Heineken (HEIA.NL) launched new week's trading with a big bearish price gap and is now trading over 6% lower on the day. Company released earnings report for the first half of 2024 today before opening of the European cash session. Results turned out to be a disappointment and the company also reported a big impairment charge on its investment in China.

Heineken reported disappointing net revenue in every region, with organic revenue growth disappointing in every region except for Africa, Middle East & Eastern Europe. Moreover, revenue growth and organic revenue growth was negative in company's key biggest market - Europe. Adjusted operating profit also missed expectations, although not in every market - the company reported a large beat in Americas. Overall, the report was disappointing but not disastrous.

However, Heineken also announced that it took one-time impairment charge of €874 million due to a decline in valuation of its stake in China Resources Beer Holdings, the largest brewer in China in which Heineken holds a 40% stake. Decline in valuation was due to concerns about consumer demand in mainland China.

Heineken also updated its full-year operating profit growth forecasts and now expects it to grow 4-8%. However, previous forecast called for growth in 'low-to-high single-digit range' therefore it can be said that it is now just more specific.

2024 first half results

- Net revenue: €14.81 billion vs €15.2 billion expected (+2.1% YoY)

- Europe: €5.91 billion vs €6.16 billion expected (-2.1% YoY)

- Americas: €5.25 billion vs €5.31 billion expected (+7.2% YoY)

- Asia-Pacific: €2.10 billion vs €2.15 billion expected (+4.0% YoY)

- Africa, Middle East & Eastern Europe: €1.92 billion vs €2.01 billion expected (-2.5% YoY)

- Organic revenue growth: +5.9% vs +7.9% expected

- Europe: -1.1% vs +2.8% expected

- Americas: +4.1% vs +5.6% expected

- Asia-Pacific: +7.9% vs +10.3% expected

- Africa, Middle East & Eastern Europe: +27.5% vs +24.0%

- Organic beer volume: +2.1% vs +3.7% expected

- Adjusted operating profit: €2.08 billion vs €2.16 billion expected

- Europe: €614 million vs €726.7 million expected (-1.1% YoY)

- Americas: €854 million vs €737.3 million expected (+42.0% YoY)

- Asia-Pacific: €409 million vs €467.9 million expected (+2.3% YoY)

- Africa, Middle East & Eastern Europe: €169 million vs €227.3 million expected (-24% YoY)

- Adjusted operating margin: 14.0% vs 14.3%

- Adjusted net income: €1.20 billion vs €1.23 billion expected

- Adjusted EPS: €2.15 vs €2.18 expected

Q2 2024 volume data

- Total beer volume: 62.8 million HL vs 65.25 million HL expected (-3.8% YoY)

- Europe: 22.8 million HL vs 23.23 million HL (flat year-over-year)

- Americas: 21.3 million HL vs 22.19 million HL (-2.3% YoY)

- Asia-Pacific: 11.7 million HL vs 11.9 million HL (+6.4% YoY)

- Africa, Middle East & Eastern Europe: 7 million HL vs 7.9 million HL (-27% YoY)

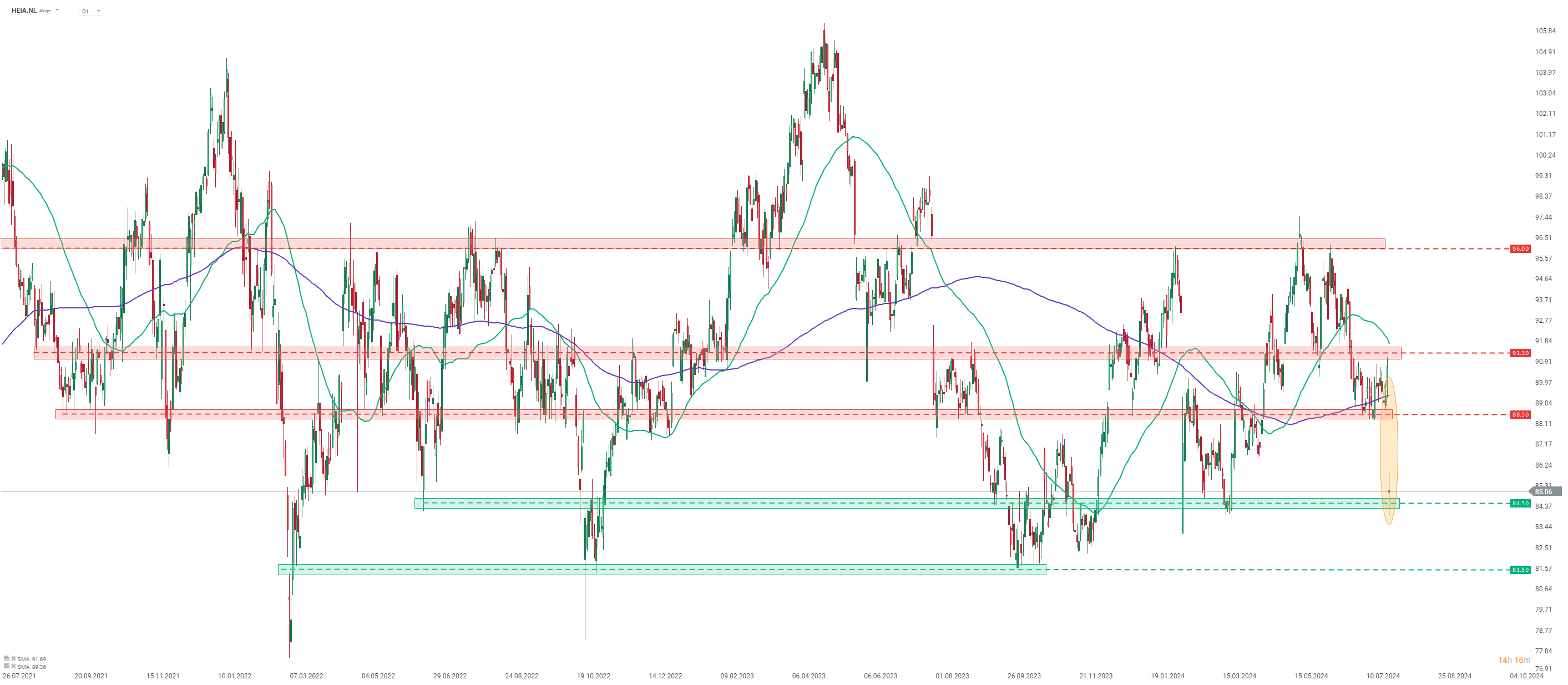

Heineken (HEIA.NL) launched today's trading with an over-6% bearish price gap and is trading at the lowest level since late-March 2024. Stock moved further lower after opening of the cash session and sellers attempted to break below the €84.50 support zone, marked with mid-March lows. However, no break below occurred and the stock has recovered back to the opening price.

Source: xStation5

Source: xStation5

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Market wrap: European and US stocks try to rebound rebound 📈

Paramount Skydance shares under pressure after S&P warning

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.