The decline in gold prices continued today, with the scale of the correction now surpassing the pullbacks seen in April and May this year. The current correction level is comparable to the 2022 decline, though that downward move was stretched over many months. The current sell-off, by contrast, has lasted exactly seven days.

Losses since the correction began have now exceeded 11%, while the gain achieved in October has been severely reduced from 13% to just 1.5%. This means that October could become the first losing month since July if the correction extends to the $3,857 per ounce level. It is also worth noting that the sell-off in July was minimal, amounting to less than half a percent. A more significant correction took place between November and December 2024, when gold cumulatively retraced by over 4%.

Gold has sharply curtailed its gains this month. Previously, October was potentially the strongest month in over 10 years. Source: Bloomberg Finance LP

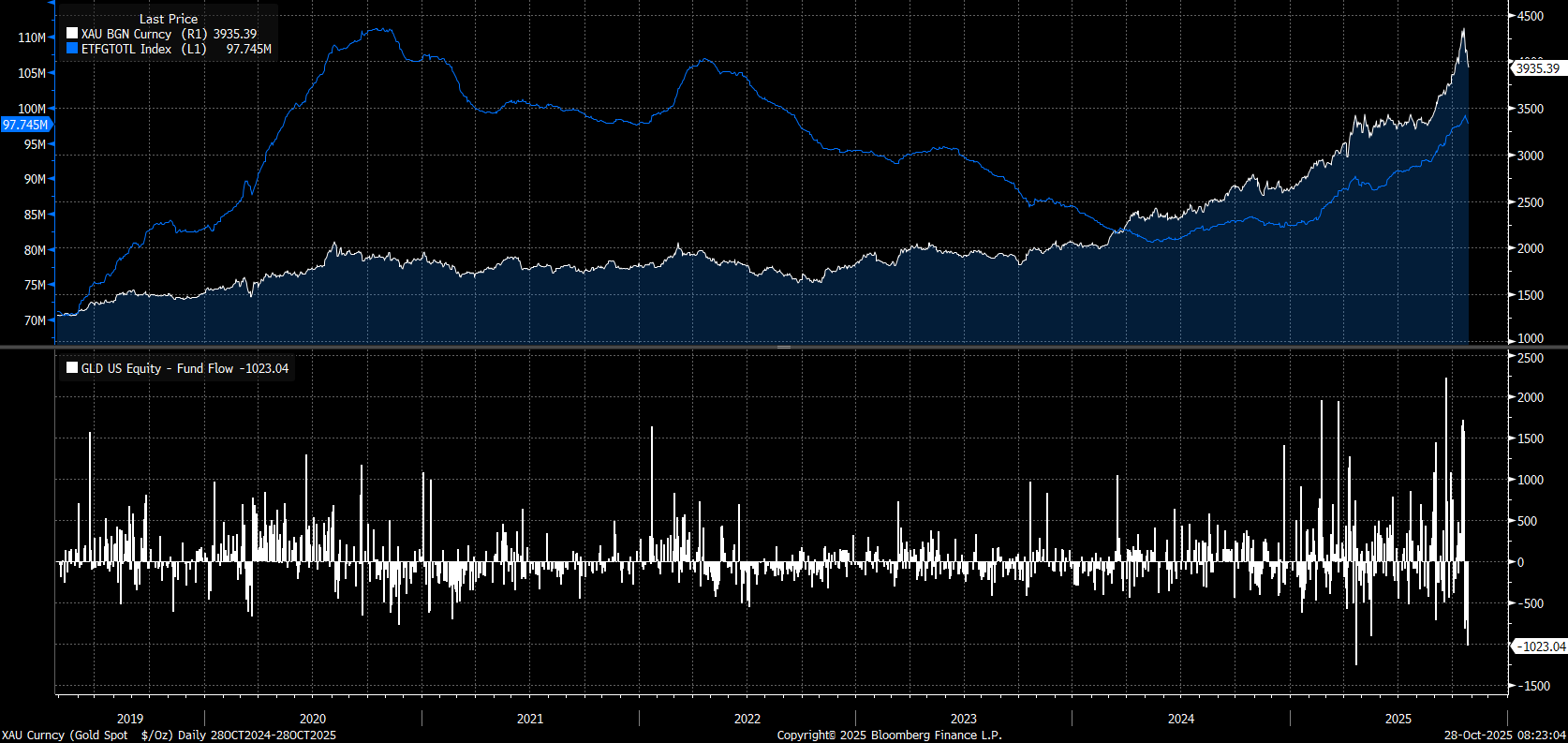

Gold has sharply curtailed its gains this month. Previously, October was potentially the strongest month in over 10 years. Source: Bloomberg Finance LPThe gold market sell-off is being motivated by improving market sentiment and profit-taking. COMEX recently raised the margin required to hold a position by approximately 5% for gold and 8% for silver. This move was mirrored by futures exchanges in Japan and India. It is evident that investors holding positions in ETFs have also decided to realize profits. Looking across all funds, ETFs are selling gold at the fastest pace since April and May. Simultaneously, the world’s largest gold ETF, the US-based SDPR Gold Shares (GLD.US), experienced its largest daily outflow since April, marking one of the largest single-day outflows in years. GLD is now experiencing its fourth consecutive day of outflows.

ETFs are selling gold in anticipation of a US-China trade deal. The Fed's decision may also be significant. If the Fed is cautious in communicating further rate cuts, it could push gold to even lower levels. Source: Bloomberg Finance LP

ETFs are selling gold in anticipation of a US-China trade deal. The Fed's decision may also be significant. If the Fed is cautious in communicating further rate cuts, it could push gold to even lower levels. Source: Bloomberg Finance LPGold temporarily retreated below $3,900 per ounce today, breaching the 38.2% Fibonacci retracement and approaching support at the 50.0% retracement of the last major uptrend. The scale of the correction exceeds what we observed in April and May.

Gold today temporarily falls below $3,900 per ounce, breaking the 38.2% retracement and approaching support at the 50.0% retracement of the latest upward wave. The scale of the correction exceeds what was observed in April and May. Source: xStation5

Gold today temporarily falls below $3,900 per ounce, breaking the 38.2% retracement and approaching support at the 50.0% retracement of the latest upward wave. The scale of the correction exceeds what was observed in April and May. Source: xStation5Looking at the price decline on the monthly chart, we could potentially see a massive 'wick' forming on the October monthly candle. The previous large candle wick occurred in April, which ultimately led to several months of consolidation.

Source: xStation5

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.