Despite decades of stagnation, the Japanese economy remains one of the largest in the world, and the Japanese yen remains one of the most important currencies. An indispensable element of this financial landscape is the so-called "Carry Trade." What is it, why is it so important, and why is it threatened?

"Carry Trade" is a method used by institutional investors to profit from interest rate differentials. In this case — between the USA and Japan. By taking advantage of ultra-low interest rates in Japan, investors borrow yen, buy dollars with them, and then purchase U.S. bonds, whose interest rates are higher than the cost of borrowing in Japan. This strategy is burdened with significant interest rate and currency risk.

"Carry trade" works as long as there is a significant difference in interest rates and bond yields — this difference between the USA and Japan is systematically decreasing. Mounting negative phenomena and pressure on the Bank of Japan (BoJ) have forced the end of the yield control program and the start of unprecedented interest rate hikes.

The yen is trapped in the structural problems of the Japanese economy. The yen cannot weaken too much, as the country will no longer be able to afford imports, on which it is critically dependent — however, even a small interest rate hike by developed country standards could lead to the collapse of the Japanese financial system due to Japan's gigantic debt — which is mostly held by Japanese banks.

What does this mean for the currency market, and what is the most likely scenario? The interest rate difference between the USA and Japan is still as much as 3.5%, which makes profits from "carry trade" easier, but exerts continuous pressure on the yen, which has already lost half of its value since 2020.

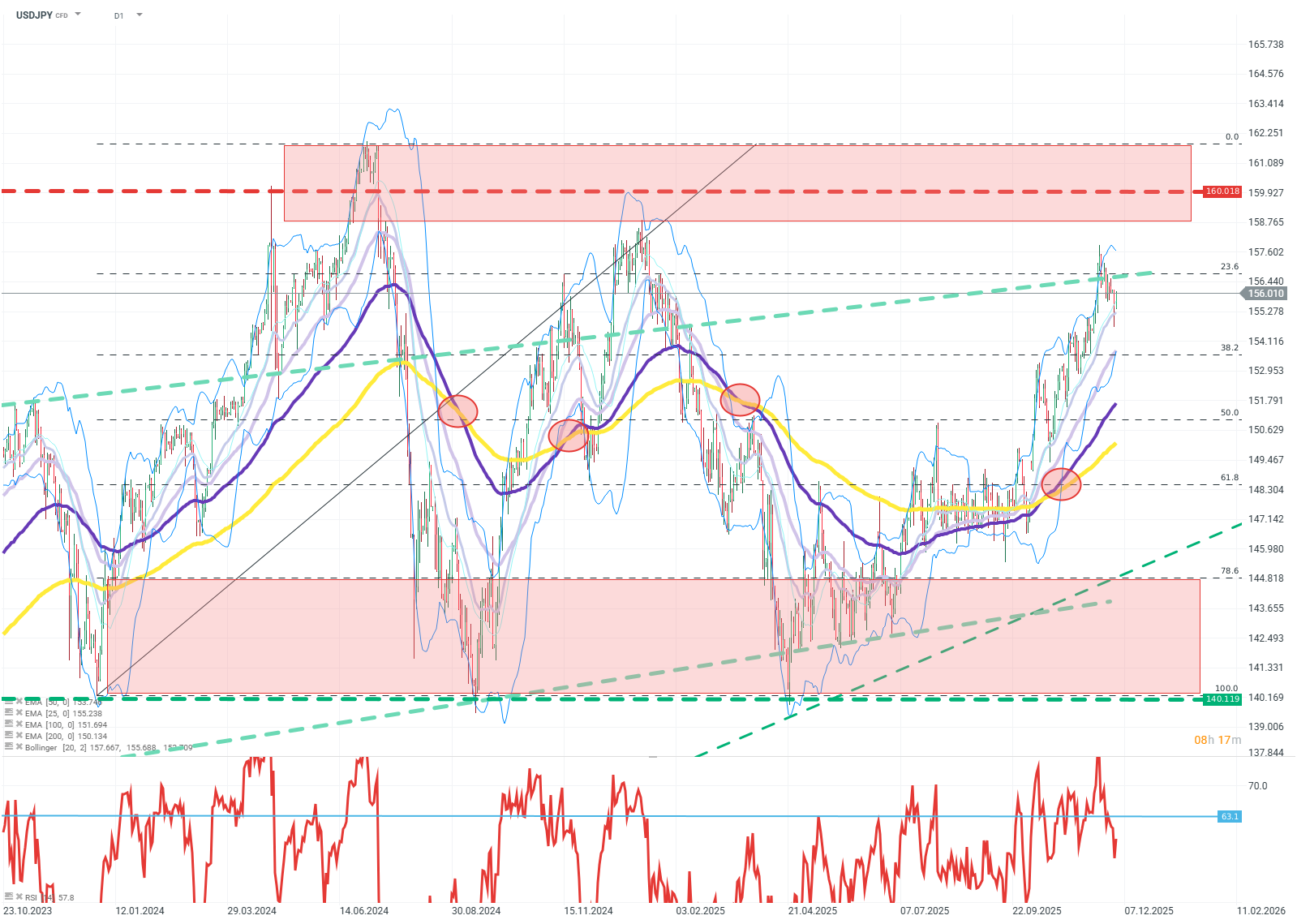

An unacceptable level for Japan is above 160 yen per dollar, due to unacceptable increases in fuel and food prices.

Why did the yen break the upward trend at 160 and has been consolidating for a year? The Bank of Japan is a heavyweight champion in the field of currency interventions, even verbal intervention by the bank can bring the rate down by several yen within minutes. The Bank of Japan has the largest foreign exchange reserves in the world and will not hesitate to use them; any speculative attack on the yen is doomed to failure. However, the BoJ cannot maintain the yen's rate so high with such low interest rates; sooner or later, the bank will be forced to raise them.

The market currently prices a 0.75-1% interest rate hike by the BoJ by March next year, while at the same time, the market expects the FED to cut rates by over 1.5%. This means a reduction in the interest rate differential from 3.5% to even 1%. This is too little to compensate investors for transaction costs and risk, and this scenario will lead to massive position closures and significant yen appreciation.

USDJPY (D1)

Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.