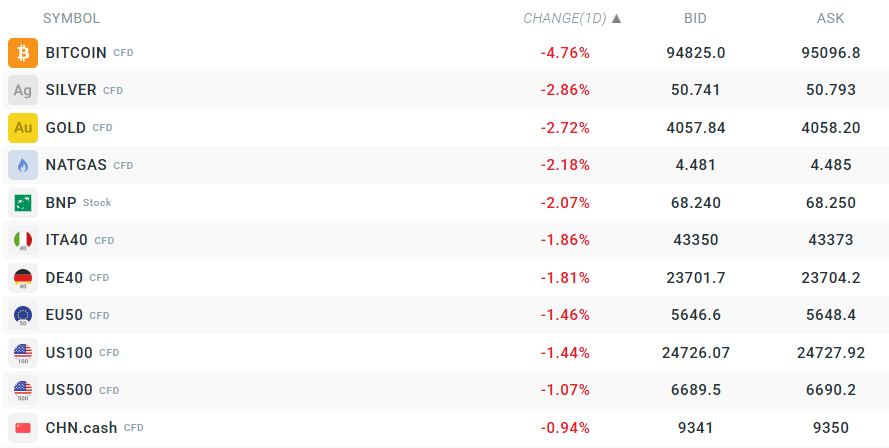

Friday, 14 November, turns out to be a day of profound reckoning on global financial markets. With investor sentiment deteriorating, we are seeing a massive sell-off of virtually all asset classes, from equities to commodities and cryptocurrencies, signalling a significant shift in investors' approach to risk.

Market sentiment stands on a knife's edge as US markets prepare to open after a bloodbath across European and Asian bourses. The critical question investors face is whether the session opening on Wall Street will mark a capitulation point—where panic selling exhausts itself and oversold conditions trigger reversal buying—or whether the momentum of weakness carries through and deepens the rout. Source: xStation

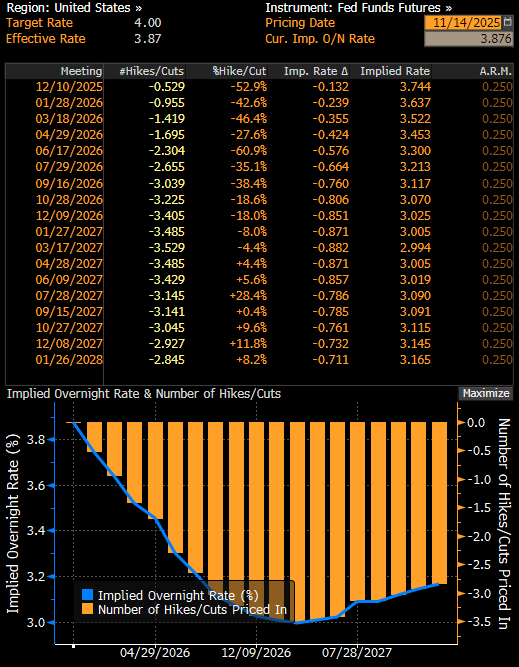

The stock market is experiencing one of its strongest sell-offs since April, when investors faced Donald Trump's tariff panic. The declines in S&P 500 and NASDAQ 100 futures are due to overlapping fundamental and macroeconomic factors. Firstly, the technology and artificial intelligence sector remains in the spotlight – growing doubts about company valuations and real returns on billion-pound investments in AI are creating selling pressure, particularly among companies such as Nvidia, Broadcom and AMD. Secondly, declining expectations for Fed rate cuts – the chance of a December decision has fallen from 95% to around 50% – combined with the central bank's hawkish tone are increasing risk aversion.

Source: Bloomberg Financial LP

In addition, the market is reacting to political and macroeconomic uncertainty. The historically long government shutdown in the US has caused delays in the publication of key data, making it difficult to assess the state of the economy, while in the UK, uncertainty over how to finance the fiscal gap is weakening the pound. Weaker data from China – factory output rose by only 4.9% year-on-year, the slowest pace in 14 months – is adding to global concerns.

The current sell-off is resulting in a rising VIX volatility index and a rotation of capital from growth stocks to more defensive assets. In the short term, markets remain cautious. Further declines are possible if new negative macro signals emerge or the Fed maintains its hawkish stance.

Today's session is not so normal, as the usual "safe havens" such as gold are not doing any better. The precious metal is currently down 2% and has fallen below USD 4,100 per ounce.

Another issue is Bitcoin, which is down 5% today alone and has fallen below 95,000 USD. This is the deepest decline for this cryptocurrency since the beginning of the year, when it lost 33% from its previous peak. At the moment, BTC has already lost 25% from its peak in early October.

The latest series of sell-offs seems to be particularly affecting Bitcoin, which has almost wiped out all of this year's gains. Source: Bloomberg Financial LP

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.