The decision of the FOMC will be taken today at 7pm CET/6pM GMT. While investors generally expect the Fed to hold rates unchanged, the post-meeting conference will be very important. Here’s the background.

The US economy remains surprisingly resilient

The tightening cycle in the US has been the most dynamic in four decades. Not only rates were lifted by more than 5pp in less than 18 months but the Fed also keeps conducting QT (a reverse of QE, aka money printing). One would expect this sort of tightening to potentially hurt growth but while it’s not all roses, the economy remains surprisingly resilient.

It’s not even about the 4.9% Q3 GDP as it was partly inflated by inventory building and government spending. A wide range of indicators shows the economy halted a downward trajectory and actually shows some signs of improvement. Let’s take a look at few examples:

- Retail sales in real terms picked up in September and nominal y/y growth stood at 8 months high of 3.8%

- Durable orders are close to record high and annual growth accelerated to 7.8%

- Unemployment rate inched up to 3.8% but it’s partly due to people returning to the labour market and weekly jobless claims stay low at just above 200k

- New job offers (JOLTS) actually rose again in September

- Consumer sentiment remains stable

- Activity surveys were recovering somewhat but the latest ISM manufacturing is a clear downside surprise – the only real stain on this picture

This is in a strong contrast to weakness in Europe and signs of slowdown in Asia and while it increases odds of a soft landing it also means less comfort for the Fed

Retail sales seems to be edging up following a period of stagnation. Source: XTB Research, Macrobond

Progress on inflation but risks remain

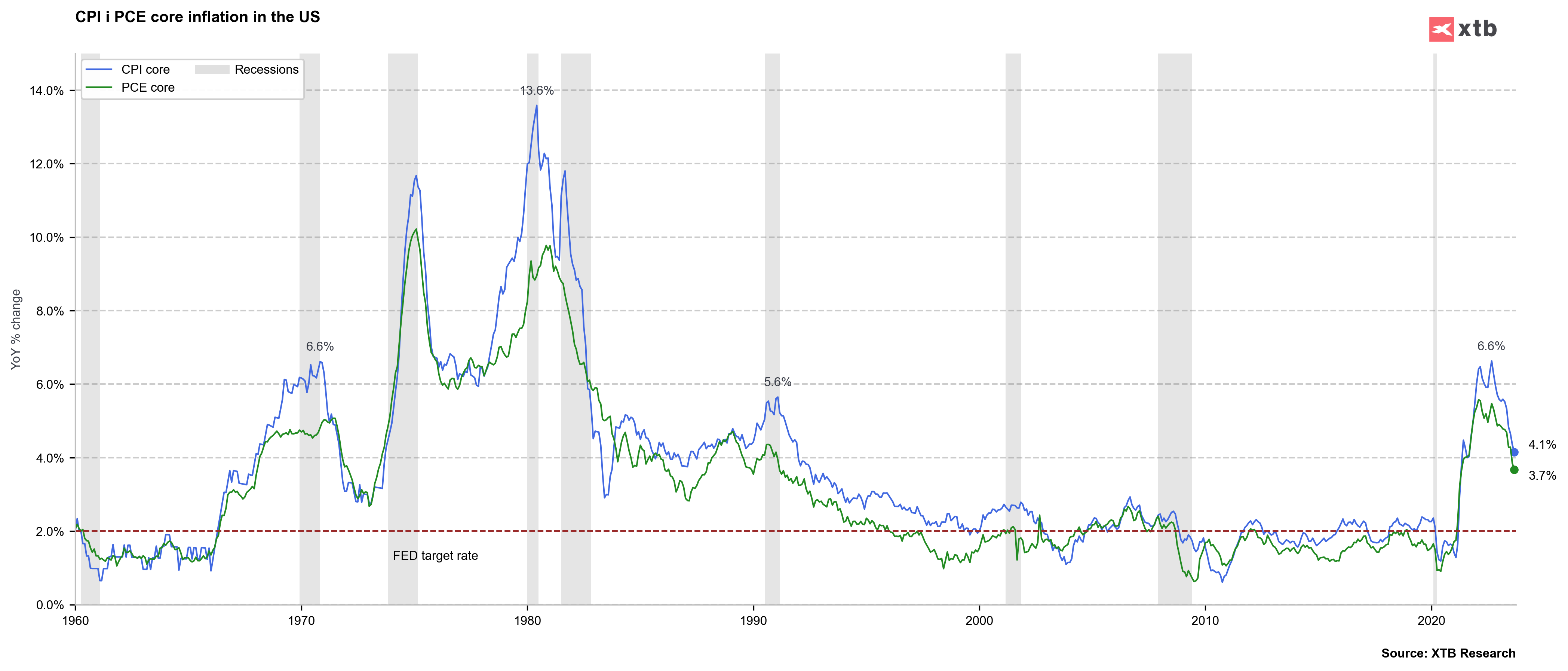

Inflation in the US has cooled considerably and is between 3.4 and 4.1% depending on the chosen (CPI/PCE) measure – less than a half from highs of 2022. Chances are that after some moderate statistical base related lift, inflation can cool down further in 2024, potentially even to the Fed’s target of 2%. But with such a strong economy, any new spark – say a further rise in OIL prices, could easily risk a second inflation wave. Just look at the University of Michigan latest survey where 1-year inflation expectations jumped to 4.2%. This is the risk that Chairman Powell pointed at over and over and it will affect the Fed policy.

Inflation outlook might be improving but risks remain. Source: XTB Research, Macrobond

Verdict: rates unchanged but hawkish Powell

One needs to give credit to the Fed for communicating their short term moves very transparently and Fed speakers turned more dovish (or less hawkish if you will) suggesting that barring some surprises the rates are unlikely to be increased again. Having said that markets would like to see rate cuts soon and we think Chairman Powell will want to fight that suggesting that if anything, rates could still go up. Therefore any joy of the end to tightening could be deflated during the post meeting conference.

Markets to watch

EURUSD

The pair has seen a correction attempt after a very decisive move down. Still this upward correction lacked momentum suggesting trend continuation and the EURUSD bears actually tried to end it even before the decision. A break lower could see the near-time test of 1.0450 with further levels much lower.

US500

The main US index is recovering following the third major leg down. This looks similar to the previous two recovery attempts and at least right now we are looking at the downward structure with impulse (down) moves much more dynamic. One needs to keep in mind that reactions to the FOMC can be very volatile and the final direction is sometimes only clear on the following day.

The main US index is recovering following the third major leg down. This looks similar to the previous two recovery attempts and at least right now we are looking at the downward structure with impulse (down) moves much more dynamic. One needs to keep in mind that reactions to the FOMC can be very volatile and the final direction is sometimes only clear on the following day.

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.