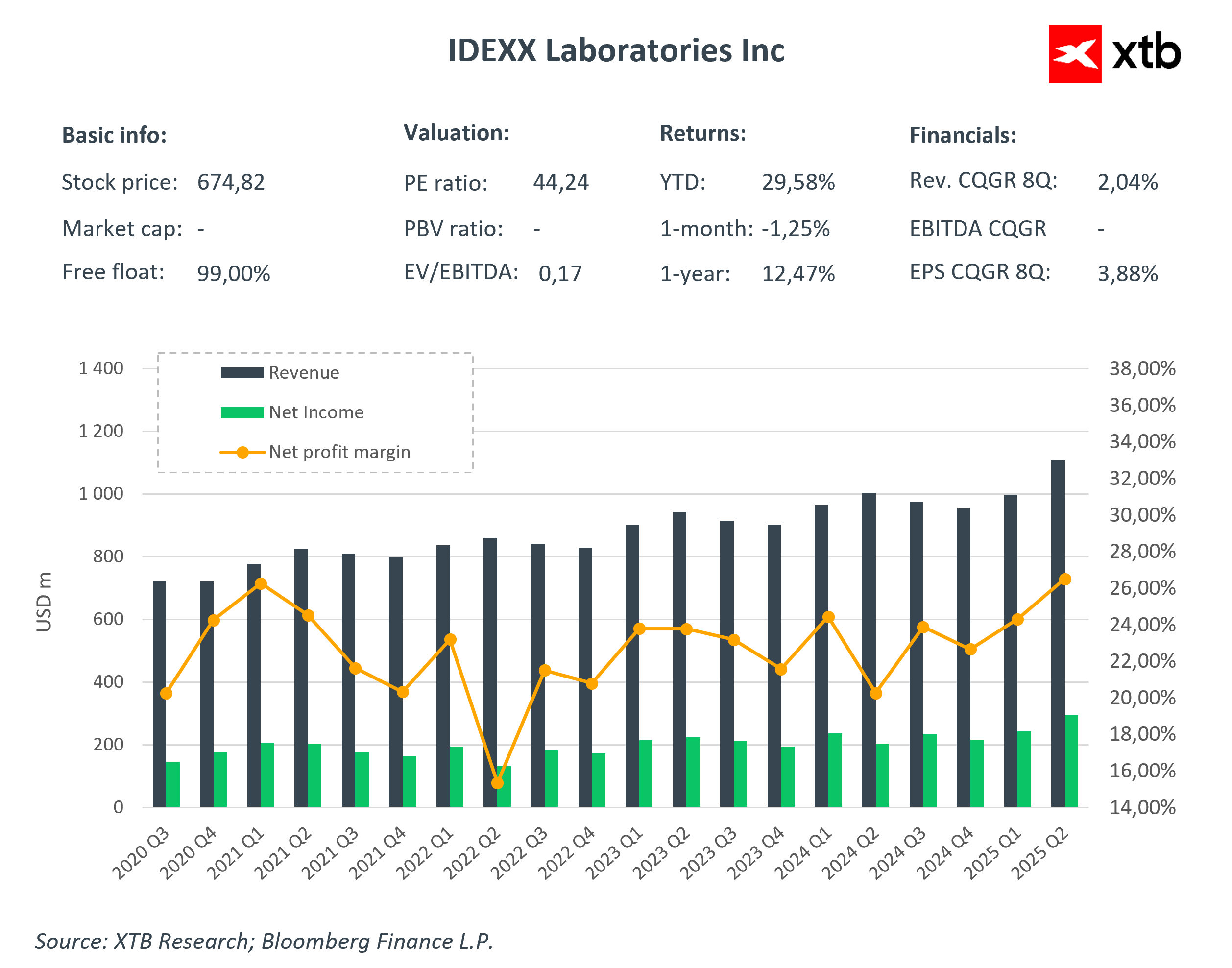

Shares of Idexx Laboratories jumped 26% to USD 676 per share after posting strong second-quarter results that beat Wall Street expectations and raising full-year guidance. Revenue rose 11% y/y to USD 1.11 billion, driven primarily by the Companion Animal Group (CAG) segment, which generated USD 1.02 billion (+11% y/y), including the installation of nearly 2,400 InVue Dx diagnostic devices—a new product that exceeded expectations. Earnings per share (EPS) rose to USD 3.63 from USD 2.44 a year earlier, significantly topping analysts’ consensus of USD 3.30. Gross margin improved to 62.6%, and operating income surged 41% to USD 373 million.

Key financial highlights:

- Revenue (Q2): USD 1.11 bn (+11% y/y); consensus: USD 1.07 bn

- CAG revenue: USD 1.02 bn (+11% y/y); consensus: USD 980.2 mn

- Water segment revenue: USD 51.0 mn (+9.1% y/y); consensus: USD 50.7 mn

- LPD revenue: USD 31.8 mn (+4.8% y/y); consensus: USD 31.2 mn

- Gross margin: 62.6% vs. 61.7% y/y; consensus: 62.2%

- Operating income: USD 373 mn (+41% y/y); consensus: USD 352.5 mn

- EPS (Q2): USD 3.63 vs. USD 2.44 y/y; consensus: USD 3.30

- FY25 EPS guidance: USD 12.40–12.76 (previous: USD 11.93–12.43)

- FY25 revenue guidance: USD 4.21–4.28 bn (previous: USD 4.10–4.21 bn)

- Number of InVue Dx devices installed in Q2: approx. 2,400

-

![]()

Management attributed the success to strong global adoption of Idexx's diagnostic technologies, particularly the InVue Dx analyzer, which enhances veterinarians' workflow and delivers faster results. CEO Jay Mazelsky emphasized that growth is driven by innovation and the resilience of the pet health market, stating, “We saw exceptional momentum in InVue Dx installations, exceeding our expectations.” Growth was also supported by rising consumables sales (+15%), strong demand for reference lab services and imaging systems. International markets, particularly in water testing, also posted double-digit growth.

Looking ahead, Idexx raised its full-year outlook. The company now expects EPS between USD 12.40–12.76 (previously: USD 11.93–12.43) and revenue between USD 4.21–4.28 billion (previously: USD 4.10–4.21 billion). Analysts view these revisions as a sign of confidence, despite recent concerns about declining vet visit volumes. The company also reaffirmed its capital expenditure plan of USD 160 million and forecast an operating margin between 31.3% and 31.6%. Continued growth is expected to be fueled by the aging pet population, stable demand for diagnostics, and expanding presence in international markets.

Source: xStation 5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.