The European session at the end of the week is taking place in a positive mood. Most indices of the old continent are recording moderate gains. Leading the way today is the German DAX, with DE40 contracts rising by over 0.6%. Other Western European indices are limiting gains to around 0.4%.

A series of positive macroeconomic data allows investors from Europe to discount a better growth trajectory for the community.

Macroeconomic Data:

- Today, the GDP reading for the Eurozone was published. The annual growth rate remained stable at 1.4%. Quarterly growth accelerated to 0.3% compared to expectations of 0.2%.

- Orders for German factories are significantly increasing, by 1.5% compared to the expected 0.3%. The boost is also visible on an annual basis.

- In France, the trade deficit is decreasing, and industrial production increased by 0.2% against the expected contraction of 0.2%.

- Towards the end of the European session, investors will learn about the PCE inflation data from the USA. This is one of the most important measures for the FED, and any surprises could seriously impact the forecasted path of policy easing by the FOMC.

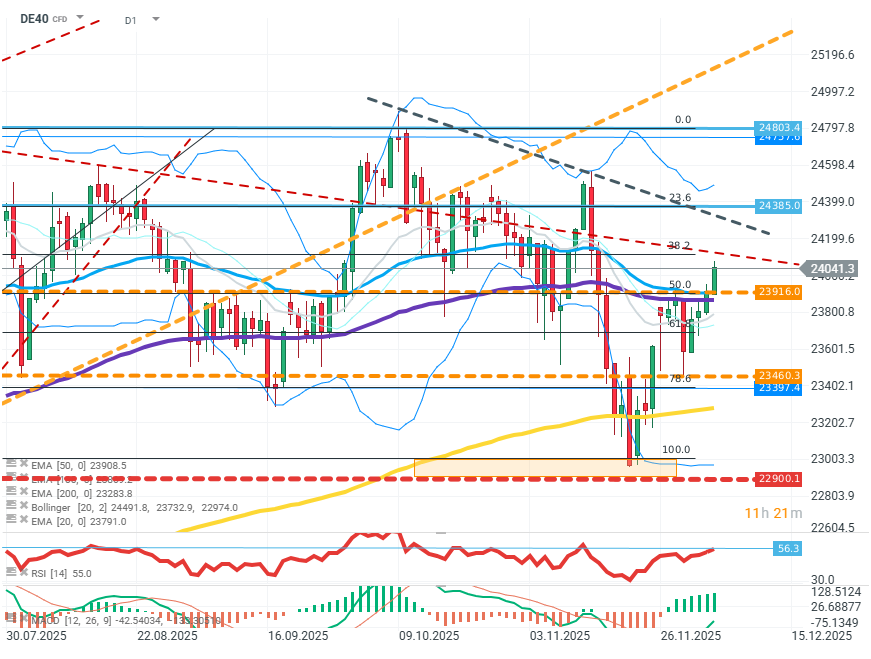

DE40 (D1)

Source: xStation5

The price on the chart continues its upward trend, with buyers managing to overcome another resistance zone, FIBO 50, and heading towards FIBO 38.2, where a downward trend line additionally runs. Overcoming the next level may open the way to test recent highs. Losing initiative by buyers at current levels may, however, trigger a correction around FIBO 78.6. Investors must closely monitor the EMA50 and EMA100 averages and the rising RSI indicator.

Company News:

- Alstom (ALO.FR) - The French railway company received a positive recommendation from an investment bank. The stock price is rising by over 2%.

- Renk (R3NK.DE) - The German manufacturer of drive systems, focused around military vehicles, received a positive recommendation from an investment bank. The company gains over 3%.

- Hensoldt (HAG.DE) - The German defense company is losing over 2%, with investor and analyst concerns about the company's valuation indicators.

- UCB (UCB.DE) - The biotechnology company publishes forecasts for EBITDA growth of over 30%, with the stock price gaining over 5%.

- Swiss Re (SREN.CH) - The Swiss insurer is losing over 4% after publishing disappointing forecasts for the next year.

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

Will Europe run out of fuel?

US OPEN: War in Iran hits the markets

BREAKING: US Manufacturing data above expectations! 📈🏭

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.