Fed's Waller, Logan, and Goolsbee presented perspectives that collectively leaned towards a cautious approach to monetary policy adjustments, indicating a generally dovish stance. Overall, the bankers' remarks reflected a preference for a careful, measured approach to monetary policy, aligning more with dovish sentiments. Below are the highlights from each of the speeches:

Waller:

- Emphasized that the pace of balance sheet reductions will be independent of policy rate changes.

- Noted that the current overnight repo usage of around $500 billion indicates that the Fed can continue reducing its holdings for some time.

- Expressed a preference for the Fed's Treasury holdings to shift towards a larger share of shorter-dated securities.

Logan:

- Advised that moving more slowly in the current environment could reduce the risk of a premature stop in monetary policy adjustments.

- Hasn't observed a reduction in reserves yet under the current Fed Quantitative Tightening (QT).

- Pointed out that after draining the Overnight Reverse Repo (ON RRP), QT will reduce reserves on a one-for-one basis.

Goolsbee:

- Stated uncertainty about where interest rates will settle.

- Noted that if inflation continues to fall, the Fed should consider the impact on employment.

- Believes the current Fed funds rate is quite restrictive.

- Emphasized the need to monitor housing inflation.

- Speculated that January's inflation might have been an anomaly.

- Commented on the unusual nature of housing inflation.

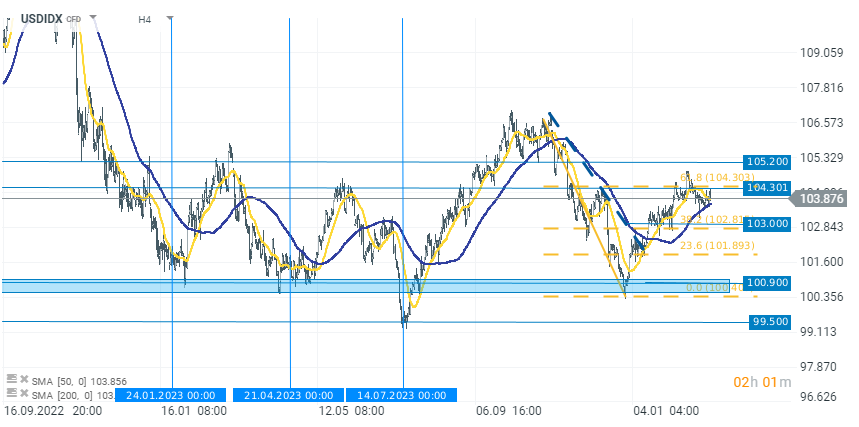

The US dollar index halted its rise at the 61.8% Fibonacci, retracement of its most recent downward move. Today, the USDIDX is losing almost 0.20%. The declines accelerated after the publication of the ISM data, which were significantly worse than expected and revived speculations about faster interest rate cuts.

Source: xStation 5

USDJPY: speculation over dissolution of the lower house drives sharp JPY weakness ✂️

Morning wrap (13.01.2026)

Economic calendar: US CPI inflation 📌

Daily Summary: Conflict with the Fed Does Not Stop Wall Street📈

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.