First Republic (FRC.US) shares are losing more than 30% today although they have already rebounded nearly 20% from their session lows. They found themselves at levels seen in the fall of 2016. Investors have become concerned about the stability of bank deposits in an environment of rising interest rates.

- First Republic primarily serves business owners and more affluent customers, who, according to The Wall Street Journal's findings, are beginning to withdraw their deposits from bank accounts in search of higher interest rates on Treasury bonds and other products that guarantee fixed income;

- First Republic's deposits rose 13% in 2022 from the previous year, but the lender had to pay more for them, which ultimately reduced its yield ratio;

- With the prospect of a growing exodus of customers, who may be further spooked by current media reports, the bank's shares are trading at record lows throughout the bank's history;

- The risk of customer outflows from banks does not only affect First Republic - it is mainly smaller banks that may be most affected.

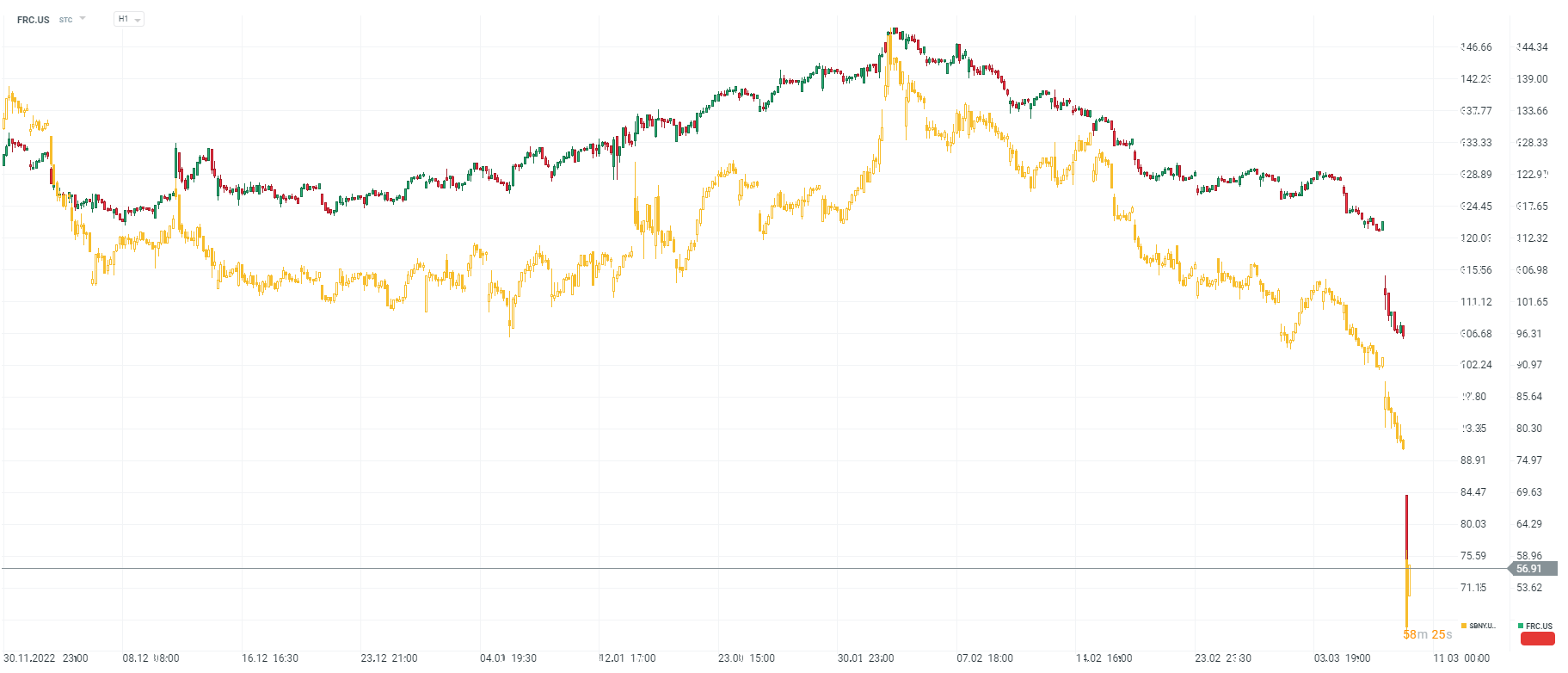

The most losing stocks on Wall Street today - Signature Bank and First Republic. Source: xStation5

First Republic's (FRC.US) share price rose after a more than 50% crash at the opening of the session and is trying to hold above the 71.6 Fiboancci retracement of the upward wave started in 2011. Source: xStation5

First Republic's (FRC.US) share price rose after a more than 50% crash at the opening of the session and is trying to hold above the 71.6 Fiboancci retracement of the upward wave started in 2011. Source: xStation5

Although yesterday's report indicated the healthy financial health of Signature Bank (SBNY.US), the bank is trading at record highs and retreating to levels not seen since 2017. Estimates show that the bank is at the 6th highest unrealized loss of a bond portfolio held by US banks. The bond portfolio may include government bonds, corporation bonds and mortgage-backed securities.

First Republic Bank ranked last on the list signaling a relatively strong balance sheet, but the sharp drop in shares indicates that the bank could potentially have other internal problems not included in the metric. Source: Bloomberg

Shares of First Republic and Signature Bank (SBNY.US,yellow chart). Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.