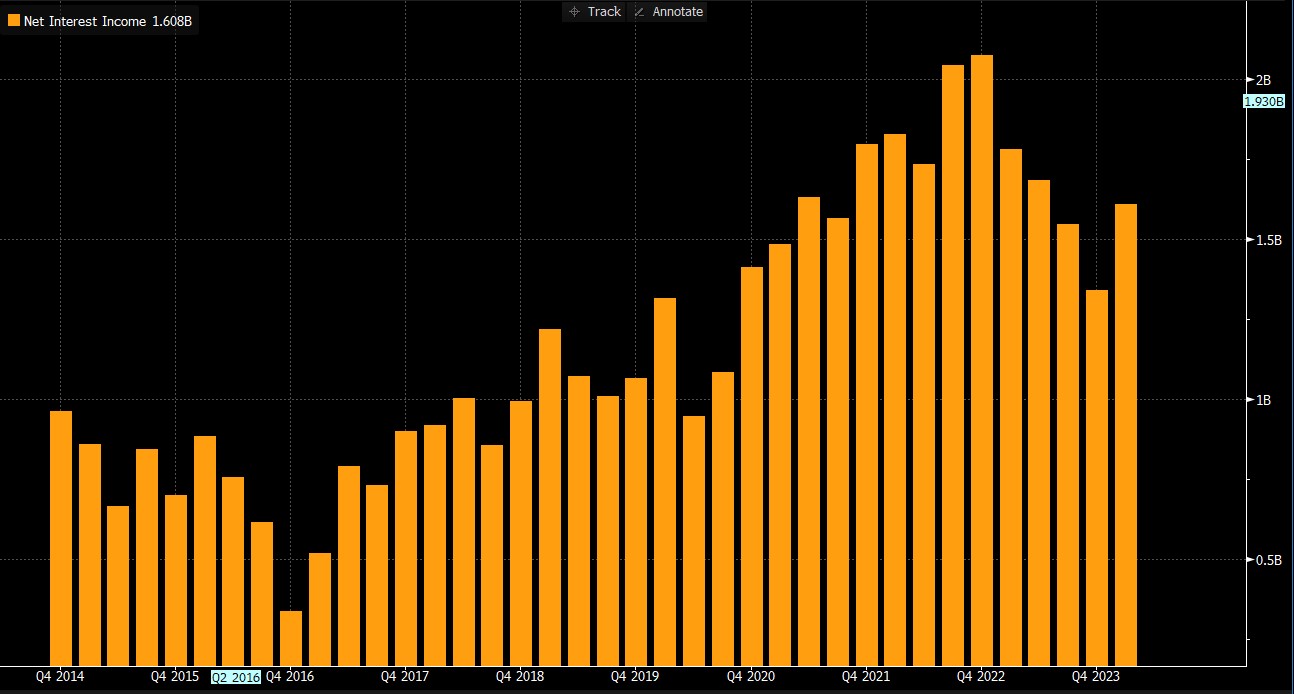

Goldman Sachs' 1Q24 results significantly exceeded expectations. Strong EPS, coupled with robust revenue dynamics, as well as a substantial decrease in credit loss provision, provide a solid foundation for potential stock price increases. For the first time in 4 quarters, the company recorded a QoQ increase in net interest income, reaching a level close to 2Q23.

Net interest income Goldman Sachs. Source: Bloomberg Finance L.P.

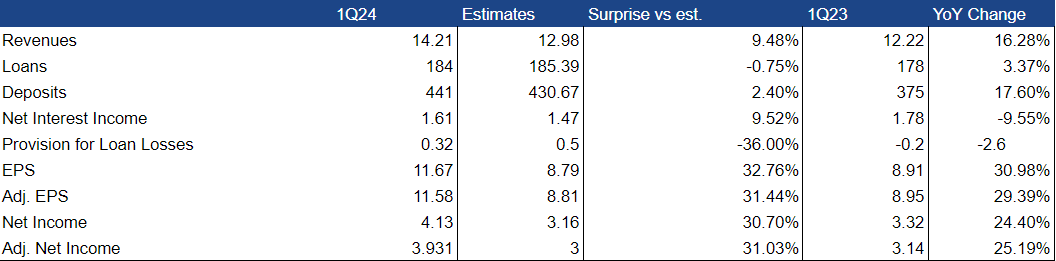

Improvements in every segment (particularly in investment banking) propelled revenues to a record level over the past two years, reaching $14.2 billion (+16.3% y/y).

In the key Banking and Markets segment, Goldman Sachs reported revenues of $9.73 billion, surpassing market expectations by 15%, thereby exceeding even the most optimistic scenarios. Particularly notable was the significant increase in investment banking fee revenues (+32% y/y), driven by a rise in successfully executed M&A transactions in the global market.

The company reduced its credit loss provision to $318 million (compared to $577 million in 4Q23) on a q/q basis. A year earlier, during the same period, it reported a result of -$171 million, stemming from a one-off event, namely the partial sale of the Marcus portfolio. This year's reserve value was significantly below market expectations (-36% compared to expectations).

The company achieved a net income of $4.13 billion, surpassing expectations by 30.7%. On a y/y basis, net income increased by 24.4%. EPS rose to $11.67 (+31% y/y growth). After adjustment, its value stood at $11.58. Both values exceeded analysts' expectations by approximately 32%.

The company also announced a dividend of $2.75 per share. The dividend date was set for May 30th, with the dividend payment scheduled for June 27th.

Goldman Sachs' 1Q24 results (in bln $, except for EPS) Source: Company's financial report, Bloomberg Finance L.P.

After Goldman Sachs' results, there has been a strong increase in the stock price in pre-market trading. The price has risen by over 4% so far. Source: xStation.

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.