Fed Austen Goolsbee commented US economy. The US 2-year/10-year Treasury yield curve turns positive today, for the first time since July 2022.

- The Fed will respond to conditions. If the economy deteriorates, the Fed will fix it.

- The stock market has a lot more volatility than the Fed. It seems like there is a lot going on in the world, which makes things a little more complicated.

- On the other side, the GDP number was a bit stronger than expected. Economic growth continues at a steady level.

- That said, there are cautionary indicators in other data, such as business defaults.

- We expected some weakness in manufacturing due to pandemic effects.

- We must be a little careful overconcluding about the jobs report. The manufacturing sector is a little complicated.

- The Fed does need to be forward-looking in making decisions.

- The jobs numbers were weaker than expected but is not looking yet like a recession.

- You only want to be that restrictive if there is fear of overheating. The data does not look like the economy is overheating.

- If the stock market moves gives the Fed indication over a longer-arc that we are looking at deceleration in growth, we should react to that.

- If jobs data is a longer-term sign, we should then respond to what those forces are.

- The Fed's job is not to react to one month's numbers on jobs.

- We can't blow through normal on jobs. If we do, we'll have to react more robustly.

- The Fed can wait for more data before the September meeting.

- We should respond to conditions on the broad through line; inflation is way down and employment is at a relatively decent spot.

- If we are not overheating, we should not tighten our restrictiveness in real terms.

- You only want to be there for as long as you have to. We are restrictive in real terms at the highest in many decades.

- There is some weakness in the jobs market, we have to pay attention to that. I have been saying for some time we are in a balanced risk posture.

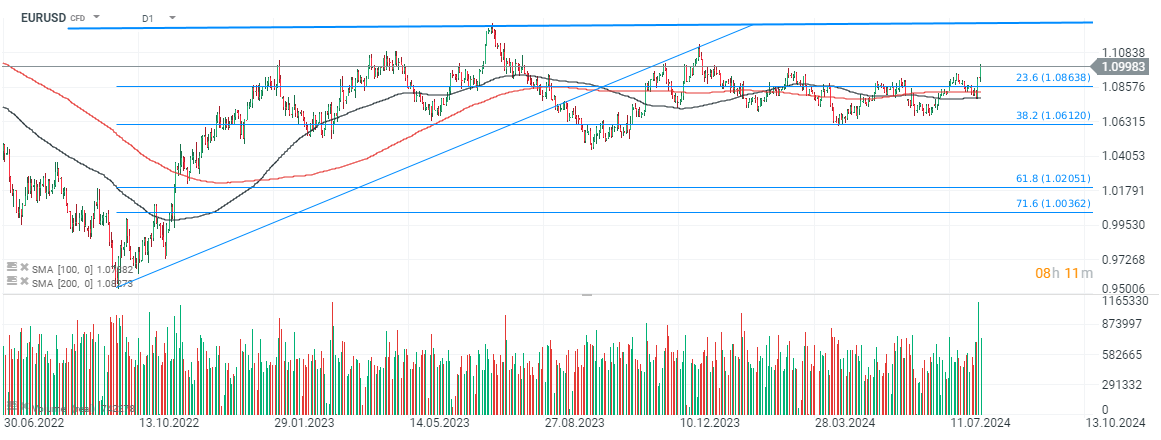

EURUSD (D1 interval)

Eurodollar gains more than 0.6% today and the pair is one step closer to the significant, psychologically resistance zone at 1.10.

Source: xStation5

Source: xStation5

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.