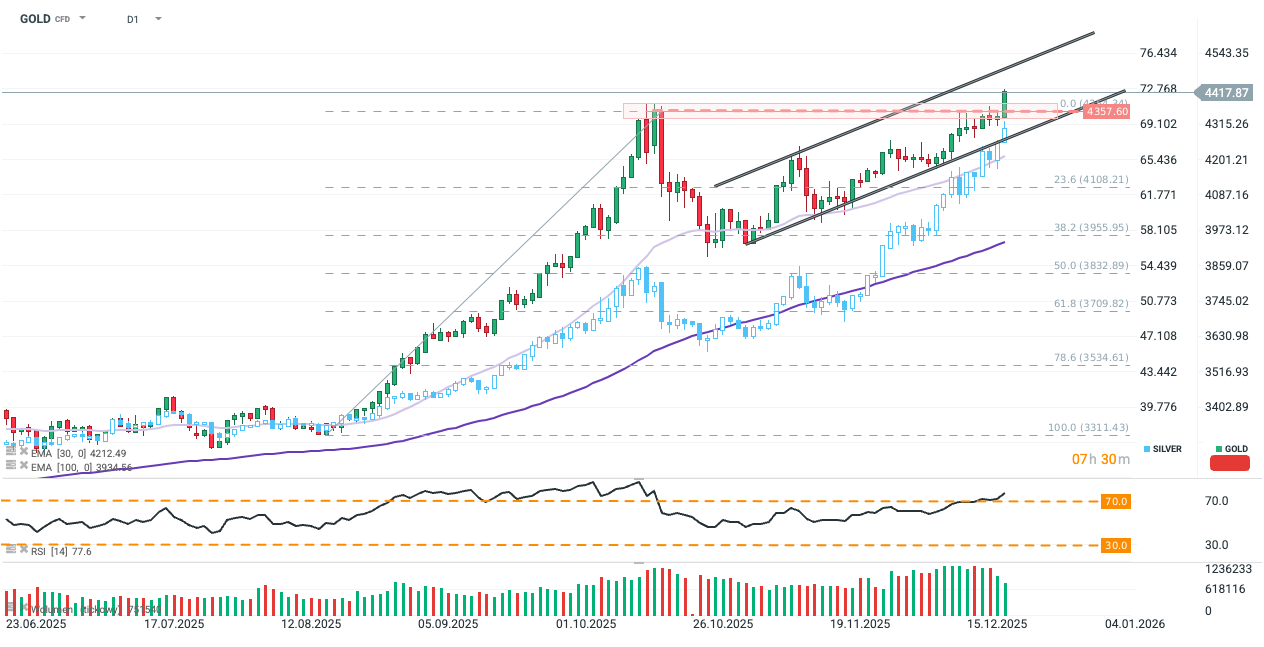

Gold and silver are opening the holiday-shortened week with strong bullish gains (GOLD: +1.8% to around USD 4,420, SILVER: +2.5% to around USD 68.20), pushing key precious metals to new all-time highs. Demand for safe havens is being driven primarily by market positioning around US monetary policy in 2026, as well as rising tensions between Venezuela and the United States.

The GOLD contract has broken through a key resistance level at the October high near USD 4,375 per ounce, following the trajectory of the current upward channel. Holding above this level will be crucial to sustain the upward move; otherwise, a correction may occur—especially if geopolitical uncertainty, which has boosted trading volumes in key precious metals in recent weeks, begins to fade. RSI has once again entered overbought territory, although this year gold has shown little difficulty trading above this level. Source: xStation5

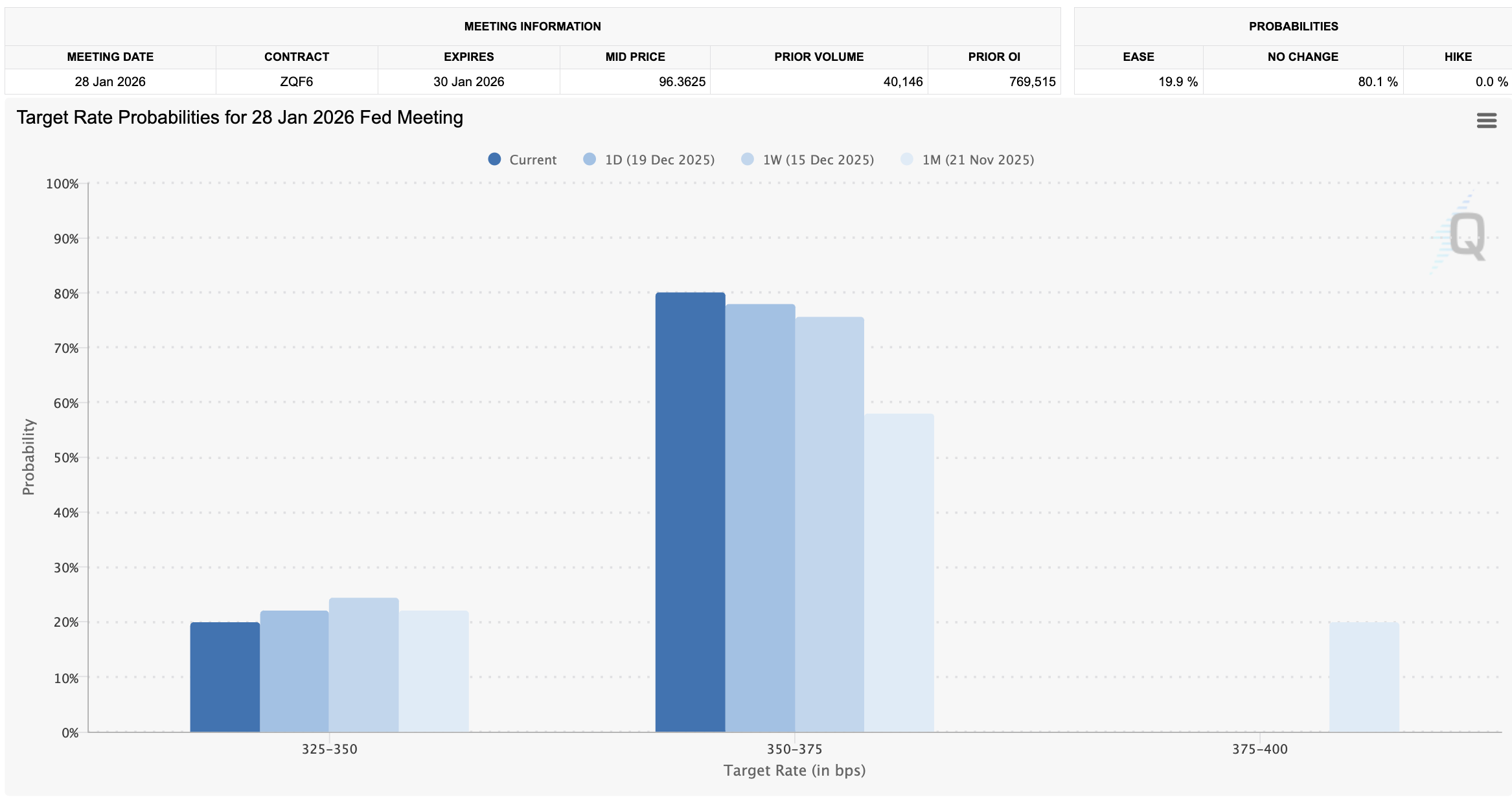

The latest breakout in precious metals is primarily driven by increasingly dovish expectations toward the Fed in 2026. The market approached the most recent FOMC meeting with considerable caution, as the decision was made without key inflation or labor market data; however, Powell’s calm stance and the absence of a so-called “hawkish cut” injected optimism into markets. Expectations for a January rate cut have eased somewhat over the past month (currently around a 20% probability of another cut, source: CME FedWatch), but the market is once again pricing in more than two rate cuts before the end of 2026, supported further by the latest CPI inflation reading, which came in well below expectations. The issue of appointing a new Fed chair is playing a diminishing role, as even a Trump-nominated candidate would face the difficult task of persuading the rest of the FOMC to adopt a more dovish stance. Nevertheless, as already lower interest rates reduce the opportunity cost of holding gold relative to other interest-bearing assets—especially government bonds—expectations toward the Fed continue to translate into rising, already elevated demand.

Market is currently betting on no cut in January, though swaps price in more than 2 cuts before Semptember. Source: CME FedWatch.

Precious metals are coming off a record year—gold alone has surged by as much as 70%. Metals that previously remained outside the market’s spotlight are now trying to catch up. Platinum and silver are also rising, not only gaining popularity as stores of value but also attracting attention for their role in rapidly growing industrial sectors.

There is also no shortage of new geopolitical factors reducing risk appetite and encouraging flows into safe havens. Over the weekend, the US seized yet another oil tanker off the coast of Venezuela, and investors are clearly concerned about the possibility of another armed conflict emerging on the global map.

Demand may continue to find support from central banks, which are not only cutting interest rates but also increasing their gold reserves—especially in emerging market countries. Retail investors are following suit, seeking rapid exposure to the market through both physical bullion and ETFs.

Morning Wrap - Oil price is still elevated (07.03.2026)

Daily Summary: Oil at new local highs; Iran and Trump dampen market sentiment 💡

BREAKING: Stronger-than-expected decline in US gas inventories

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.