JPMorgan Chase kicked off the earnings season with a mixed signal, leaving the stock flat in the premarket trading (currently at around $325). The bank capped a record 2025 with its highest-ever annual revenue of $182 billion, despite a fourth-quarter profit hit from its strategic takeover of the Apple Card portfolio.

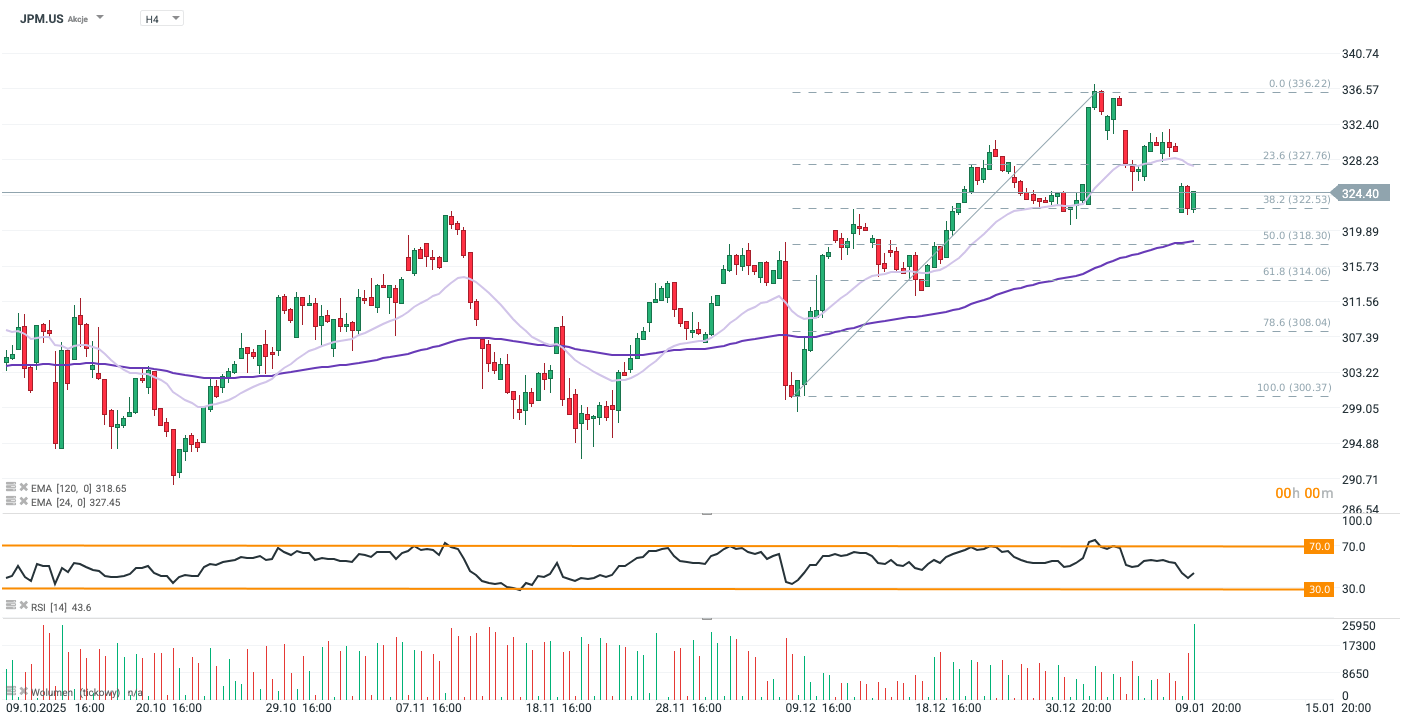

JPM stock has retreated to the 38.2% Fibonacci retracement level, weighed down by pre-earnings caution and President Trump’s recent comments on credit rate caps. The decline broke through immediate support around $330—a key level coinciding with the 30-day Exponential Moving Average (EMA30). This breach suggests that a quick return to recent highs is unlikely, potentially setting the stage for a deeper bearish test of the 100-day moving average (EMA100). Source: xStation5

Caution despite many beats

The bank reported Q4 net income of $13 billion, down 7% from the previous year. However, excluding the $2.2 billion provision for the Apple deal, EPS of $5.23 comfortably beat Wall Street's $4.85 forecast. (total EPS: $4.63). CEO Jamie Dimon cited a "resilient" economy but warned of "sticky inflation" and geopolitical hazards.

Shares initially rose 1% after volatility from President Trump’s proposed credit card rate caps, as the bank issued strong 2026 guidance projecting $95 billion in net interest income. Nevertheless, the overall EPS miss and premium-client-driven performance spark caution among investors, in spite of Jamie Dimon’s optimism regarding the U.S. economy, bringing stock’s premarket down to around 0.15-0.2%.

Top Line Results

-

Net Income: $13.03 billion, down 7% y/y.

-

EPS (Earnings Per Share): $4.63, down 4% y/y.

-

Note: EPS was $5.23 excluding significant items.

-

-

Adjusted Revenue: $46.77 billion vs. Estimate $46.35 billion. (BEAT)

-

Managed Net Interest Income: $25.11 billion (+7% y/y) vs. Estimate $24.99 billion. (BEAT)

Trading & Banking Highlights

-

Equities Sales & Trading: $2.86 billion (+40% y/y) vs. Estimate $2.7 billion. (BEAT)

-

FICC Sales & Trading: $5.38 billion (+7.5% y/y) vs. Estimate $5.27 billion. (BEAT)

-

Investment Banking Revenue: $2.55 billion (-1.9% y/y) vs. Estimate $2.65 billion. (MISS)

-

Note: Both Equity and Debt underwriting revenues missed estimates, with Equity underwriting down 16% y/y.

-

Credit & Balance Sheet

-

Provision for Credit Losses: $4.66 billion (includes Apple Card reserves) vs. Estimate $4.68 billion.

-

Net Charge-Offs: $2.51 billion vs. Estimate $2.56 billion. (BETTER THAN FEARED)

-

Assets Under Management: $4.79 trillion vs. Estimate $4.73 trillion.

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Market wrap: European and US stocks try to rebound rebound 📈

Paramount Skydance shares under pressure after S&P warning

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.