- J.B. Hunt released its Q3 2025 earnings yesterday after the market close

- AI continues to be widely implemented across the organization

- J.B. Hunt released its Q3 2025 earnings yesterday after the market close

- AI continues to be widely implemented across the organization

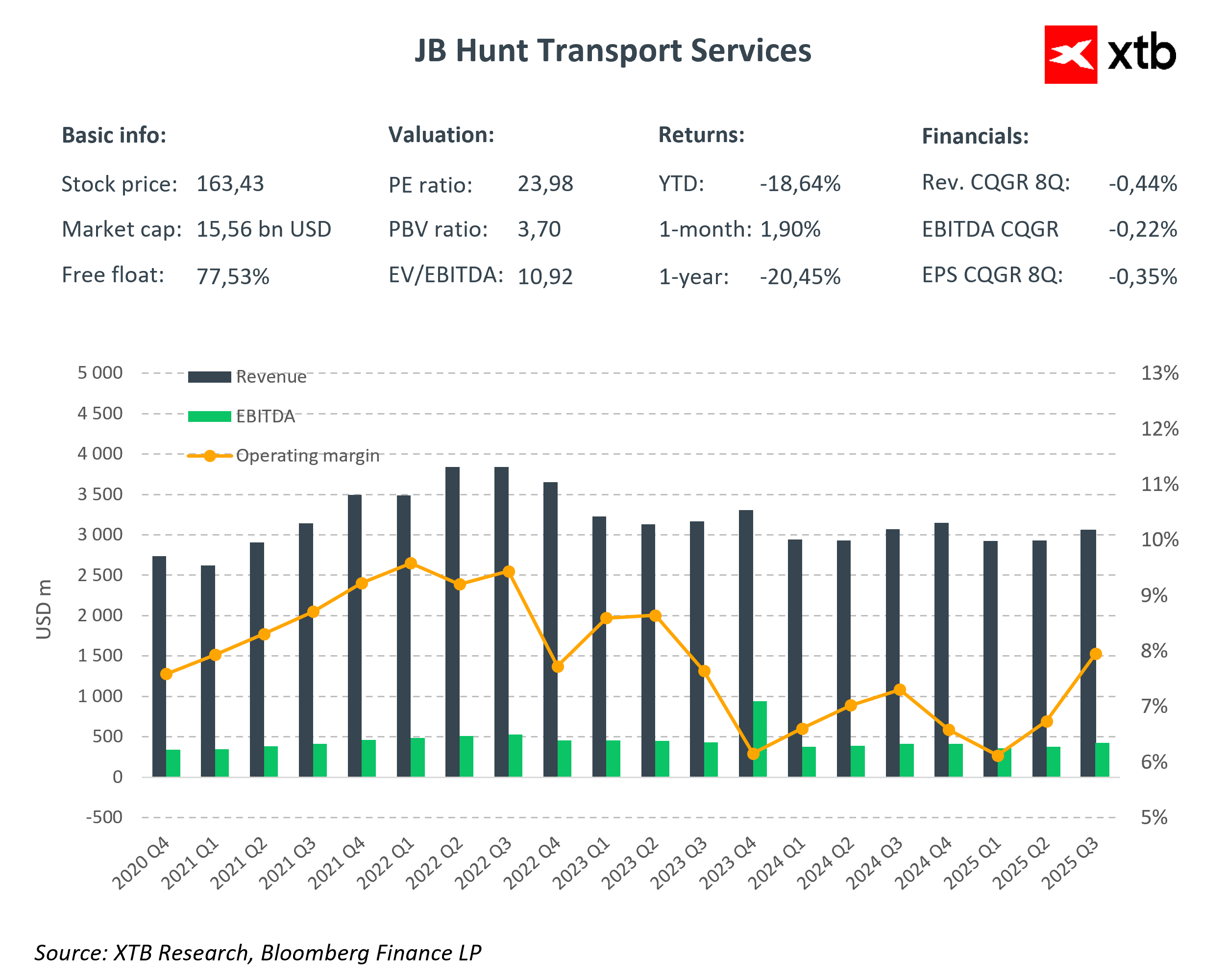

J.B. Hunt released its Q3 2025 earnings yesterday after the market close. The quarter was solid despite flat revenues, which held steady at $3.05B. Operating income rose 8% to $242.7M, and EPS increased 18% to $1.76. Results were boosted by structural cost reductions, better productivity, and lower external transportation costs, partially offset by higher driver wages and equipment expenses.

CEO Shelley Simpson reaffirmed confidence in the company’s long-term strategy built on operational excellence, safety, and continued cost discipline.

Key Financial Metrics

- Revenue: $3.05B (≈ flat YoY)

- Operating Income: $242.7M (+8% YoY)

- Earnings per Share (EPS): $1.76 (vs. $1.49; +18%)

- JBI (Intermodal): Revenue $1.52B (-2%); Operating Income $125.0M (+12%); Volume -1% (East +6%, Transcon -6%); Revenue/Load -1%

- DCS (Dedicated Contract Services): Revenue $864M (+2%); Operating Income $104.3M (+9%); Productivity +3%; Truck count -1%; Retention ~95%

- ICS (Integrated Capacity Solutions): Revenue $276M (-1%); Operating Income $(0.8)M (improved from $(3.3)M); Volume -8%; Revenue/Load +9%; Gross Margin 15.0% (from 17.9%); Carrier base +13%

- FMS (Final Mile Services): Revenue $206M (-5%); Operating Income $6.9M (-42%)

- JBT (Truckload): Revenue $190M (+10%); Operating Income $7.4M (-9%); Loads +14%; Revenue/Load ex-fuel -4%; Trailer turns +19%

Trends across segments were mixed but improving, driven by efficiency gains. Management remains focused on network balance (especially Transcon), productivity growth, and cost discipline.

During the press conference, management emphasized a three-pillar strategy — operational excellence, scaling prior investments, and margin repair.

The company’s $100M “lowering cost to serve” program is ahead of schedule, with >$20M realized in Q3, and most savings expected to materialize in 2026.

Technology continues to be widely implemented across the organization. So far, about 50 AI agents have been deployed:

- 60% automated check calls with carriers

- 73% automated order acceptance

- ~80% touchless invoicing

- ~2M dynamic quotes annually

- In total, the company has automated roughly 100,000 labor hours per year.

Challenges

Wages/benefits and insurance costs remain the biggest planning challenges for 2026, and the industry likely needs single-digit price increases to restore profitability.

J.B. Hunt (JBHT.US)

The stock is up nearly 19% today, testing the February highs.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.