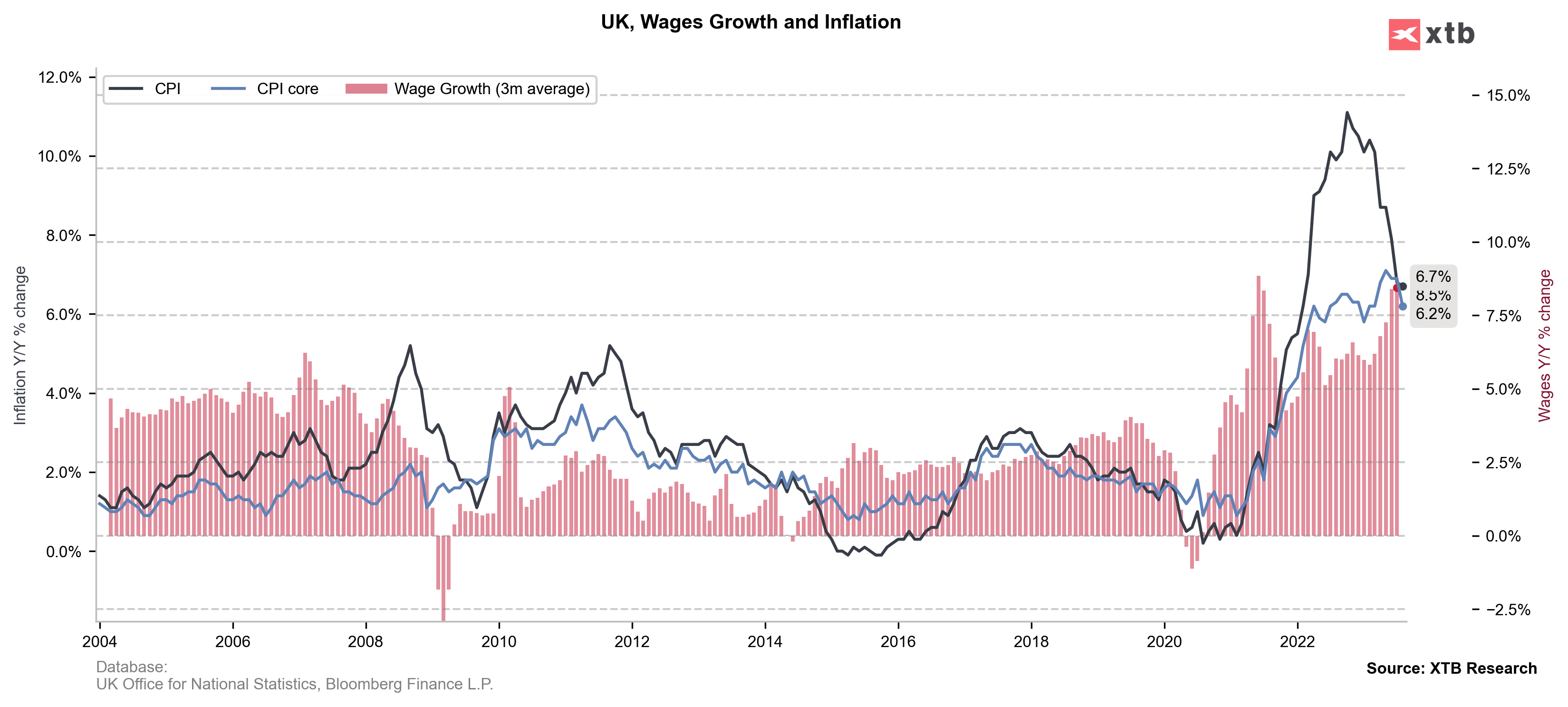

GBP has been under significant pressure this morning after 7:00 am BST. UK CPI report showed headline price growth decelerating from 6.8 to 6.7% YoY in August (exp. 7.0% YoY) while core gauge dropped from 6.9% to 6.2% YoY (exp. 6.8% YoY). A significant drop in core inflation means that the latest pick-up in wage growth did not have much of an impact on inflation in the United Kingdom. This, in turn, has triggered a drop in rate hike bets for the upcoming BoE meeting.

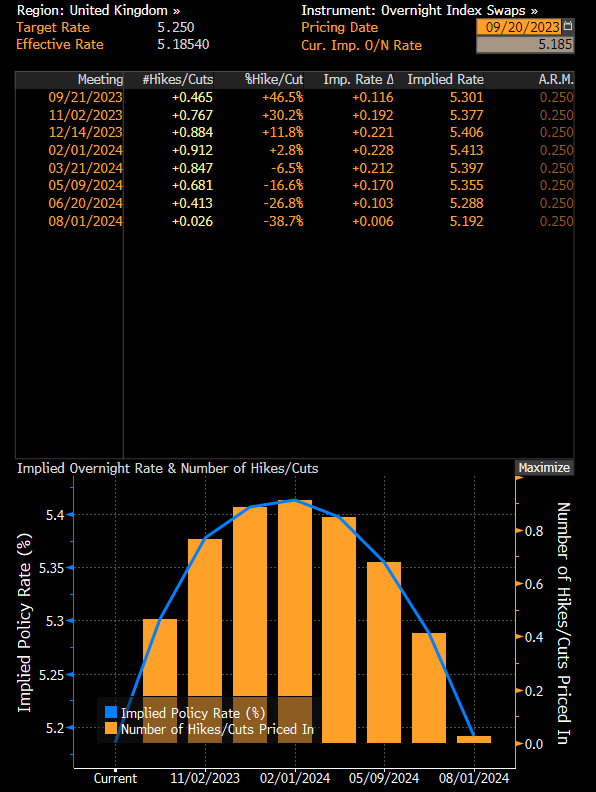

Goldman Sachs says that it looks rather unlikely that the Bank of England will hike rates at a meeting tomorrow. Money market bets for a rate hike have dropped to below 50% following today's data release from around 70% beforehand. Nevertheless, money markets price in one more rate hike before the end of this year.

Money markets expect one more rate hike this year but not tomorrow. Source: Bloomberg Finance LP

UK CPI inflation and wage growth. Source: Bloomberg Finance LP

It should be noted that the market is still almost 100% certain that one more 25 basis point rate hike will be delivered before year's end. Moreover, USD is pulling back ahead of today's FOMC decision, which has helped to almost fully erase GBPUSD drop from earlier today. On the other hand, the pair is trading in a clear downtrend and the 50-hour moving average is being tested at press time.

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

Morning Wrap - Oil price is still elevated (07.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.