-

The market is pricing in an increasingly prolonged pause in U.S. rate cuts.

-

Business activity and consumer spending continue to support economic expansion, raising the risk of a renewed pickup in inflation.

-

Meanwhile, the labor market appears to be stabilizing, bringing the Fed’s balance of risks closer to equilibrium.

-

The market is pricing in an increasingly prolonged pause in U.S. rate cuts.

-

Business activity and consumer spending continue to support economic expansion, raising the risk of a renewed pickup in inflation.

-

Meanwhile, the labor market appears to be stabilizing, bringing the Fed’s balance of risks closer to equilibrium.

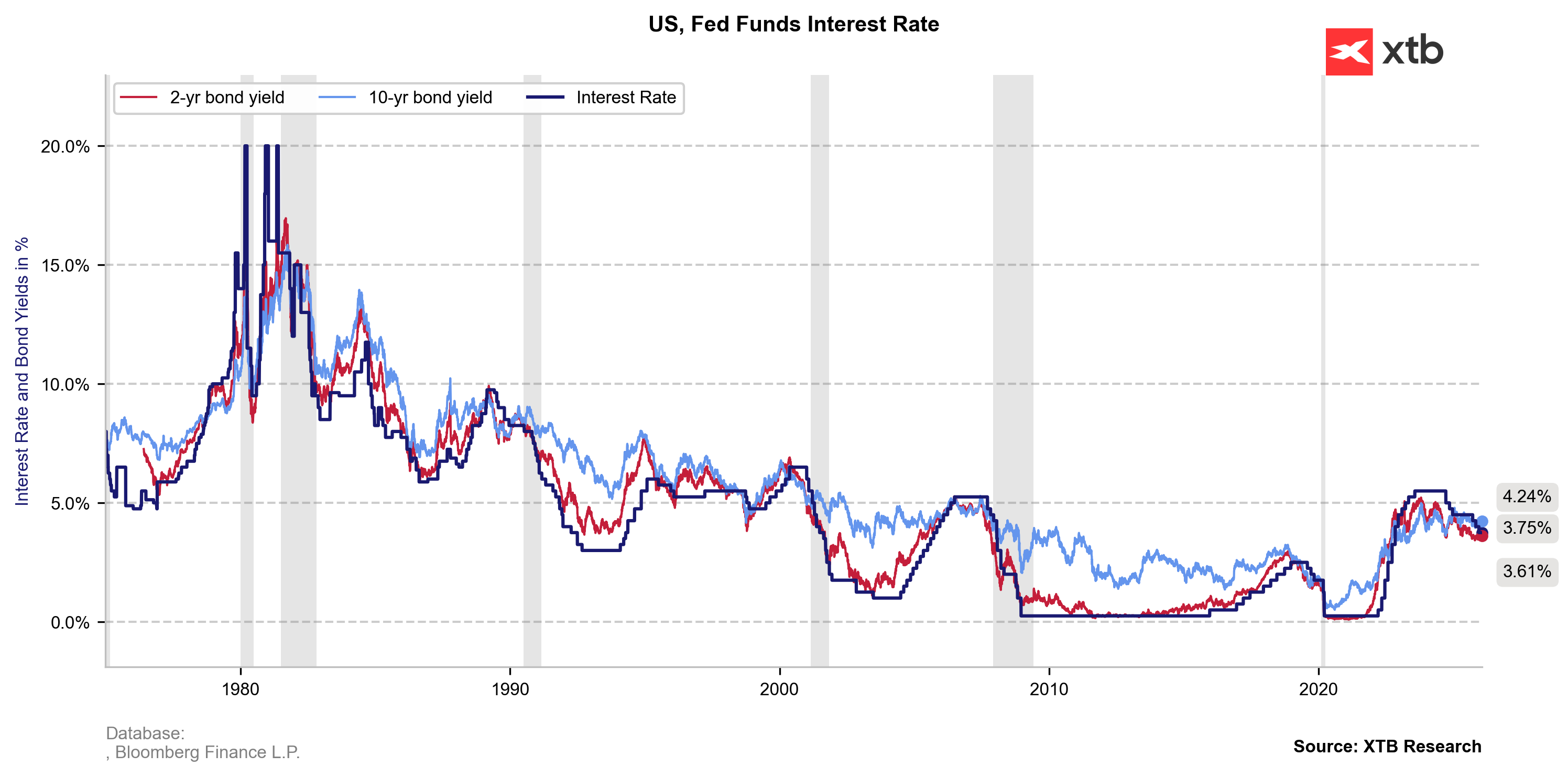

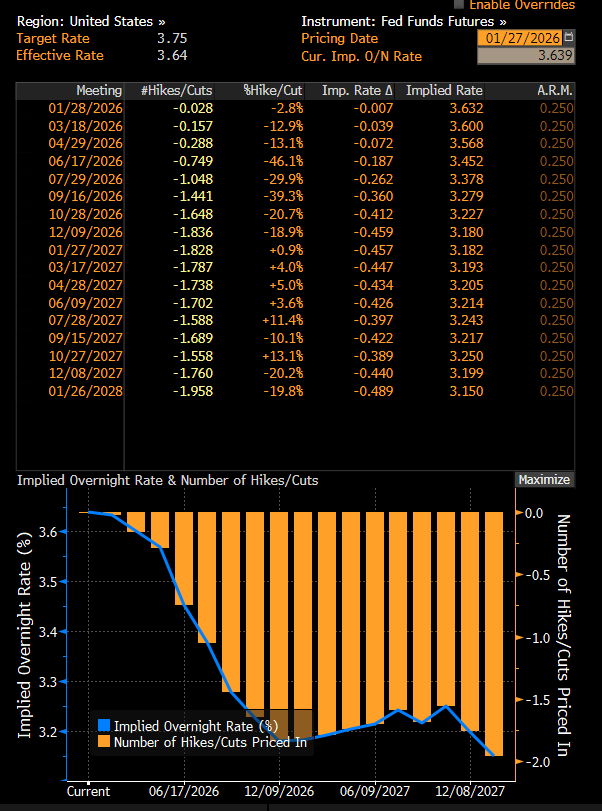

Tomorrow at 8:00 PM CET, the Federal Reserve will announce its first interest rate decision of 2026. After December’s 25 bp cut to the 3.50–3.75% range, expectations for further monetary easing in the U.S. have almost completely faded. Markets not only assume no cut after the ongoing FOMC meeting, but also a prolonged pause that could last until the second half of 2026. Has Fed policy therefore returned to a neutral level?

Two-year Treasury yields have risen about 10 bps since the start of the year, signaling a clear increase in medium-term rate expectations. Source: XTB Research

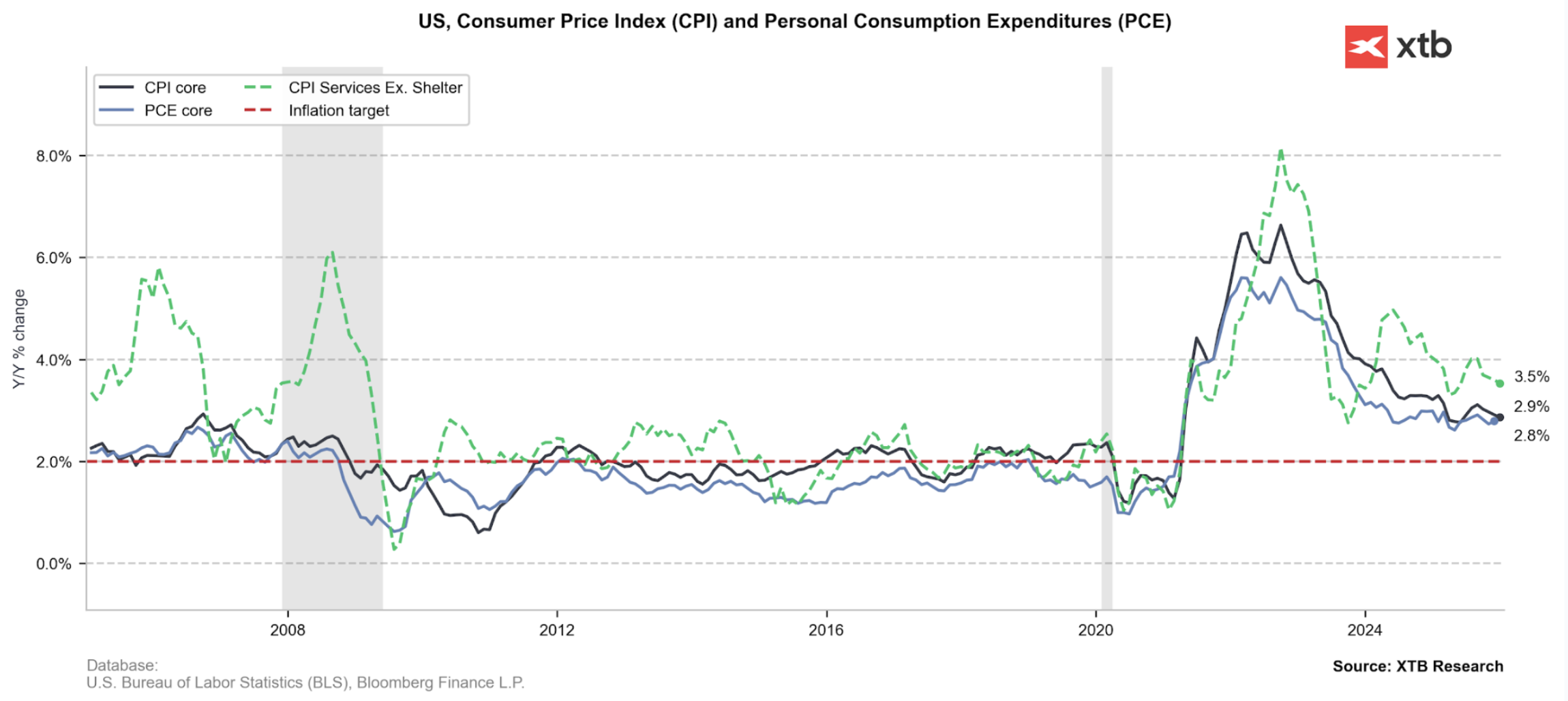

The economy is accelerating with inflation near 3%

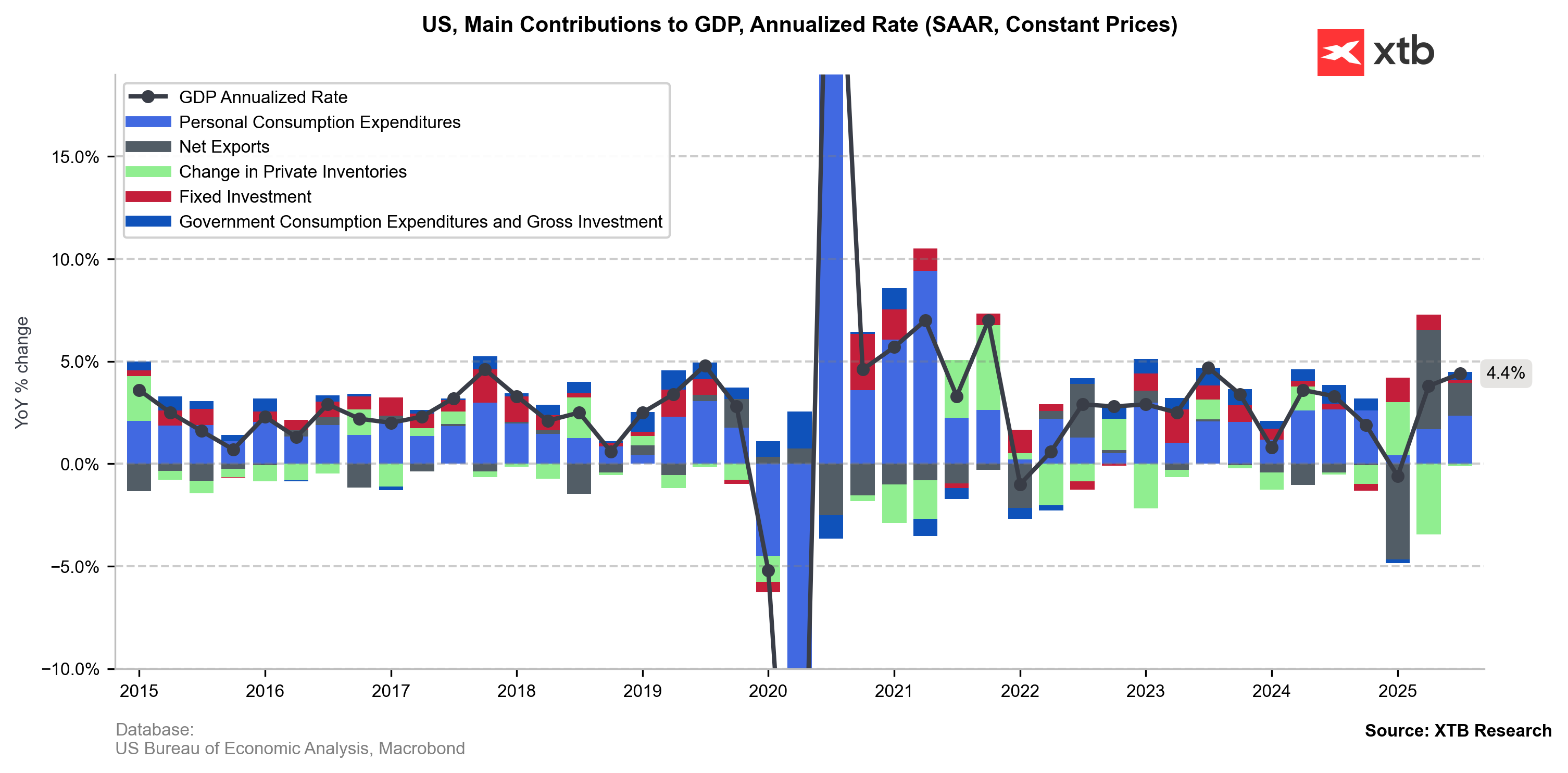

Recent U.S. data point to stronger-than-expected economic activity, which in 2025 had been dampened by uncertainty surrounding Donald Trump’s tariff policy. The latest upward GDP revision may not have been spectacular (from 4.3% to 4.4%), but it sent an optimistic signal that both consumers and businesses navigated a turbulent period, defined by rising costs (especially medical and food), restrained capital spending and fears of a labor market downturn.

The Q3 2025 GDP revision confirmed that consumer demand remains the main growth driver and revealed stronger-than-expected business investment. This dual optimism poses a risk for sticky inflation, which is once again approaching 3%. Source: XTB Research

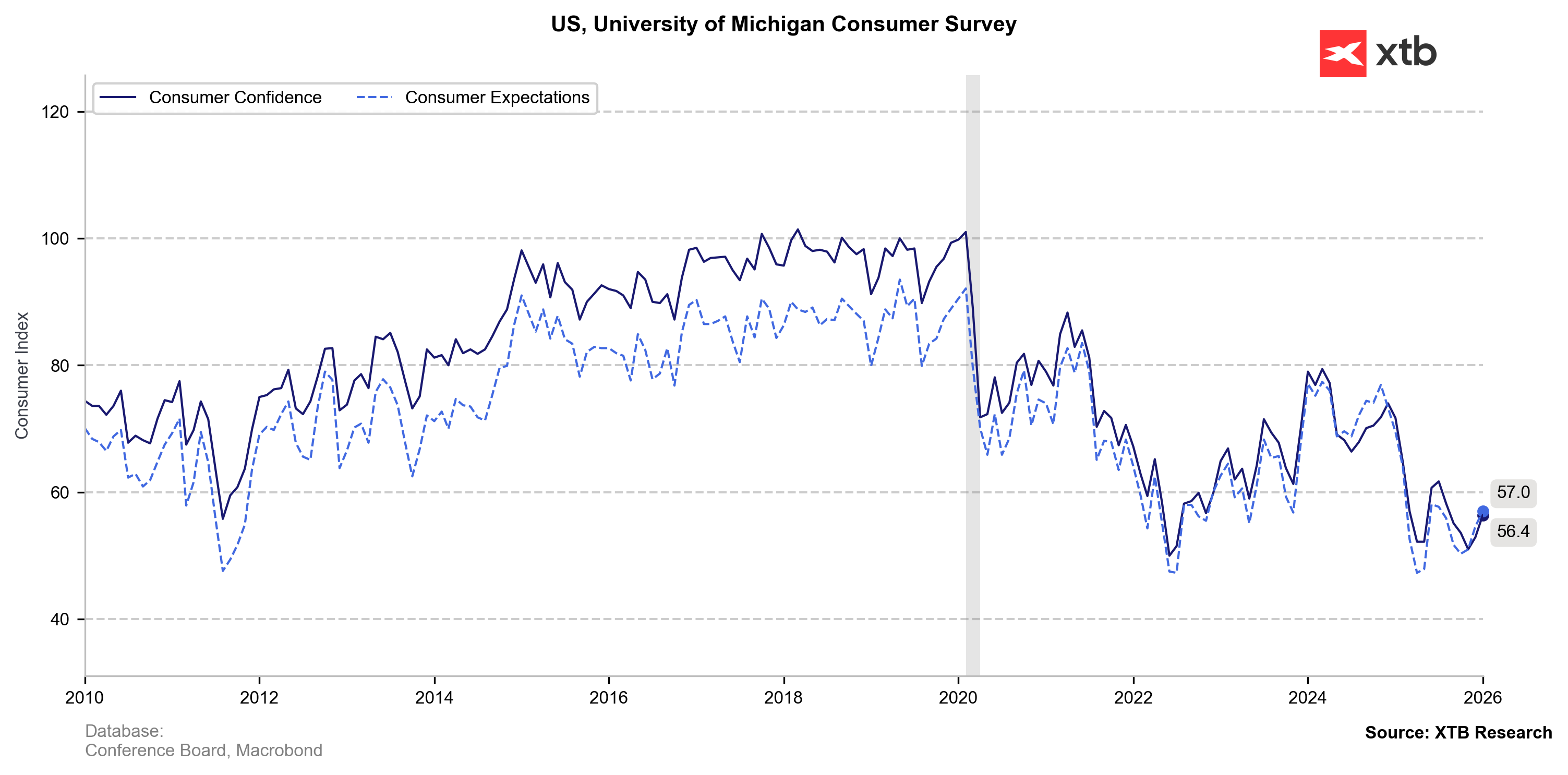

High-frequency data tell a similar story. The University of Michigan consumer sentiment index rose for a second straight month (from 52.9 in December to 56.4 in January), matching an increase in consumer spending (PCE) of +0.5% m/m in both October and November. Americans are also becoming less cautious, saving less despite recent labor market tensions and the government shutdown (savings rate fell from 3.7% in October to 3.5% in November; January 2025: 5.1%).

U.S. consumer sentiment is rebounding from recent lows. Source: XTB Research

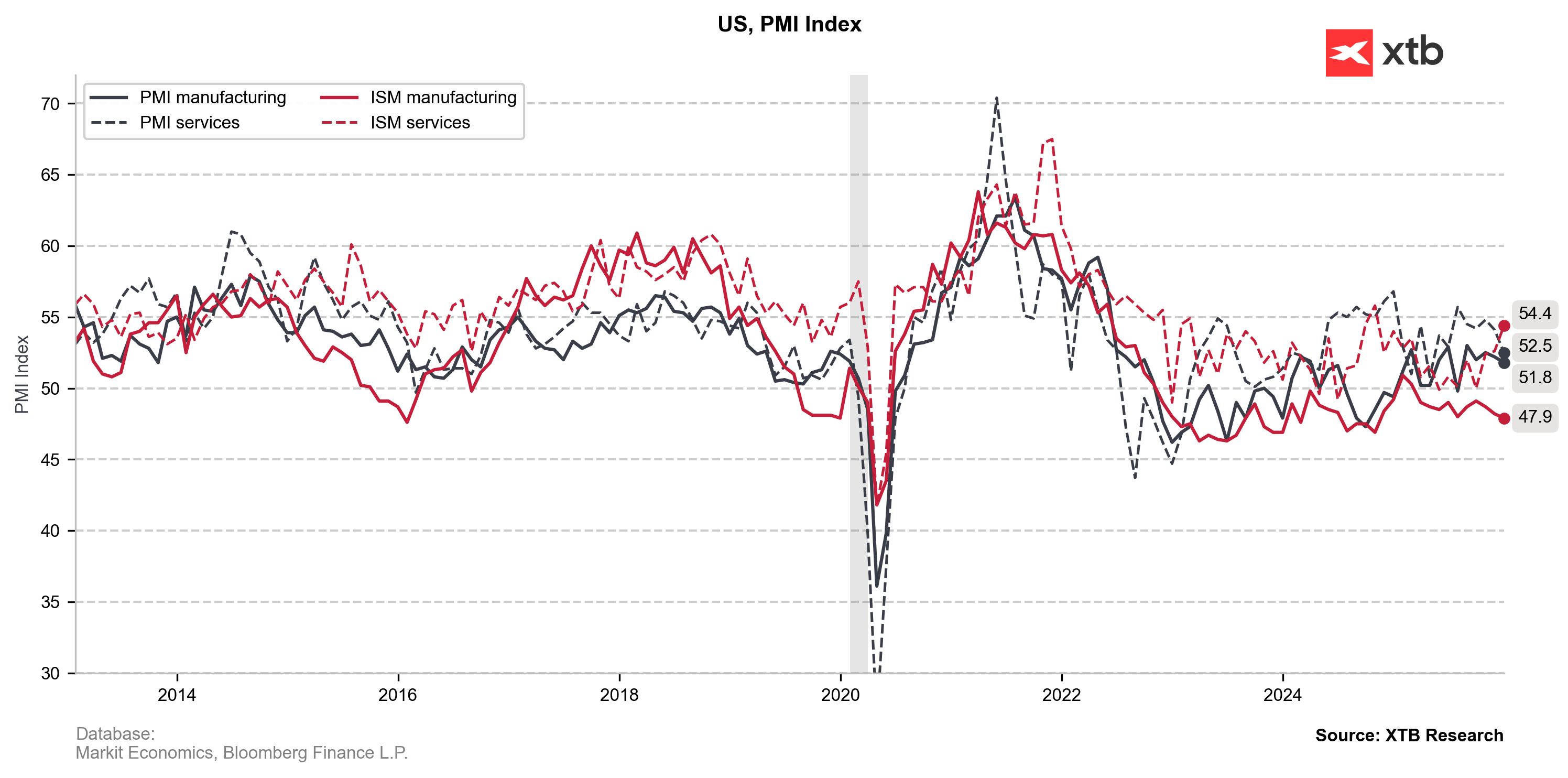

Alongside stronger demand-side sentiment, activity is rising in key U.S. sectors. Services are shining, with the latest ISM report showing the fastest expansion since October 2024 (ISM Services: 54.5). As many as 11 of 16 sectors reported growth (led by retail, finance, and accommodation & food services), indicating broad-based optimism rather than tech dominance alone. Manufacturing remains in contraction (ISM Manufacturing: 47.9), but its share in GDP and inflation dynamics is smaller.

PMI and ISM indicators for the U.S. Source: XTB Research

Both manufacturing and services have one thing in common: persistent price pressure, largely stemming from Trump’s tariffs. Businesses report mounting strain from strong demand and higher labor and material costs. The muted price response to tariffs in 2025 was mainly due to record inventories accumulated in 2021–2022, as well as in 2024 and just before reciprocal tariffs in 2025. That buffer is limited, which should translate into higher price tags in 2026.

Core PCE inflation returned to 2.8% in November, and further tariff pass-through combined with stronger activity raises the risk of a return toward 3%. Source: XTB Research

Employment is becoming less of a slippery issue

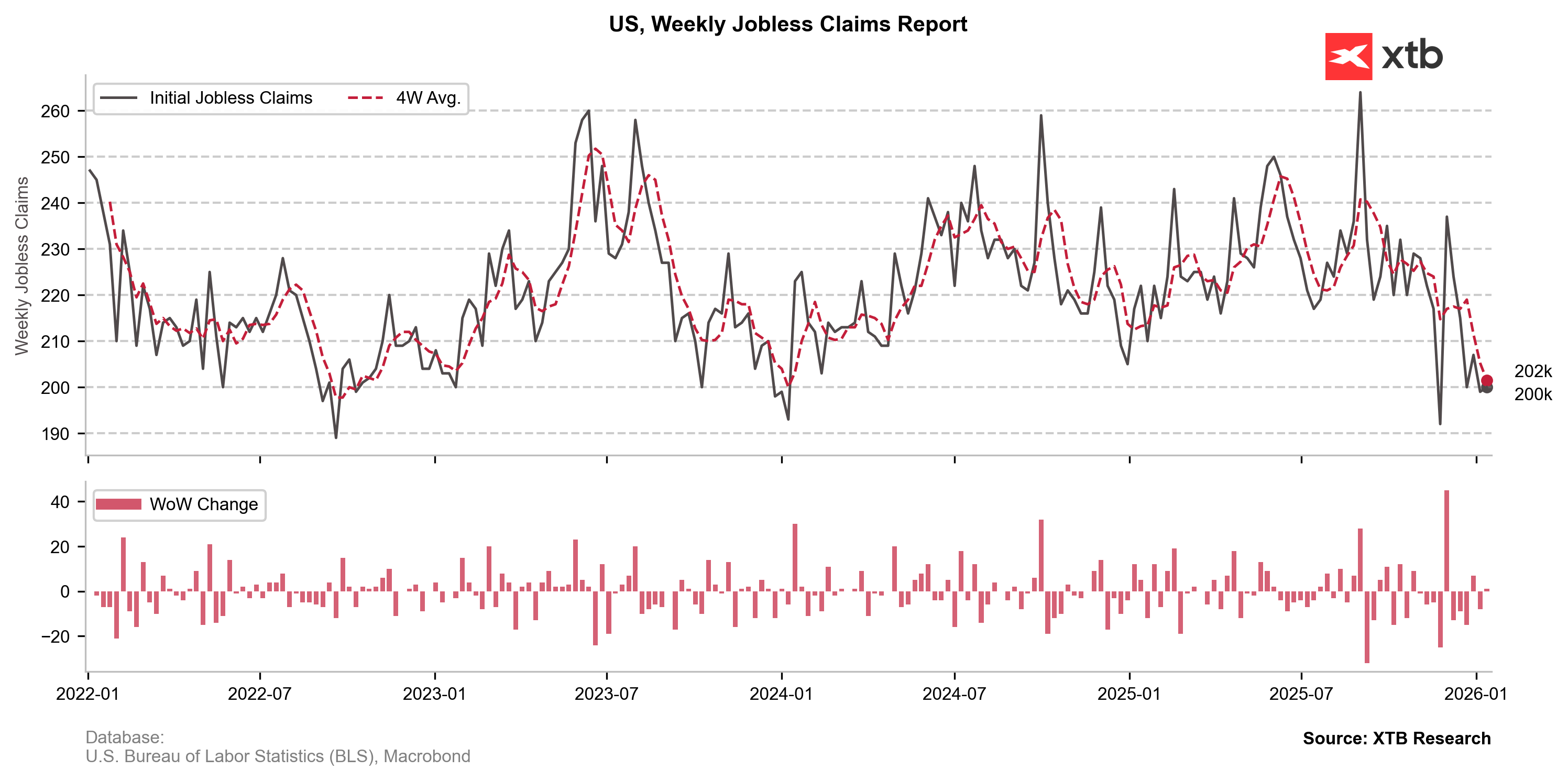

The U.S. labor market remains in a “no hire, no fire” mode, but overall data should ease Fed concerns about a sudden employment collapse, especially given rising consumer demand.

-

ISM reports showed improving employment components in both manufacturing (slower declines) and services (first increase since May 2025), suggesting a gradual recovery of hiring momentum.

-

Initial jobless claims have fallen sharply despite recent public-sector disruptions, now hovering near 2022 and 2024 lows (~200k). This trend also supports the recent unexpected drop in unemployment (from 4.5% to 4.4%).

-

NFP data remain directionless, but do not signal mass job losses. The latest reading disappointed (50k vs 66k expected), yet net job growth in Q4 2025 stayed positive despite a clear hiring freeze.

The sharp downtrend in jobless claims should reduce fears of a renewed rise in unemployment. Source: XTB Research

“Soft” arguments for a more hawkish Fed

Beyond hard macro data, sentiment within the Fed may turn more hawkish due to recent political developments. The U.S. Department of Justice proceedings against Jerome Powell are widely viewed as an unprecedented challenge to central bank independence. This atmosphere alone encourages greater caution in adjusting rates, to avoid any perception that the Fed is bowing to White House pressure.

Another reason for the Fed’s “wait mode” is data quality. The longest government shutdown in history raises concerns about noise in recent data releases, especially CPI. The FOMC may argue that waiting carries less risk than acting on potentially distorted data.

Summary

Core PCE inflation hovering just below 3% should once again draw the Fed’s attention. While economic activity and sentiment had previously been subdued, allowing the Fed to focus on labor market uncertainty, the risk balance now appears even, and rates look closer to neutral. As disinflation slows near target, the Fed is likely to keep rates at current levels at least this quarter to guard against a renewed inflation pickup.

The futures market now fully prices the first U.S. rate cut only in July 2026. Source: Bloomberg Finance LP

Aleksander Jablonski

Quant Analyst XTB

Daily summary: Wall Street and EURUSD rise ahead of tomorrow’s Fed decision 🗽 Oil gains

US100 gains 0.8%📈

U.S. dollar sell-off 🚨 USDIDX slumps nearly 1%

Natural gas rebounds attempt 📈 U.S. East Coast weather in focus

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.