The Bank of Japan (BoJ) maintained its rhetoric of loose monetary policy, keeping interest rates at a steady level of -0.10%. This decision is in line with market expectations. The BoJ continues to uphold its Yield Curve Control (YCC), leaving the reference rate at 1.0% for 10-year Japanese government bonds and maintaining the target yield for 10-year bonds at around 0%. This decision confirms the bank's ultra-loose policy, despite speculation about its potential reversal in the coming year.

Key BoJ comments:

- Japanese economy is gradually reviving. Future prospects remain uncertain due to global economic conditions and domestic moderate private consumption growth.

- BoJ notes a slight revival in the Japanese economy, with stable exports and industrial production.

- BoJ expects the CPI to rise above 2% in the entire fiscal year 2024, but also anticipates a subsequent gradual decline.

- The core consumer price index is expected to gradually rise towards, and then the pace of growth will stabilize.

- BoJ is analyzing the wage-price growth cycle and attaches great importance to data and wage growth in companies.

- BoJ emphasizes the importance of monitoring movements in the financial and foreign exchange markets and their impact on the economy and prices.

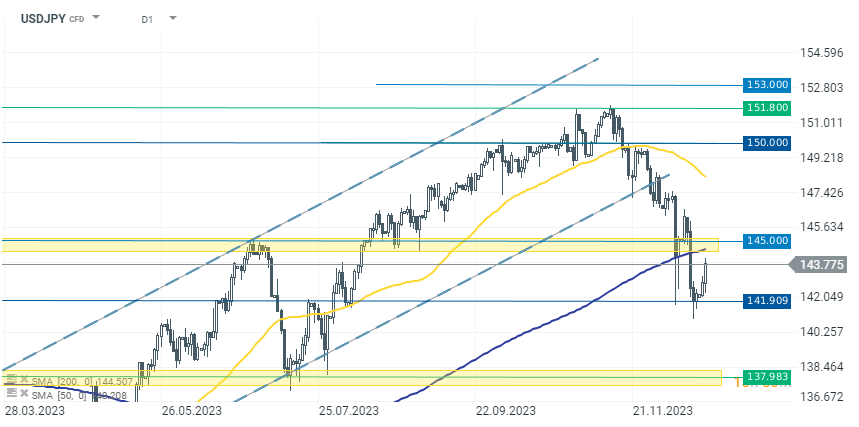

In the forex market, we see a decisive reaction of the Yen to the BoJ's rhetoric. JPY is today one of the weakest currencies among the G10 countries. The USDJPY pair gains about 0.80%, consolidating around 143.800. This marks the third consecutive day of gains for this pair. However, despite the declines, USDJPY remains below the SMA 200 average. After dynamic declines in recent weeks, the exchange rate has stopped around the support level of 141.000-142.000. The first limitation of the current breakout is the level of 145.000, which also marked the local peak in July this year.

Source: xStation 5

Economic Calendar: Jobless Claims 🔎

Morning wrap (31.12.2025)

Daily Summary - Previous metals rebound, FOMC still see cuts

Minutes FOMC: Further cuts are possible if inflation eases. EURUSD limits decline

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.