-

BoE Expected to Hold: Bank of England likely to keep rates unchanged despite falling inflation; focus is on sustained disinflation.

-

Timeline: Decision will be announced at 12:00 London time, along with minutes. 30 minutes later Bailey will speak on decision

-

Dovish Surprise Risk: Market underprices a cut (25% chance); a fiscally tight November budget could prompt a December rate cut and increase dovish dissent today.

-

GBPUSD Watch: A hold supports GBPUSD rebound towards 1.3200; a surprise cut or strong dovish signal risks an immediate drop below 1.30.

-

BoE Expected to Hold: Bank of England likely to keep rates unchanged despite falling inflation; focus is on sustained disinflation.

-

Timeline: Decision will be announced at 12:00 London time, along with minutes. 30 minutes later Bailey will speak on decision

-

Dovish Surprise Risk: Market underprices a cut (25% chance); a fiscally tight November budget could prompt a December rate cut and increase dovish dissent today.

-

GBPUSD Watch: A hold supports GBPUSD rebound towards 1.3200; a surprise cut or strong dovish signal risks an immediate drop below 1.30.

Despite recent disappointing macroeconomic figures, the Bank of England is widely expected to hold interest rates steady during today's Monetary Policy Committee (MPC) meeting. While inflation has cooled (dropping to 3.8% in September, below the BoE's forecast), service price pressure has eased, and wage growth has slowed, the rate of inflation remains nearly double the central bank's 2% target. Furthermore, the likelihood of fiscal tightening via tax increases in the forthcoming budget is a factor.

Consequently, the MPC is likely to prioritize seeing a sustained disinflationary trend before contemplating monetary easing, which is generally not anticipated until Spring 2026, when inflation is projected to near 2.5%.

Market Pricing and Dissenting Voices

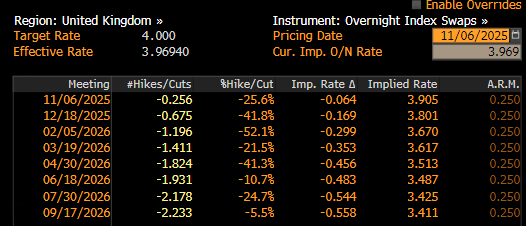

The market currently prices in only a 25% probability of a rate cut today, with a full 25 basis point cut fully factored in for February. However, it is notable that the combined probability of a cut by December sits near 70%, mirroring the pricing seen recently in the US, where a December cut was nearly fully priced in. Source: Bloomberg

While the market assigns a low 25% chance to a rate cut today, this scenario appears underpriced. A key factor that will shape the inflation outlook for the coming quarters is the UK’s budget outline, due at the end of November. Should the budget deliver the anticipated fiscal restraint, the BoE may gain confidence in a continued disinflationary path and proceed with a rate reduction at its December meeting.

In light of this, there is a chance today that a dovish signal will emerge, both through the official statement and the voting split. Recently, two MPC members voted for a cut; today, that dissent could grow to three members.

Impact on the Pound

A hold decision could support the recent rebound in the GBP/USD pair. The pair is currently testing a range corresponding to a similar upward correction seen in late October. If the tone of today's decision is not excessively dovish, this correction could extend further, potentially towards the 1.3200 area.

Conversely, a rate cut would likely lead to an immediate dip below the 1.30 level. This downward scenario could also materialize if the BoE signals a clear readiness to ease policy in December, contingent on the forthcoming budget details.

Morning wrap (05.03.2026)

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.