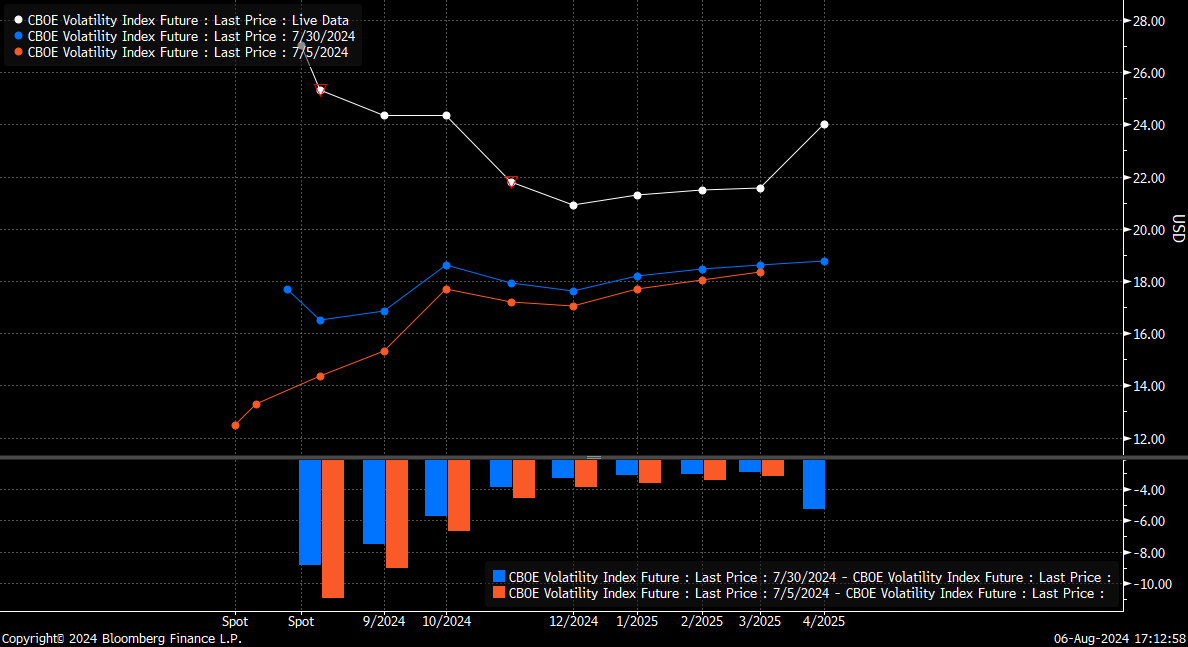

The VIX index experienced a sharp decline from yesterday's peak of around 38 to a current level of 27. This is due to investors perceiving less risk, leading to changes in the prices of options on the S&P 500 index. It is worth noting how the forward curve for VIX index contracts has clearly changed. Just a week and a month ago, the curve was very similar and indicated a slight contango. Currently, the curve has inverted and is in backwardation, which indicates still considerable uncertainty now but expectations of a volatility decline in the near future.

Forward curve for VIX contracts. Source: Bloomberg Finance LP

The VIX contract is dropping very sharply from minute to minute, related to a strong rebound in futures contracts on the S&P 500. The quotes have already fallen to around 23 points, with the closing on Friday. However, it is worth noting that a significant rise started from around 15 points at the turn of the month. Important support levels before this are 20 and 18. Theoretically, at this point, the volatility index has been reduced by 2/3 compared to the start of the previous week, with important support occurring around 20.

It is worth noting that since mid-June, we have observed a significant correlation between the VIX and the US500. A drop in volatility to the level of 20 should bring the US500 back to around 5400 points. However, it must be kept in mind that tomorrow will involve rolling, and this should be negative rolling and should not exceed 1 point. Earlier rollings in May, June, or July were positive, obviously related to a premium for future risk. Currently, it is expected that this volatility will drop from the current level. Source: xStation5

Daily summary: Markets capitulate under the influence of the Persian Gulf

US Open: Wall Street in Blood

DE40 dips 3% and falls to 2026 lows 🚨📉

Morning wrap (03.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.