the Fed’s mandates — labor market weakness and elevated inflation. What do the report details show and what could this mean for the Fed? And should Wall Street be worried?

Main drivers of inflation

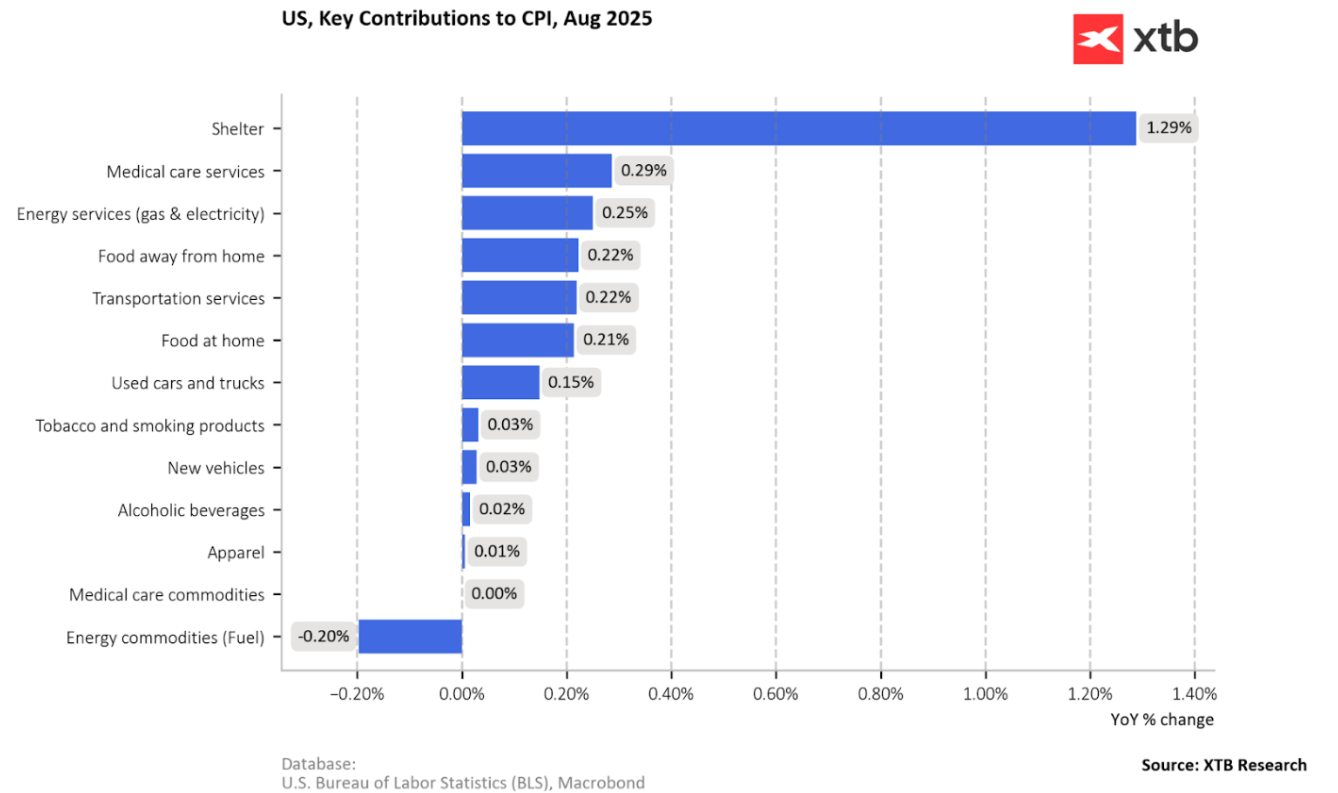

- Housing (shelter) was the largest contributor to the monthly increase, rising 0.4%.

- Transportation services were the key driver of so-called SuperCore CPI (well above 3% y/y and just over 0.3% m/m); airline fares jumped 5.9%.

- Energy rose 0.7% m/m, with gasoline up 1.9%. Food prices increased 0.5% m/m.

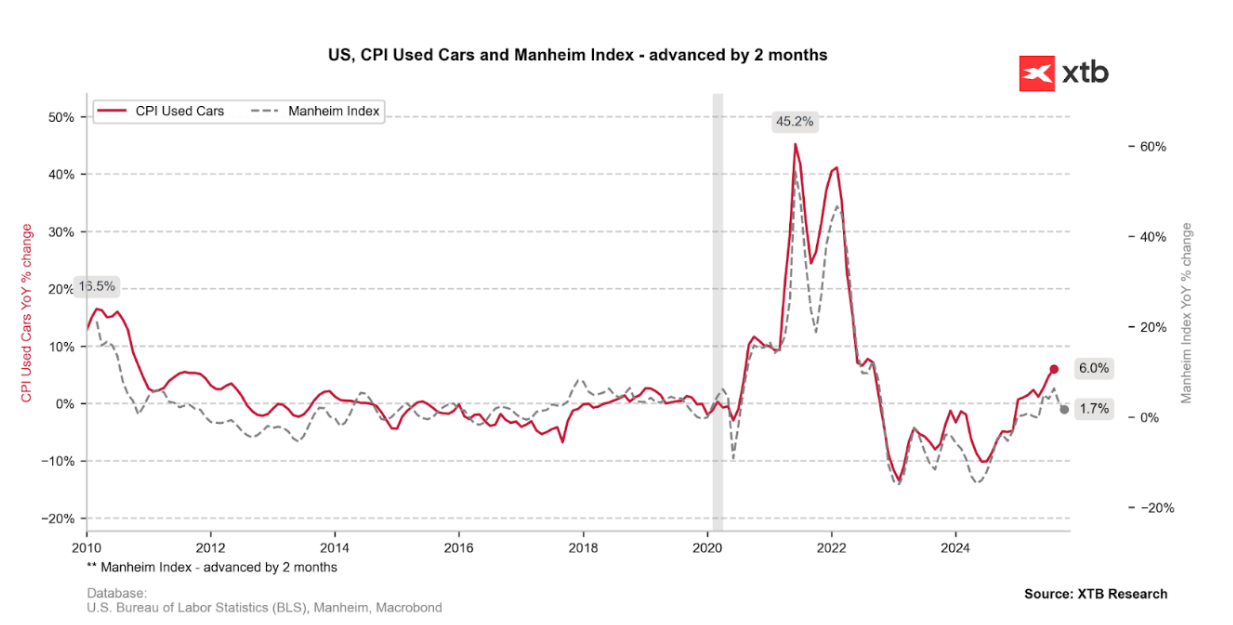

- Cars have started to rise in price again. New vehicle prices rose +0.3%, used cars +1.0%, and auto repairs as much as 2.4%.

Tariffs vs. services impact

The key point is that the inflation increase came mainly from services, not from tariffs introduced by the Trump administration.

- Prices in import-exposed categories showed mixed signals, with no clear acceleration linked to tariffs.

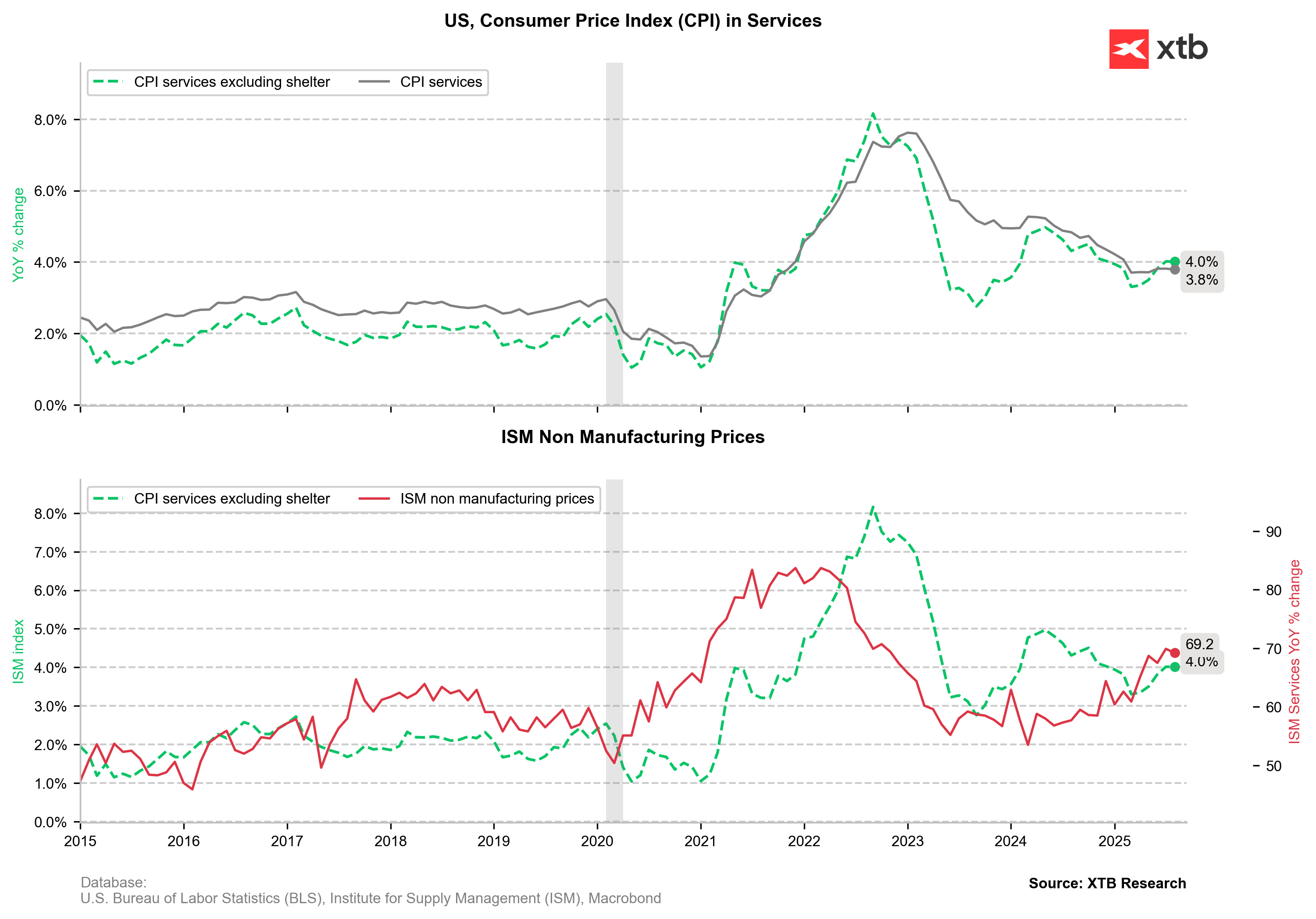

- SuperCore CPI (services excluding shelter) slowed slightly to 3.52% y/y, suggesting price pressures are not as intense as they might appear. Still, far from the target.

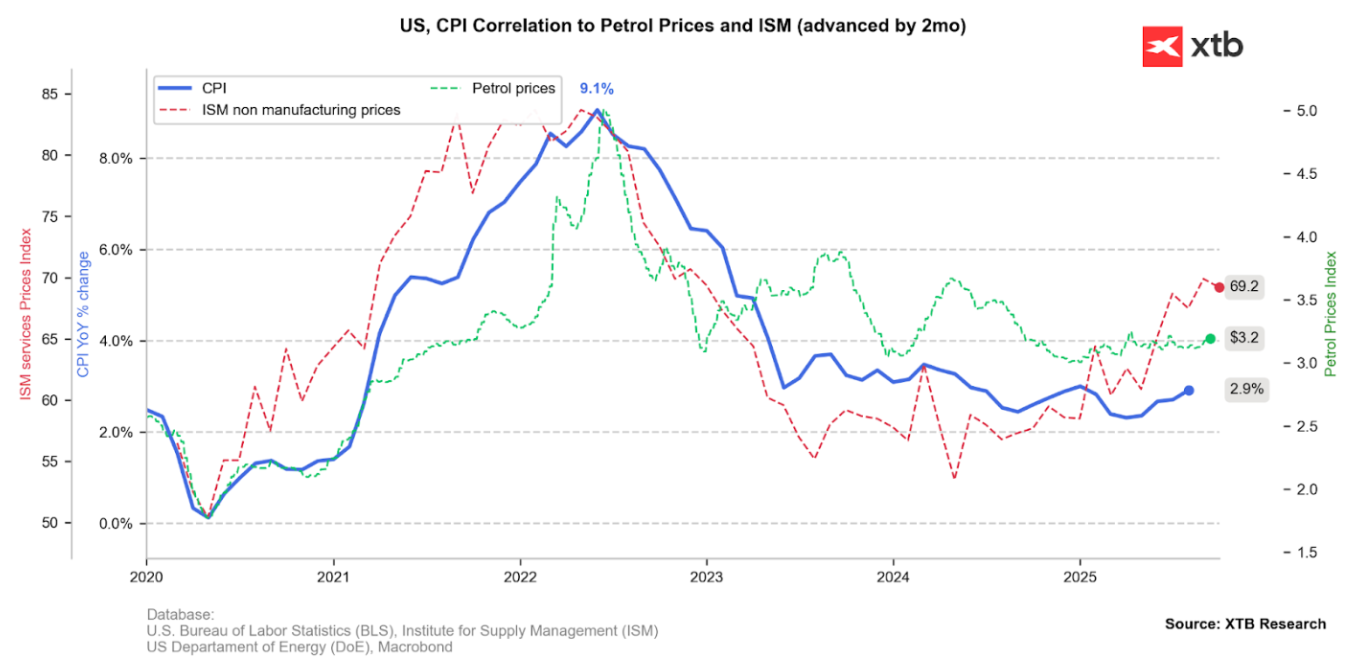

These data confirm that the Fed is likely to begin easing monetary policy but will remain cautious in the pace of cuts due to persistent inflation well above the 2% target. Services remain sticky, and with any potential jump in gasoline prices, the picture would look much worse.

Key charts

CPI inflation rebounds as expected to 2.9% y/y. As leading indicators show, the biggest problem in the U.S. remains rising service prices. This is clearly illustrated by the price subindex of the ISM services survey. Source: Bloomberg Finance LP, XTB

Looking at the main components, rental inflation remains the largest contributor. However, contributions tied to rising service costs are growing steadily. The main driver of inflation is not tariffs but services. Medical, energy, transport, and food costs are rising strongly (with food partly impacted by tariffs). Source: Bloomberg Finance LP, XTB

Food prices in the U.S. are rising faster than suggested by the FAO food price index, partly linked to tariffs. Source: Bloomberg Finance LP, XTB

Used car inflation is rising — new cars are subject to tariffs. Nonetheless, the Manheim index suggests this dynamic should slow in the coming months. Source: Bloomberg Finance LP, XTB

Service inflation remains high, though stabilizing at elevated levels. Source: Bloomberg Finance LP, XTB

High inflation is a problem, but labor market weakness is an even bigger one

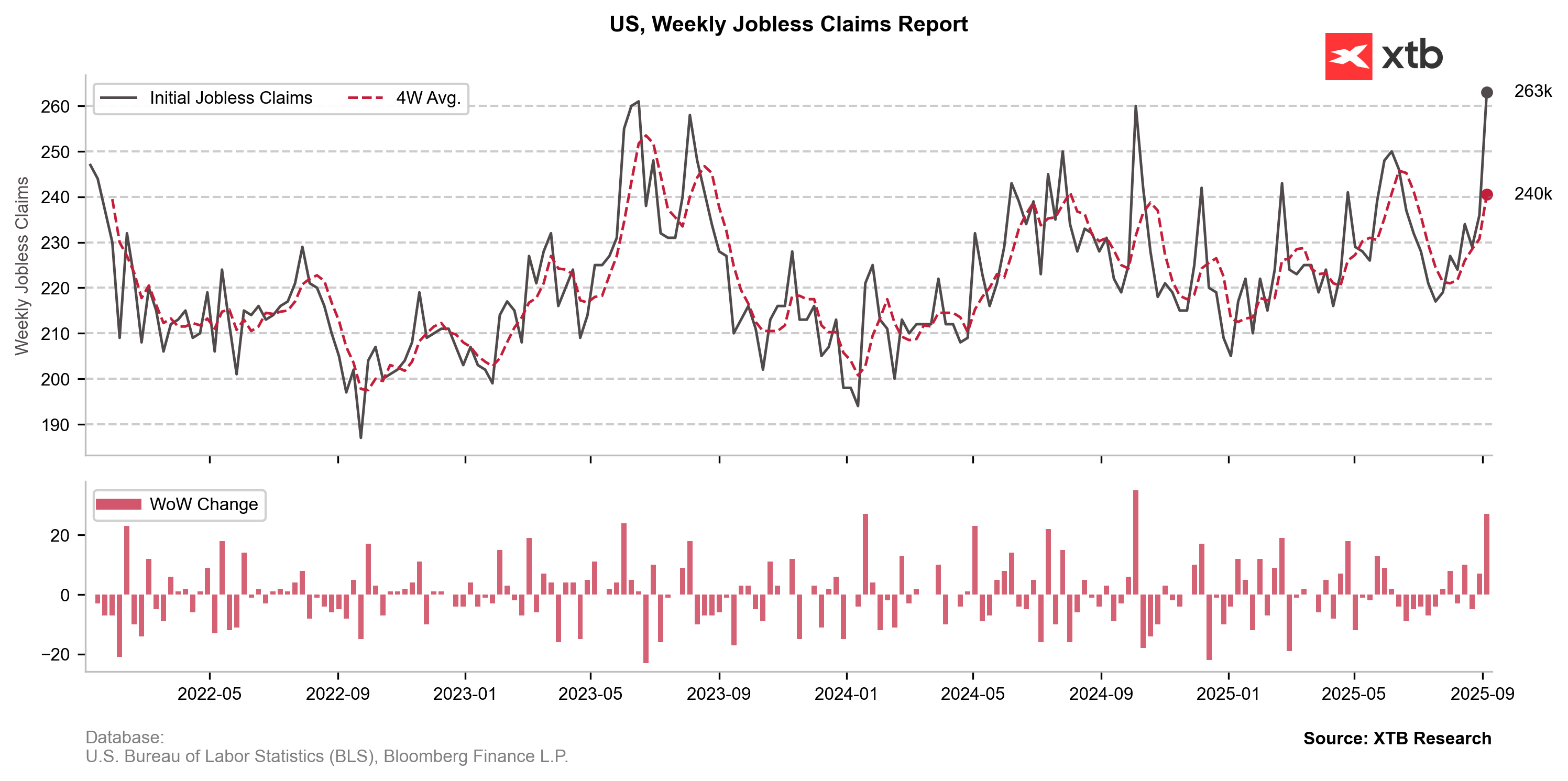

Initial jobless claims are rising to their highest levels in 4 years, though in 2023 and 2024 we saw levels above 250k. The biggest increase is linked to a strong rise in claims in Texas. While not yet a cause for panic, claims around 300k have usually been a recession signal.

A huge jump in initial jobless claims, with the level now the highest since 2021. Source: Bloomberg Finance LP, XTB

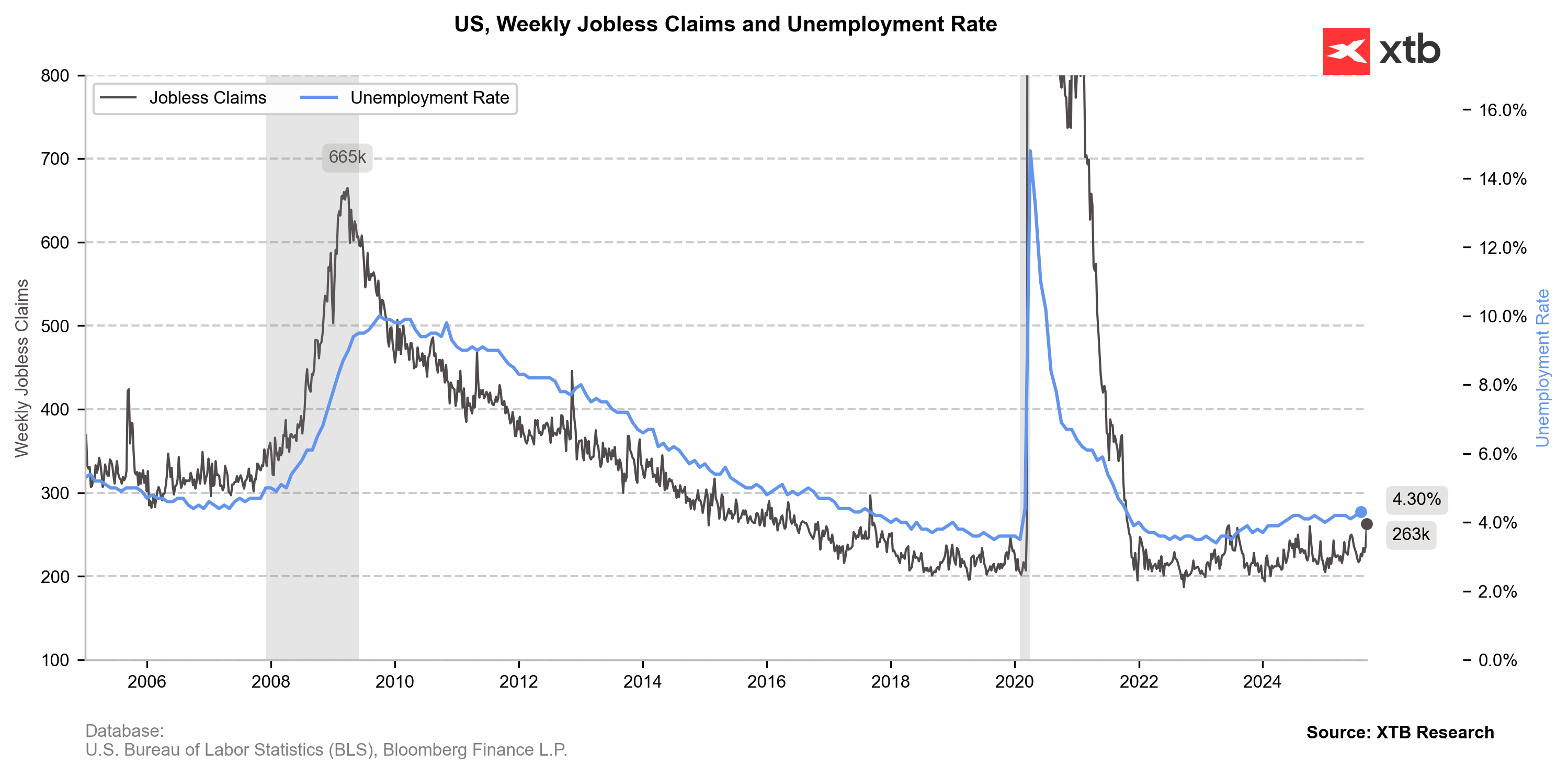

If this is not a one-off, the sharp rise in claims may suggest an uptick in the unemployment rate. Source: Bloomberg Finance LP, XTB

Fed will cut rates

It seems the Fed should not opt for a larger 50bp cut, given still-elevated inflation risks. However, it is clear that tariffs — the main source of price uncertainty — have had limited impact on U.S. prices. Therefore, the Fed will cut rates, but likely without pre-committing to a full cycle, remaining very data-dependent.

Economic Calendar: US Data Distorted by Government Shutdown

BREAKING: ISM data above expectations. EUR/USD under pressure

Economic calendar: Manufacturing PMI data in focus, Palantir earnings in the background💡

Economic calendar: markets await Trump’s official Fed chair nomination 🔎

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.