Howmet Aerospace (HWM.US) is at the heart of one of the strongest aerospace & defense upcycles in recent years. The company has delivered a total return of more than 80% year-over-year, and its latest quarterly results have only reinforced the momentum. Fundamentals remain solid: cash flows are rising, the balance sheet is disciplined, and the market is now pricing in an almost flawless execution of the growth strategy.

In Q4, Howmet reported:

-

Non-GAAP EPS: $1.05 (vs. $0.97 consensus)

-

Revenue: $2.2bn (+16% y/y)

-

Commercial Aerospace sales: +13% y/y

The market reaction was clearly positive, with the stock up nearly 10% following the release. The company also issued constructive guidance for 2026, calling for:

-

Revenue: approx. $9.1bn

-

Adjusted EPS: approx. $4.45

-

Free cash flow: approx. $1.6bn

On a full-year basis:

-

Revenue: +11% y/y to $8.25bn

-

Adjusted EBITDA: +26% y/y to $2.4bn

-

Adjusted EPS: +40% y/y to $3.77

-

Free cash flow: $1.43bn

At the same time, Howmet reduced its net debt-to-EBITDA ratio to 1.0x, paid down part of its debt, executed share buybacks, and raised its dividend significantly—underscoring the quality and resilience of its cash generation.

Fundamentals: strong demand in a cyclical environment

Howmet’s growth is supported by:

-

Sustained demand in commercial aviation and high product quality

-

A dynamic defense segment (Defense Aerospace +21% y/y in 2025)

-

Rising defense budgets in the US and Europe

-

Operating leverage alongside double-digit revenue growth

At the same time, the company is maintaining elevated capital expenditure, which may limit near-term FCF growth but strengthens its competitive position over the longer term. With 2026 EPS expected around $4.45–$4.50, the market values Howmet at over 50x forward 12-month earnings, while the trailing P/E exceeds 60x. These multiples are typical of high-growth technology names rather than a traditional aerospace components manufacturer—even one operating with exceptional efficiency. Assuming long-term EPS growth in the high-teens, current multiples still imply a very optimistic scenario of a continued upcycle with limited disruption.

Key risks to monitor

-

Potential volatility in defense spending

-

Risk of slower deliveries in key programs (e.g., the F-35)

-

Competitive pressure in aerospace components

-

Elevated capex if the cycle weakens

-

Escalation of trade tensions and the impact of tariffs

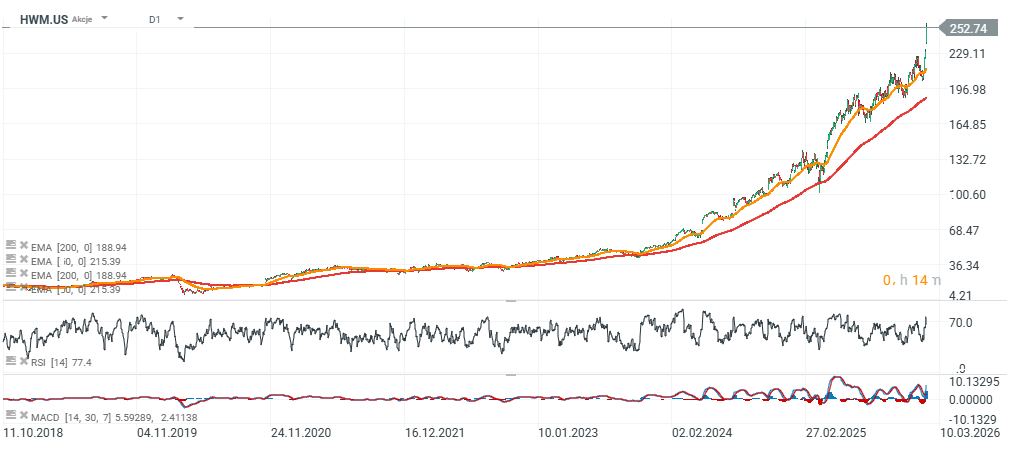

Technical picture and sentiment

Momentum remains exceptionally strong, with the stock at all-time highs and clearly above long-term moving averages. Such a setup often attracts momentum capital and can sustain the trend even at premium valuations. On the other hand, a significant distance from the 200-day moving average increases vulnerability to a correction if sentiment turns.

Howmet Aerospace remains one of the leaders of the current aerospace & defense cycle. Fundamentals are strong, the balance sheet is healthy, and earnings growth is robust. However, the valuation requires continued near-perfect execution and a supportive macro and defense-budget backdrop. From an analytical perspective, this is a high-quality operator—but at current multiples, the market has already priced in much of the upside scenario. The next leg for the stock will likely depend on the durability of the commercial and defense aviation cycle and Howmet’s ability to sustain its current pace of earnings growth.

Source: xStation5

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Market wrap: European and US stocks try to rebound rebound 📈

Paramount Skydance shares under pressure after S&P warning

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.