Ford Motor (F.US) recorded a strong decline in operating profit in 2Q24 despite an increase in sales. The main reason turned out to be higher-than-expected warranty costs, which particularly affected the company's largest segment, Ford Blue. This translated into an erosion of profitability and, as a result, a strong sell-off for the carmaker. The company is losing more than 13% in pre-opening trading.

Source: xStation

Source: xStation

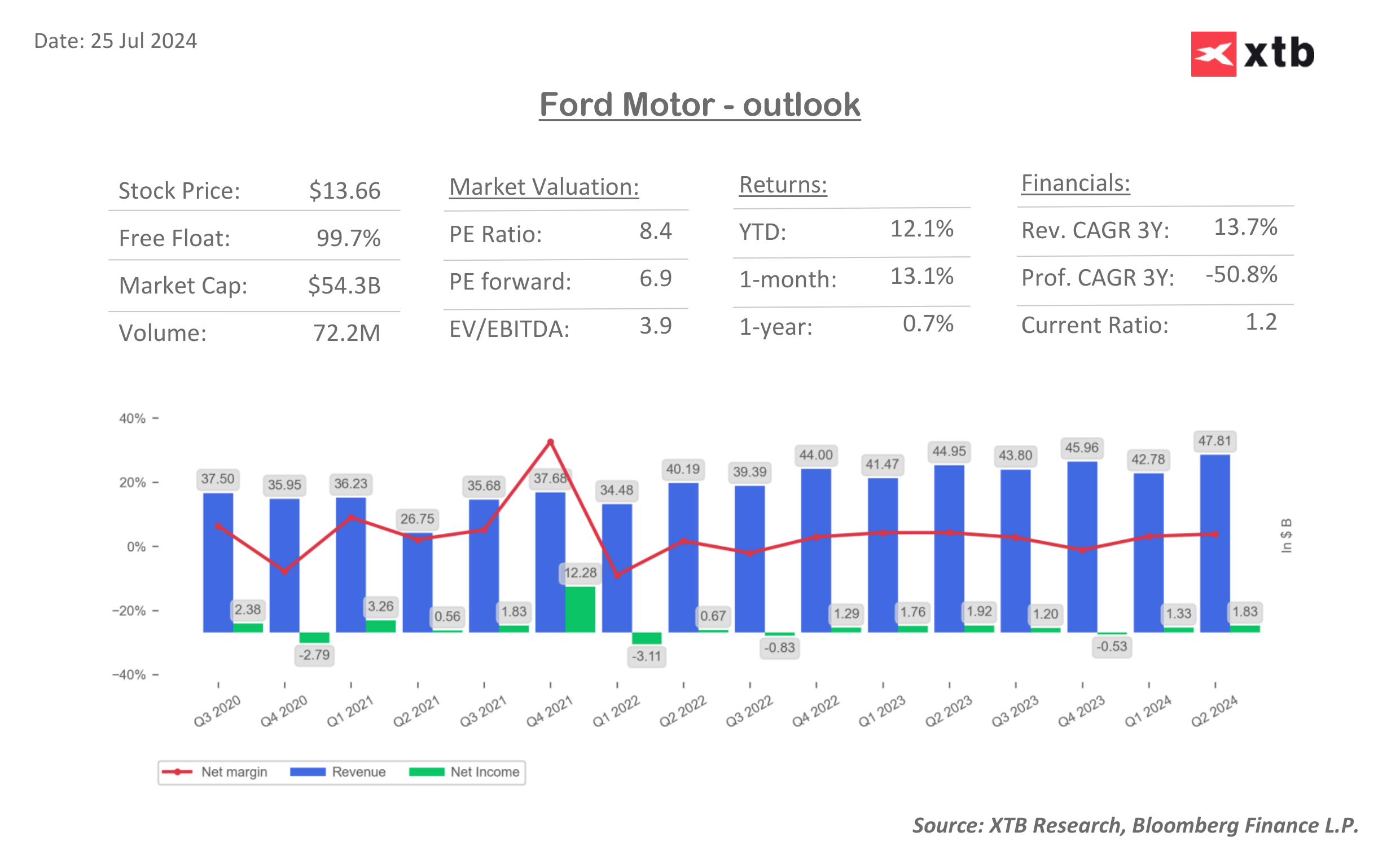

The company reported a 6.2% year-on-year increase in revenue to $47.8 billion. The strongest contributor to the growth was the Ford Pro segment, with sales of $17 billion, up 9% y/y. Ford Blue, a segment that consists of internal combustion engine cars, also posted a y/y increase to $26.7 billion (+7% y/y). In this case, however, sales were not connected with improved margins, as the company's EBIT in this segment fell to $1.17 billion (-50% y/y). Such a strong decline in profitability is due to large warranty costs, which are currently weighing most heavily on the company's profitability. On top of that, the electric car segment (Ford Model E) turned out to be much weaker than expected, both at the revenue level (-40% y/y) and at the margin level itself (the segment generated a loss of -$1.14 billion). This resulted in a final adjusted operating profit of $2.8 billion, down -26% y/y (against a forecast of $3.73 billion).

Source: XTB Research, Bloomberg Finance L.P.

A strong growth in warranty costs, a decline in sales in the electric car segment, along with the operating loss generated by the segment as a result of a tight EV market, contributed to surprisingly low adjusted earnings per share of only $0.47 (-35% y/y) in 2Q24 versus an estimate of $0.67.

2Q24 RESULTS

- Total revenue $47.8 billion, +6.2% y/y

- Ford Blue revenue $26.7 billion, est. $25.63 billion

- Ford Model e revenue $1.1 billion, est. $1.31 billion

- Ford Pro revenue $17.0 billion, est. $16.48 billion

- Adjusted EBIT $2.8 billion, -26% y/y, est. $3.73 billion

- Adjusted EBIT margin 5.8% vs. 8.4% y/y, est. 7.99%

- Ford Blue EBIT $1.17 billion, est. $2.43 billion

- Ford Model e EBIT loss: -$1.14 billion, est. loss -$1.38 billion

- Ford Pro EBIT $2.56 billion, est. $2.57 billion

- Adjusted EPS $0.47, est. $0.67

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.