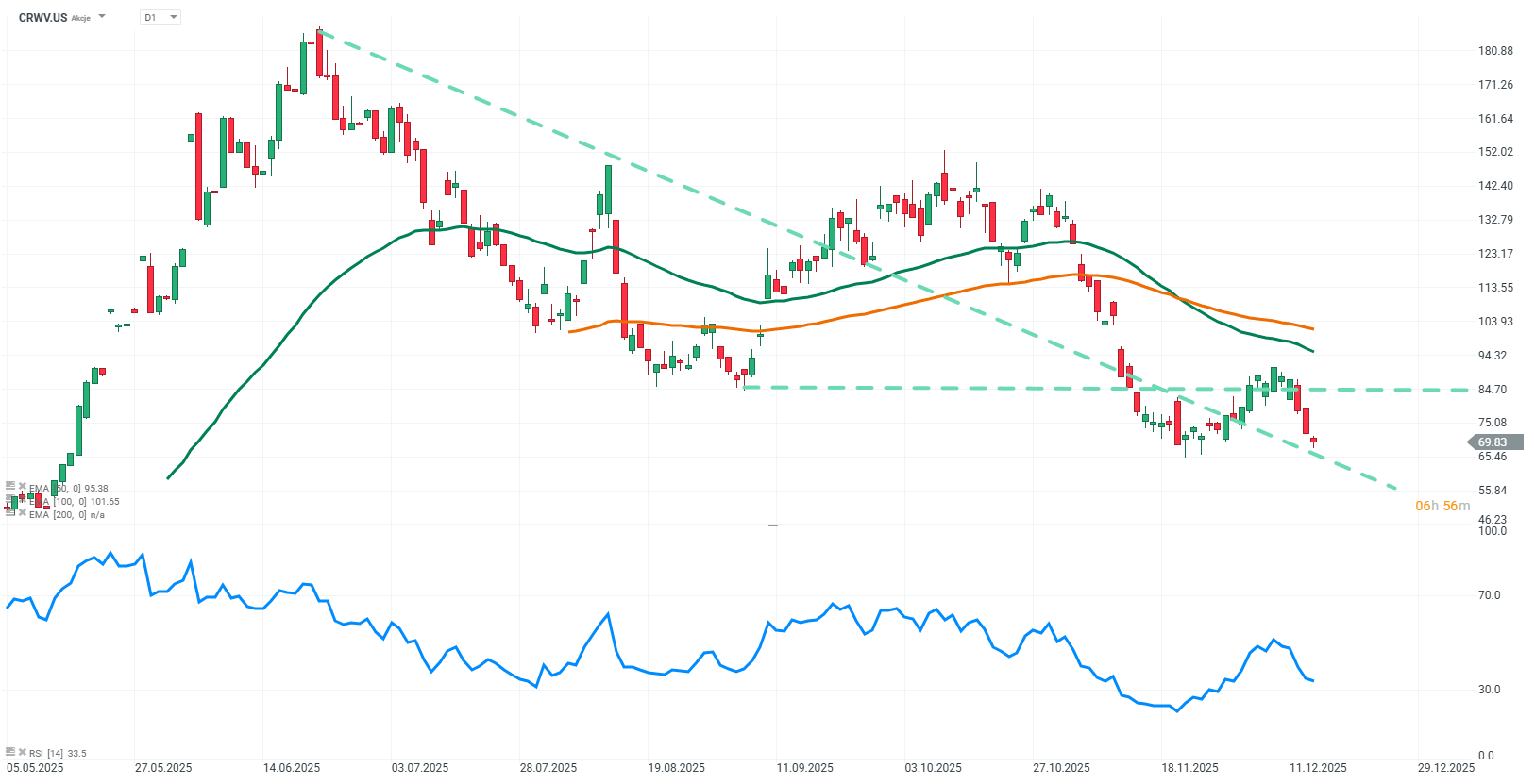

CoreWeave has recently become a symbol of cracks in the narrative of the seemingly endless AI infrastructure boom. The company, which until recently was considered a “pure play” on generative artificial intelligence, lost tens of billions of dollars in market capitalization within a few weeks. Its stock price dropped by several dozen percent, and markets are beginning to question whether its valuation reflects the real fundamentals of the business. This is not just a problem for a single company but a warning signal for the entire AI infrastructure segment, including specialized data centers, cloud providers, and hardware manufacturers.

The reasons behind CoreWeave’s decline are multiple. The company is facing delays in building data centers, including a key facility in Denton for OpenAI, a failed attempt to merge with Core Scientific, and criticism from investors holding short positions. Its business model relies on purchasing advanced GPU processors and renting computing power to large clients such as OpenAI, Microsoft, and Meta. Financing investments with high debt burdens cash flows and margins, and the pace of investment growth exceeding revenue growth raises concerns about a potential bubble in the AI sector.

Several key challenges come to the fore. A business model based on expensive hardware and large investments in data centers works well in an environment of cheap money and AI euphoria, but it becomes risky when interest rates rise and profitability is uncertain. The market is beginning to see the risk of overinvestment, as computing capacity is growing faster than the certainty that clients will fully use and pay for it. The company has come under scrutiny from critics and short-selling investors, accelerating capital outflows and increasing pressure on the entire segment of AI-related firms.

The CoreWeave situation has broader implications for the entire technology market and investors. Companies exposed to artificial intelligence and major tech corporations could benefit from potential interest rate cuts, which would improve access to credit and support investment and consumption. However, massive investments in AI do not benefit everyone. Leaders in the investment race can gain significant advantages, while less capital-intensive companies may soon face challenging financial conditions.

Source: xStation5

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.