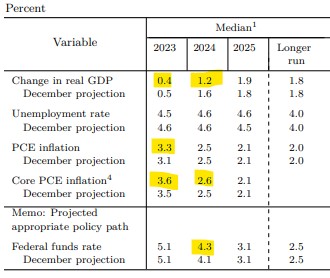

- The median for 2023 remains unchanged at 5.1%. This is quite a change, given the stance from the Fed just 2 weeks ago.

- Projection for 2024 marginally up, but still points to 3 cuts next year

The slight change in rate projections is positive news for the stock market. The Fed is giving itself room for one more hike, which is a much lower ceiling than the market might have expected just 2 weeks ago. Source: Fed, ZeroHedge

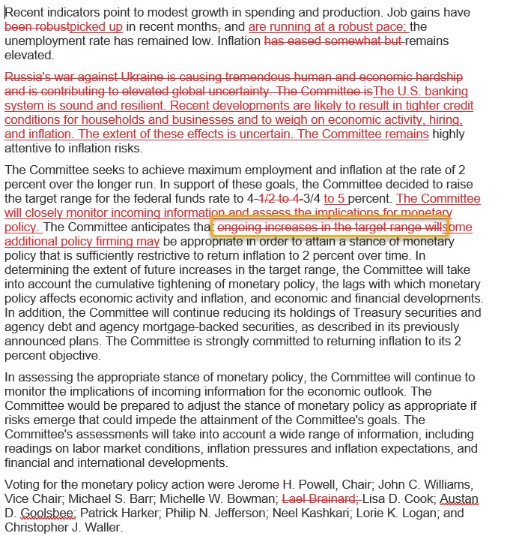

- The Fed referred to recent problems in the banking market, but indicates that the system is robust and resilient

- Nonetheless, this will affect slightly heavier credit conditions, which could theoretically help inflation to fall further

- The long-term impact is uncertain

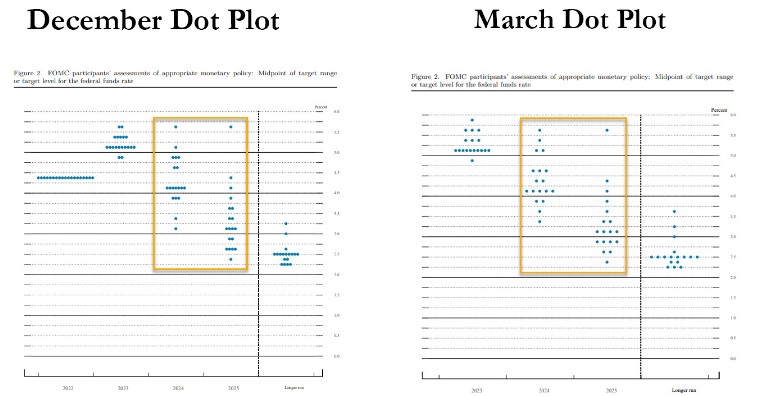

- The Fed is softening its stance on further increases. Here it indicates that further policy tightening should be assured. Abandonment of the statement on "further increases"

The Fed announcement softened. So did the interest rate projections. Source: Fed, ZeroHedge

- Projection for 2024 rate slightly upwards, but still points to 75bp cuts

- Slightly higher inflation projections, but for 2023 and 2024 raised by just 0.1 pp

- Lower growth expectations for the current year and markedly lower for the following year

- Unemployment rate expectations marginally lower for this year

Source: Fed

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.