Big news hit the markets yesterday after the close of the Wall Street session. Fitch Ratings announced a downgrade to US credit rating - from AAA to AA+. This did not come entirely out of the blue as Fitch put the US economy on negative watch back in May, citing debt ceiling disagreements and overall deteriorating fiscal situation as a reason. Nevertheless, the move is somewhat puzzling as debt ceiling agreement has been ultimately reached and US default was avoided.

This is important especially for bonds as some funds are required to hold only AAA-rated bonds, meaning that downgrade could trigger a sell-off on US Treasury market. However, Fitch is not the only major ratings agency and for a bigger sell-off to be triggered on bond markets, two others would also likely need to downgrade (S&P and Moody's). However, S&P has already downgraded US credit from top-tier rating back in 2011 and has not upgraded it since.

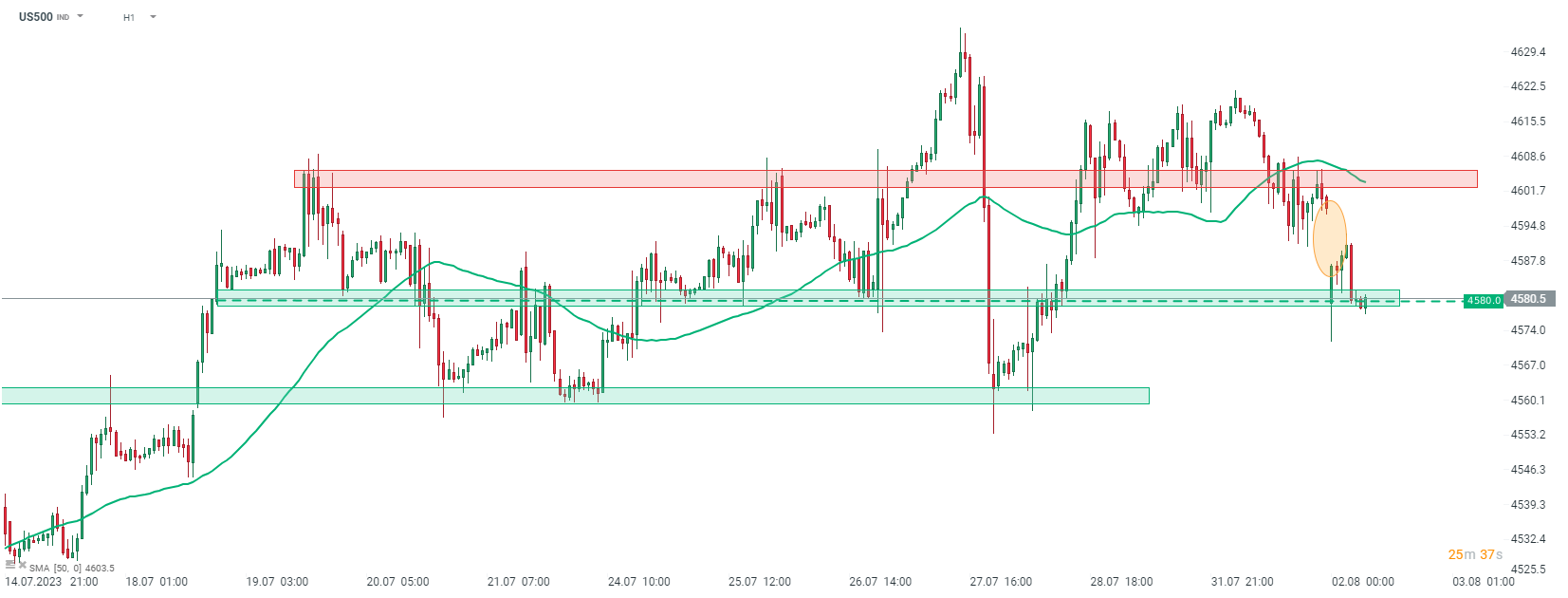

Market reaction has been rather subdued. EURUSD jumped higher and climbed above the 1.10 mark but has since given back some gains. USDJPY pulled back and moved back below the 143.00 mark while S&P 500 futures (US500) opened overnight with an around 0.4% bearish price gap. We have also observed increased safe haven flows into gold… and Treasuries, following Fitch downgrade.

US500 gapped lower following Fitch downgrade but bears have not yet managed to break below the 4,580 pts support zone. Source: xStation5

US500 gapped lower following Fitch downgrade but bears have not yet managed to break below the 4,580 pts support zone. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.