Summary:

-

Pound rising across the board

-

Conservatives hold circa 15% in election polls

-

Equities mixed with FTSE still around 7300

The pound has begun the new week on the front foot after the latest election polls showed the Conservatives extending their lead over Labour, boosting the currency back near the $1.30 handle to trade at its highest level since the start of the month. News on Friday that the Brexit party would not contest further seats has come as a positive for the Tories and with just over 3 weeks to go until the election they continue to hold a strong lead of around 15% in most opinion polls.

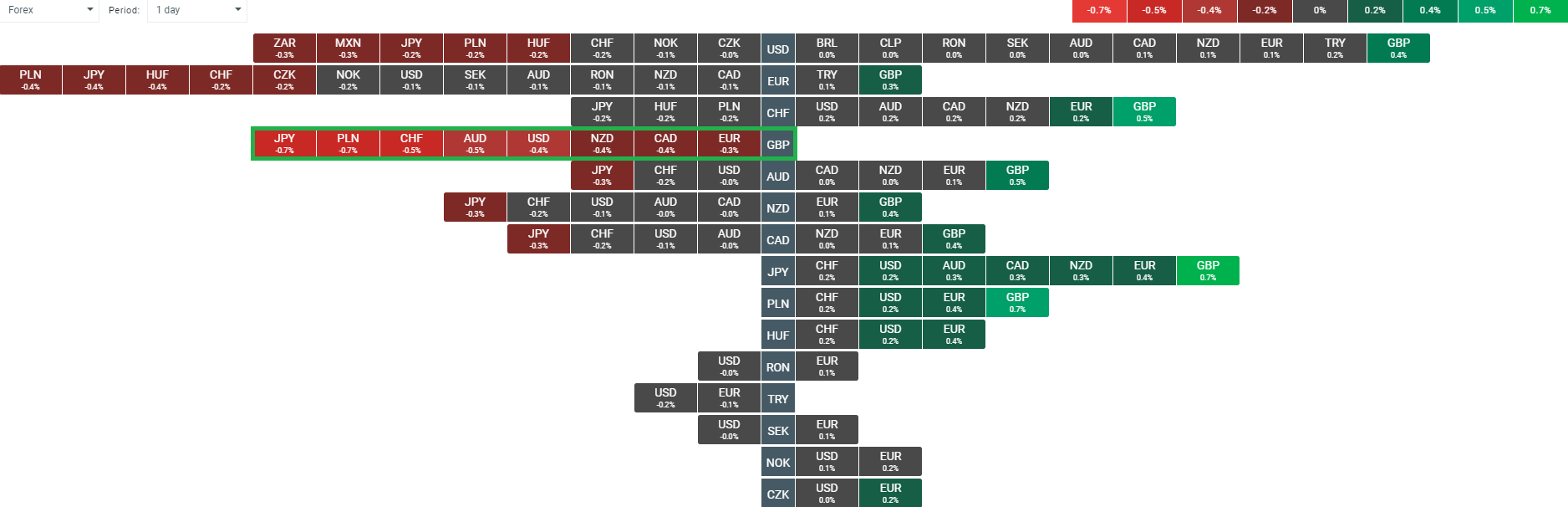

GBP is rising against all its peers today, with the biggest increase of 0.7% seen against the Japanese Yen. Source: xStation

Despite some forecasts that the two leading parties would lose ground at the forthcoming election, the recent trend in polling data since it was called has shown both the Conservatives and Labour party gain support at the expense of the Lib Dems and Brexit party. A series of TV debates between Boris Johnson and Jeremy Corbyn will start tomorrow evening and the latter could do with some good performances if he is to close the gap and prevent a Conservative majority.

Stocks mixed to start the week

On the whole it’s been a fairly mixed start to the new week for stock markets with Asian benchmarks moving higher, Europe little changed and US futures pointing to a record open for Wall Street this afternoon. The moves higher overnight came on the back of some monetary easing from the People’s Bank of China after they cut their 7-day repo rate by 0.05% to 2.5% - the first reduction in this rate in 4 years. It’s a quiet day ahead on the economic data front with little of interest in terms of market moving events.

The FTSE continues to trade in a fairly directionless manner with dips into the region around 7230 being bought and 7450 providing a ceiling. Source: xStation

The FTSE continues to trade in a fairly directionless manner with dips into the region around 7230 being bought and 7450 providing a ceiling. Source: xStation

Three Markets to Watch Next Week (16.01.2026)

Chart of the day: USD/JPY under pressure from BoJ and Japanese policy (January 16, 2026)

Morning wrap (16.01.2026)

📉EURUSD loses 0.3%

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.