- Japan’s ruling Liberal Democratic Party (LDP) has elected Sanae Takaichi, who is set to become the first female prime minister in the country’s history.

- Her victory reinforces expectations for continued fiscal stimulus and a patient stance from the Bank of Japan (BoJ).

- The Nikkei 225 index broke above 48,000 points, reaching a new record high, while the yen weakened beyond ¥150 per dollar.

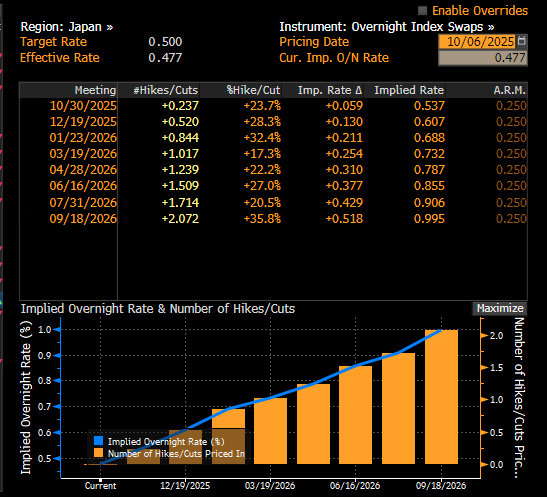

- Markets are now reassessing BoJ expectations, pricing in an extended period of loose monetary policy and a delay in rate hikes.

- Japan’s ruling Liberal Democratic Party (LDP) has elected Sanae Takaichi, who is set to become the first female prime minister in the country’s history.

- Her victory reinforces expectations for continued fiscal stimulus and a patient stance from the Bank of Japan (BoJ).

- The Nikkei 225 index broke above 48,000 points, reaching a new record high, while the yen weakened beyond ¥150 per dollar.

- Markets are now reassessing BoJ expectations, pricing in an extended period of loose monetary policy and a delay in rate hikes.

The Liberal Democratic Party, which has governed Japan almost continuously since the 1950s, elected Sanae Takaichi as its new leader, replacing Shigeru Ishiba. The LDP leadership vote effectively determines the next prime minister, as the party holds a parliamentary majority. Takaichi — a seasoned conservative lawmaker and protégé of the late Shinzo Abe — is known for her support of Abe-style stimulus policies: aggressive fiscal expansion, corporate investment incentives, and strategic industrial spending. Her election signals a continuation of Abe’s pro-growth strategy rather than a shift toward fiscal restraint. Takaichi has pledged to revitalize Japan’s economy through strong state intervention, focusing on national capacity building, higher public investment, and closer security ties with the United States.

Markets interpreted her victory as a clear signal of pro-growth and accommodative policy. Takaichi’s agenda calls for increased public investment in key sectors — such as defense, semiconductors, and artificial intelligence — along with tax relief for households and businesses. She supports close coordination with the BoJ to maintain an expansionary environment rather than tighten financial conditions. This stance contrasts with earlier expectations that the BoJ might raise rates again by the end of 2025. Traders have since sharply reduced bets on near-term rate hikes, pushing short-term bond yields lower even as long-term yields rose on deficit concerns.

Before the vote, investors priced in nearly a 70% chance of a BoJ rate hike by year-end; by Monday, those odds had fallen to around 50%.

Market reaction

Financial markets reacted sharply, with capital flowing into equities. The Nikkei 225 (JP225) surged 4.60% to a record 48,100 points, led by technology, heavy industry, and real-estate stocks that benefit from easy credit conditions.

At the same time, the yen weakened nearly 0.70% against the dollar, breaking below the ¥150 level. Markets have labeled this dynamic the “Takaichi trade” — a strong rotation toward equities at the expense of bonds — reflecting expectations that fiscal stimulus and a delayed BoJ normalization will dominate Japan’s economic outlook in the coming months.

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

India: New battleground of the trade war?

Another US Gov. Shutdown: What can it mean this time?

Mercosur: Farmers’ fears are exaggerated, industry triumphs - facts vs. myths

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.