IBM (IBM.US) shares dropped over 3.0% after Morgan Stanley downgraded the iconic tech company to 'equal weight' from 'overweight', citing concerns of decelerating revenue growth.

-

Bank analysts lowered price target to $148 per share from $152.00 and noticed signs of a slowdown in IT spending, which coupled with deteriorating macroeconomic environment could have a negative impact on "Big Blue" future performance.

-

"Since the beginning of 2022, IBM has been the best performing name in our coverage, outperforming our IT Hardware coverage by 40 points, and the S&P 500 by 25 points. However, as Y/Y comps get more difficult, IBM laps its mainframe and ELA renewal cycles, and macro uncertainty persists, we are increasingly more guarded that IBM can sustain its goal of mid-single digit Y/Y revenue growth (in constant currency) in CY23," the analysts wrote in a client note.

-

On the other hand, analysts' from BofA pointed to the recent outperformance of IBM stock and lifted the price target to $152 per share from $145 as in their opinion the company should benefit from its defensive positioning.

-

"We expect shares of IBM to outperform in a weaker macro backdrop on an improving fundamental story." BofA analysts pointed to continued turnaround at IBM (expanding revenue and rising FCF), defensive portfolio and high dividend yield.

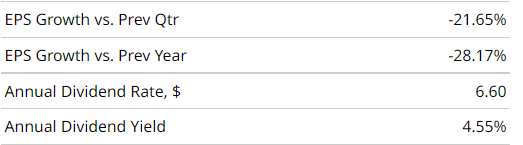

Key IBM ratios. Source: Barchart

IBM (IBM.US) stock pulled back from its 2022 highs in recent days after recording positive returns in the last 52 weeks. Stock launched today's session with a bearish price gap and is moving towards local support at $137.65, which is marked with previous price reactions and 23.6% Fibonacci retracement of the upward wave launched in March 2020. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.