-

US500 and US100 climb in first post-holiday session

-

Technology stocks post robust gains in the final trading session of the week

-

Investors bank on a sustained "Santa Rally" and continued momentum into early January

-

US500 and US100 climb in first post-holiday session

-

Technology stocks post robust gains in the final trading session of the week

-

Investors bank on a sustained "Santa Rally" and continued momentum into early January

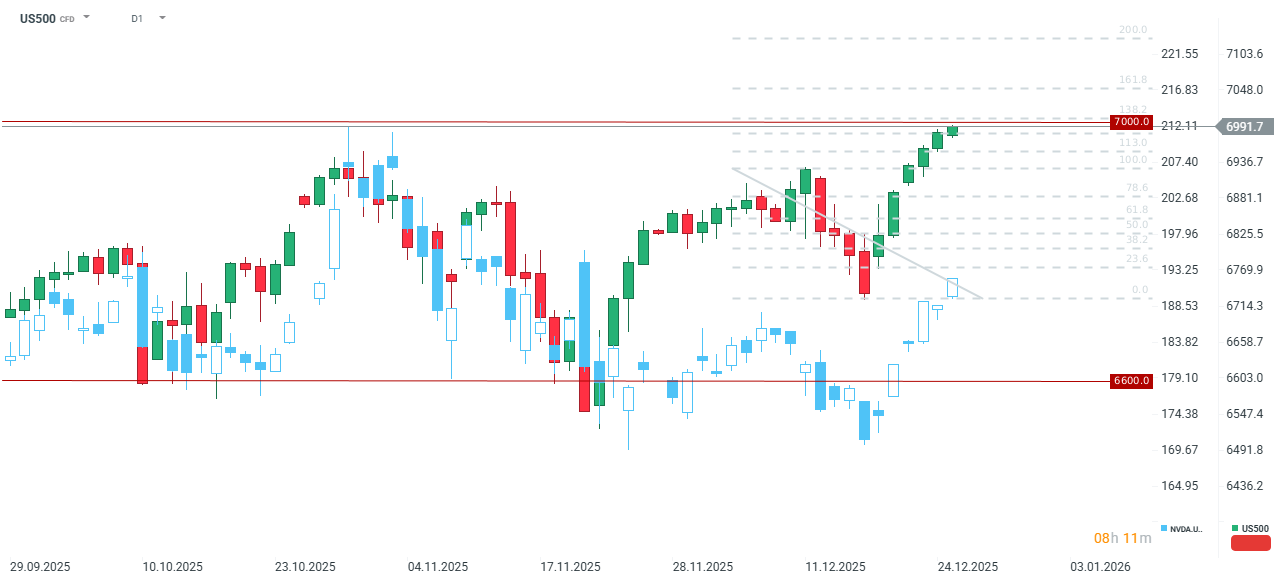

Wall Street opened in a measured mood following the Christmas break. Futures for the benchmark S&P 500 (US500) are trading at all-time highs, while the tech-heavy Nasdaq 100 (US100) sits approximately 2% below its intraday record set in late October. Investors are poised to close the year near peak levels, underpinned by expectations of further US interest rate cuts and resilient corporate earnings. The S&P 500 has gained nearly 18% this year, marking its third consecutive year of expansion following two years of returns exceeding 20%.

The US500 rose 0.11% during Friday’s session, potentially marking the sixth consecutive day of gains for Wall Street. As the index approaches the psychological 7,000-point threshold, analysts suggest further upside remains, given that heavyweights such as Nvidia and other tech majors are still trading below their individual historic peaks.

Corporate News

- Nvidia (NVDA.US): The chipmaker has announced the acquisition of AI startup Groq for $20bn, marking the largest deal in Nvidia’s history. By acquiring Groq, Nvidia gains access to LPU (Language Processing Unit) technology, which offers significantly higher performance for large language models compared to traditional GPUs. Given Nvidia’s dominant market share, the transaction is expected to trigger rigorous antitrust scrutiny. Nvidia shares rose 0.7% at the open.

- Micron (MU.US): Shares continued their ascent, adding to a monthly gain of over 20% driven by robust growth forecasts. As a primary manufacturer of memory essential for scaling processor sales, the company gained 1.5% in early trade.

- Biohaven (BHVN.US): The biotech firm plummeted over 11% at the open after its experimental depression treatment failed to meet its primary endpoint in a mid-stage trial. This latest setback compounds a difficult year for the firm, with the stock having lost nearly three-quarters of its value in 2025.

- Coupang (CPNG.US): The South Korean e-commerce giant surged over 8% following reports that leaked company data had been successfully deleted by a suspect.

- Precious Metals Miners: Producers, particularly those focused on silver, saw sharp gains at the open as silver prices hit fresh records of $75 per ounce. First Majestic, Coeur Mining, and Endeavour Silver all posted gains in the region of 3%.

Daily Summary: Oil at new local highs; Iran and Trump dampen market sentiment 💡

BREAKING: Stronger-than-expected decline in US gas inventories

Stock of the Week: Broadcom Driven by AI Sets Records

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.