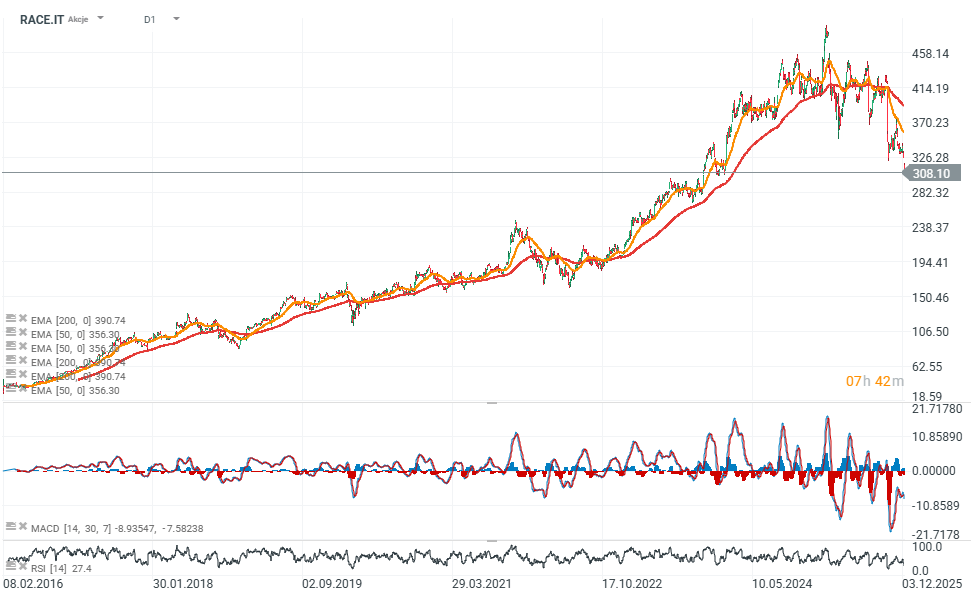

Ferrari (RACE.IT) shares dropped to their lowest level in nearly two years (23 months), falling to €312.90 after yet another analyst downgrade. Oddo BHF cut its rating for the second time this week, lowering it from Outperform to Neutral and reducing the price target from €430 to €340. The downgrade is partly due to a slower-than-expected rollout of the F80 model; the 2026 delivery forecast was reduced from 250 to 200 units. Oddo also lowered its 2026 EBIT estimate by 3.4%, indicating that results may remain below consensus.

- Earlier, Morgan Stanley also downgraded Ferrari, reducing its price target to $367 and pointing to limited volume growth through 2030. According to analysts, the strategy of protecting brand exclusivity is positive but implies more moderate short-term growth.

- Ferrari’s revenue growth is expected to remain below 5% over the next three quarters, mainly due to slower shipments and delays in new launches. Morgan Stanley also highlighted uncertainty surrounding the upcoming electric model and ongoing concerns about residual values, which are currently capping the company’s valuation multiples.

- Since the beginning of the year, Ferrari shares are down around 25%; earnings forecasts have been revised lower, and valuation multiples have corrected from last year’s highs.

- Jefferies analysts also lowered Ferrari’s price target from €345 to €310, maintaining a Hold rating as the stock trades near its 52-week low after a 20% decline over the past six months.

- The downgrade reflects revised 2026 forecasts, with Jefferies accounting for Ferrari’s steady pace of new model introductions planned for next year.

- The firm expects these launches to temporarily reduce vehicle shipments and put pressure on margins due to rising depreciation and amortization expenses. The reduced price target reflects valuation headwinds that may persist as consensus estimates continue to be revised downward.

- Jefferies now forecasts 6.7% growth and €9.32 EPS in 2026, below the market consensus of 8.2% growth and €10.05 EPS. Ferrari recently secured a €350 million revolving credit facility for general corporate and working capital purposes. The facility was arranged with a consortium of twelve banks.

Analyst sentiment toward Ferrari remains mixed, with current recommendations as follows:

-

Morgan Stanley downgraded the stock to Equalweight, citing limited volume growth until 2030.

-

UBS raised its price target to $563 and maintained a Buy rating, arguing that Ferrari’s growth targets are conservative.

-

Goldman Sachs initiated coverage with a Buy rating, expecting Ferrari to outperform consensus in 2026 and 2027 thanks to rising average selling prices.

-

Morgan Stanley also initiated coverage of Ferrari’s European listing with an Equalweight rating and a €367 price target.

Source: xStation5

Paramount Skydance shares under pressure after S&P warning

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

Nvidia Faces New H200 Limits in China

US Open: Wall Street in Blood

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.