Geopolitical risk has decisively returned to the forefront after President Donald Trump threatened to escalate tariffs against European allies in an effort to force concessions over Greenland. The prospect of a widening trade conflict, combined with open tensions within NATO, has sharply increased political uncertainty. Investors responded by cutting exposure to risk assets, pushing US equity futures and the dollar lower, while the euro and precious metals strengthened.

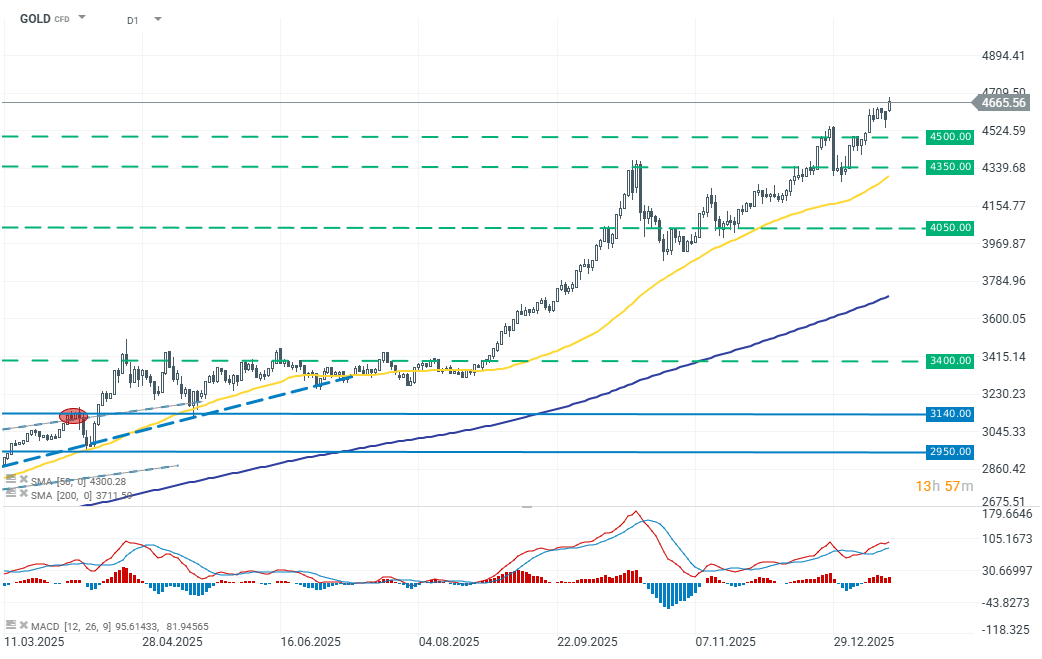

Gold broke to new all-time highs, reinforcing its role as a safe-haven asset in turbulent times. Europe and the United Kingdom immediately announced retaliatory measures, while also signaling a willingness to negotiate before the tariffs formally take effect. The European Union is preparing to reinstate a €93 billion package of retaliatory tariffs on US goods, which was suspended last year and could automatically return on February 6 if talks fail.

Gold is benefiting from capital inflows seeking protection from political shocks, trade risks, and the growing likelihood of fragmentation of the current international order.

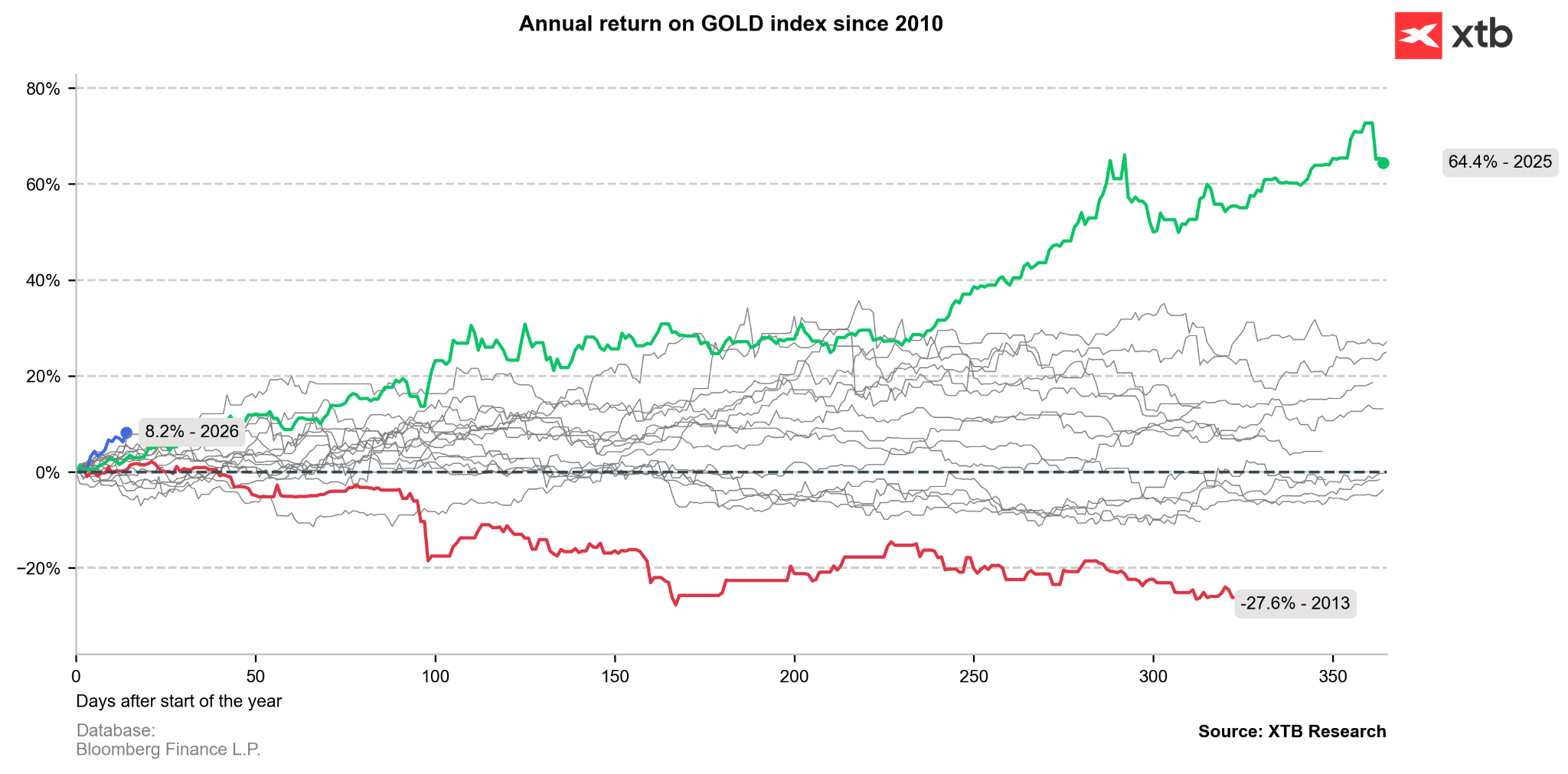

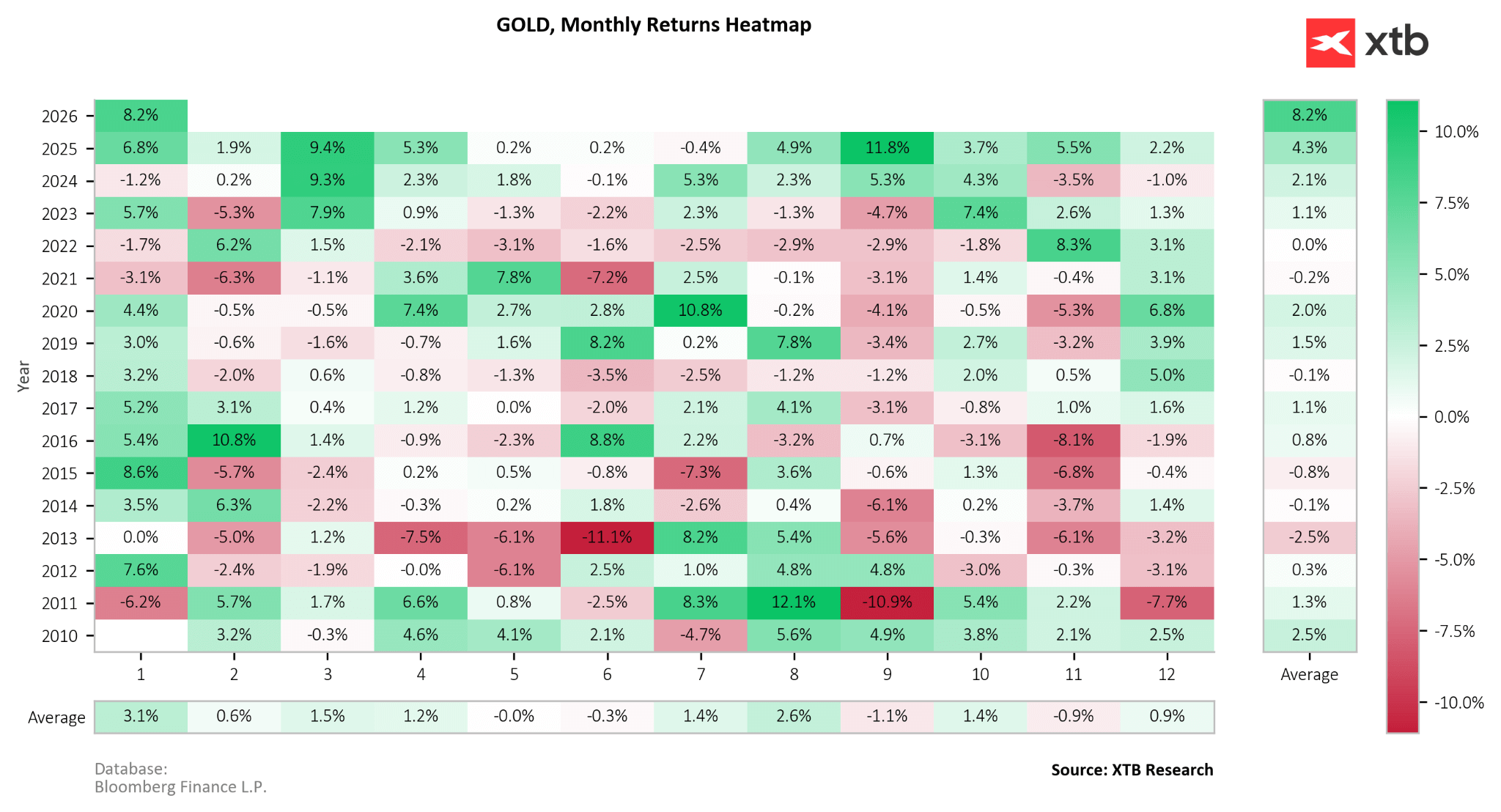

The beginning of the year—particularly January—has historically been seasonally favorable for gold. The current price rally is further reinforced by elevated geopolitical tensions.

Gold continues to break through successive levels and is approaching USD 4,700 per ounce.

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.